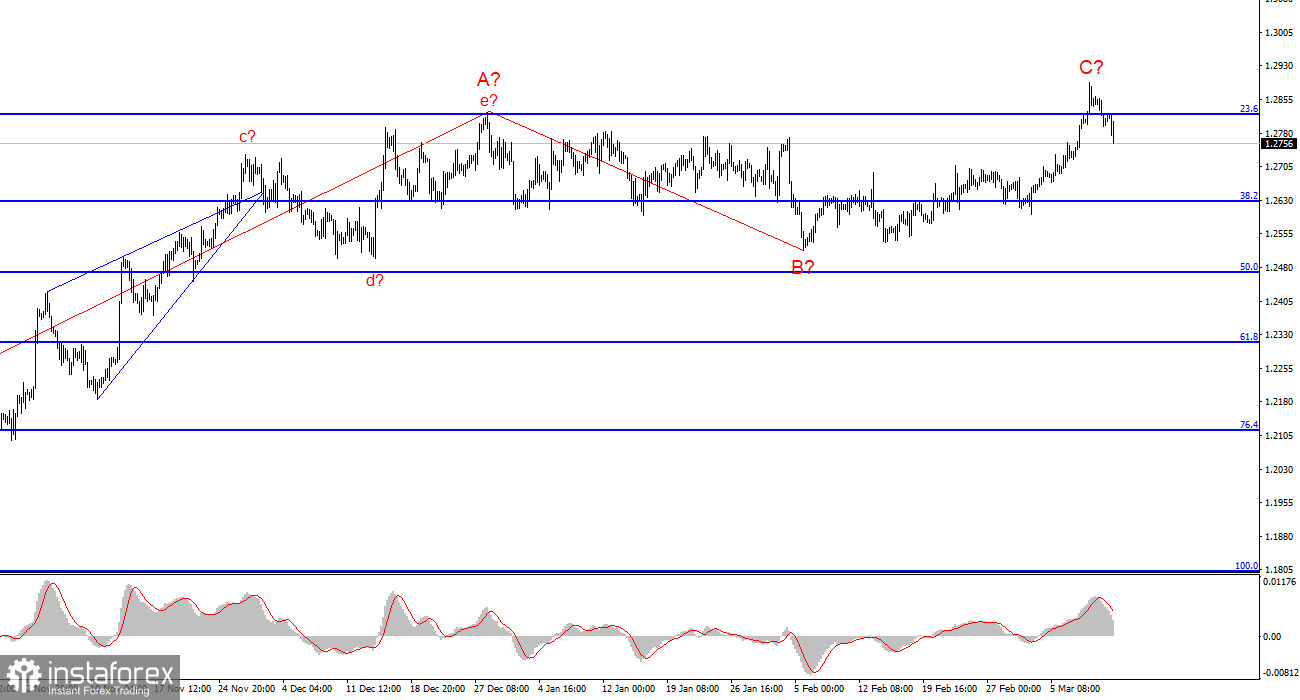

The wave analysis of the GBP/USD pair remains relatively clear and, at the same time, remains complex. The construction of a new downward trend section continues, and its first wave has taken on quite extensive form. The second wave has also turned out to be quite prolonged, giving us every reason to expect a long construction of the third wave.

At the moment, I have no confidence that the construction of wave 2 or b is complete. Wave 2 or b has already taken on a five-wave form, but it has again become more complex due to the increase in pound quotes this week. Now we need to look for waves within the current upward wave on a larger scale to try to predict its completion. Theoretically, wave 2 or b can extend to 100% of wave 1 or a. Wave 2 or b has currently taken on a three-wave form, which may be sufficient. An unsuccessful attempt to break through the level of 1.2876, corresponding to 76.4% on the Fibonacci, may indicate the long-awaited completion of the upward wave.

Targets for reducing the pair within the assumed wave 3 or c are located below the level of 1.2039, corresponding to the low of wave 1 or a. Unfortunately, wave analysis tends to complicate and not correspond to the news background. At the moment, I am not abandoning the working scenario, but the market does not yet see long-term sales of the pair.

Bulls may retreat on a large scale in the near future.

The GBP/USD pair dropped by 60 basis points on Tuesday, but by the end of the day, it could lose much more. The inflation report itself seems not to cause such a strong market reaction, but this report is of great importance for the monetary policy of the Federal Reserve. I remind you that for the past six months (if not more), the market has constantly increased demand for the pound. And when it couldn't do that, at least it didn't decrease it. I constantly wondered why this was happening. The market refused to admit that it was wrong to expect a rate cut from the Federal Reserve in March. It refused to see the obvious – the American economy is much stronger and more stable than the British one. The Bank of England is not a benevolent wizard who can do whatever he wants – the UK economy has already entered a recession.

Based on this, I expected and continue to expect the construction of a downward wave 3 or c, the targets of which are much lower than the current levels. Today's inflation report once again confirmed the obvious – the FOMC has no grounds to lower the rate even in June. Therefore, one should expect another postponement of deadlines to July or September. This is a hawkish factor for the American currency. Demand for it should continue to increase.

General conclusions.

The wave pattern of the GBP/USD pair still implies a decline. At the moment, I am considering selling the pair with targets located below the level of 1.2039, as I believe that wave 3 or c will start sooner or later. However, until wave 2 or b is completed (with one hundred percent probability), an increase in the pair can be expected up to the level of 1.3140, which corresponds to 100.0% on the Fibonacci. A successful attempt to break through the level of 1.2877, which is equivalent to 76.4% on the Fibonacci, will indicate the market's readiness to further increase demand. However, at the moment, it is unsuccessful, so the construction of wave 3 or c may have already begun.

On a larger wave scale, the picture is similar to the EUR/USD pair, but there are still some differences. The descending corrective section of the trend continues its construction, and its second wave has acquired an extended form – up to 61.8% of the first wave. An unsuccessful attempt to break through this level may lead to the start of building wave 3 or c.

Key principles of my analysis:

- Wave structures should be simple and understandable. Complex structures are difficult to play with; they often bring changes.

- If there is no confidence in what is happening in the market, it is better not to enter it.

- There is never one hundred percent certainty in the direction of movement. Don't forget about protective stop-loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română