Brent crude has seen a modest 7% increase since the onset of the year, yet prices have remained relatively stable around the $82.5 per barrel level over the past five weeks. This stability is viewed positively by Kuwait in terms of demand, although there are concerns that further reductions in output by OPEC+ might limit the alliance's influence over the global oil market. Rystad Energy's projections suggest that the alliance's share of global production could dip to 34% by June, the lowest since its formation in 2016, down from 38% in 2022.

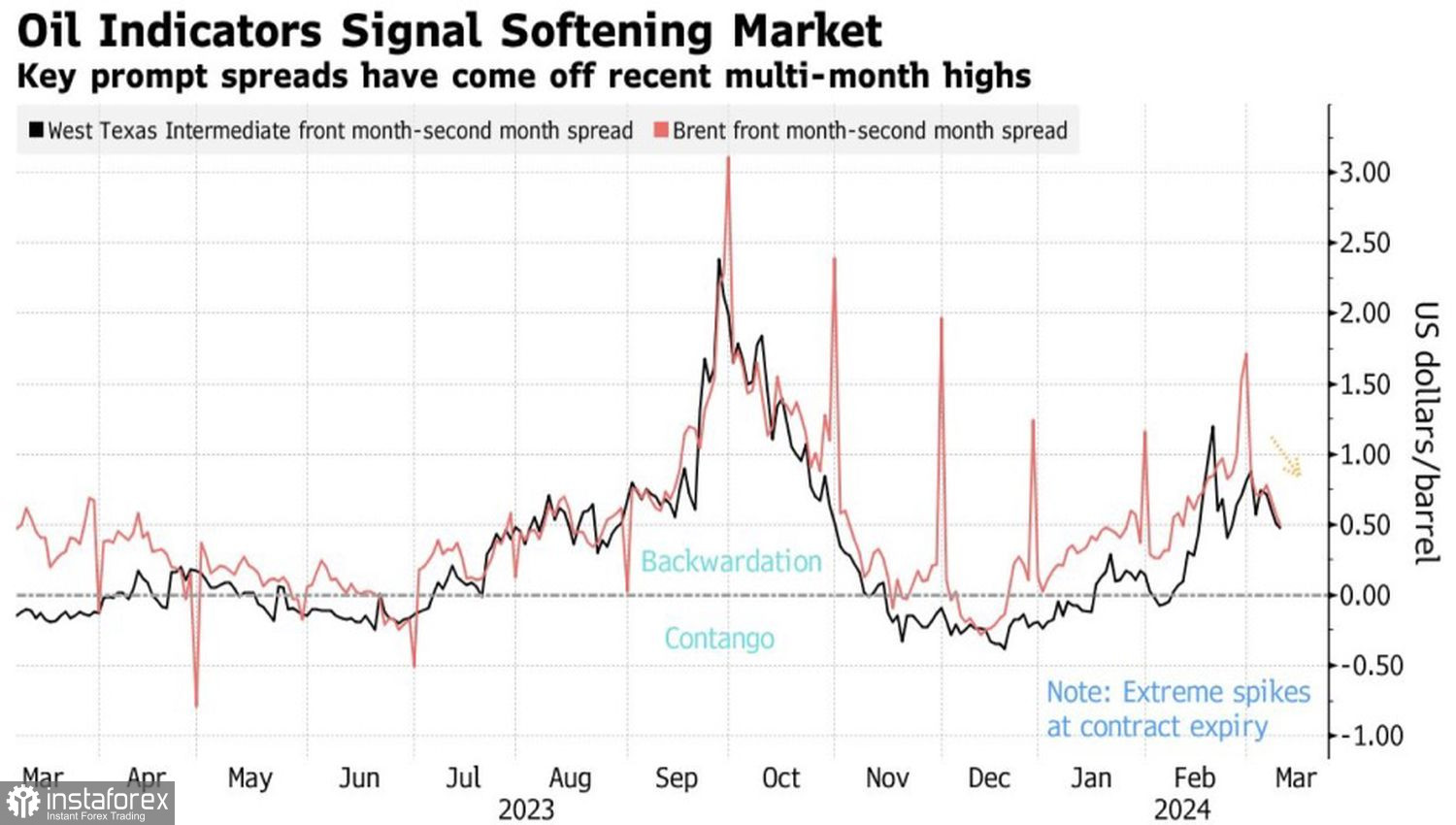

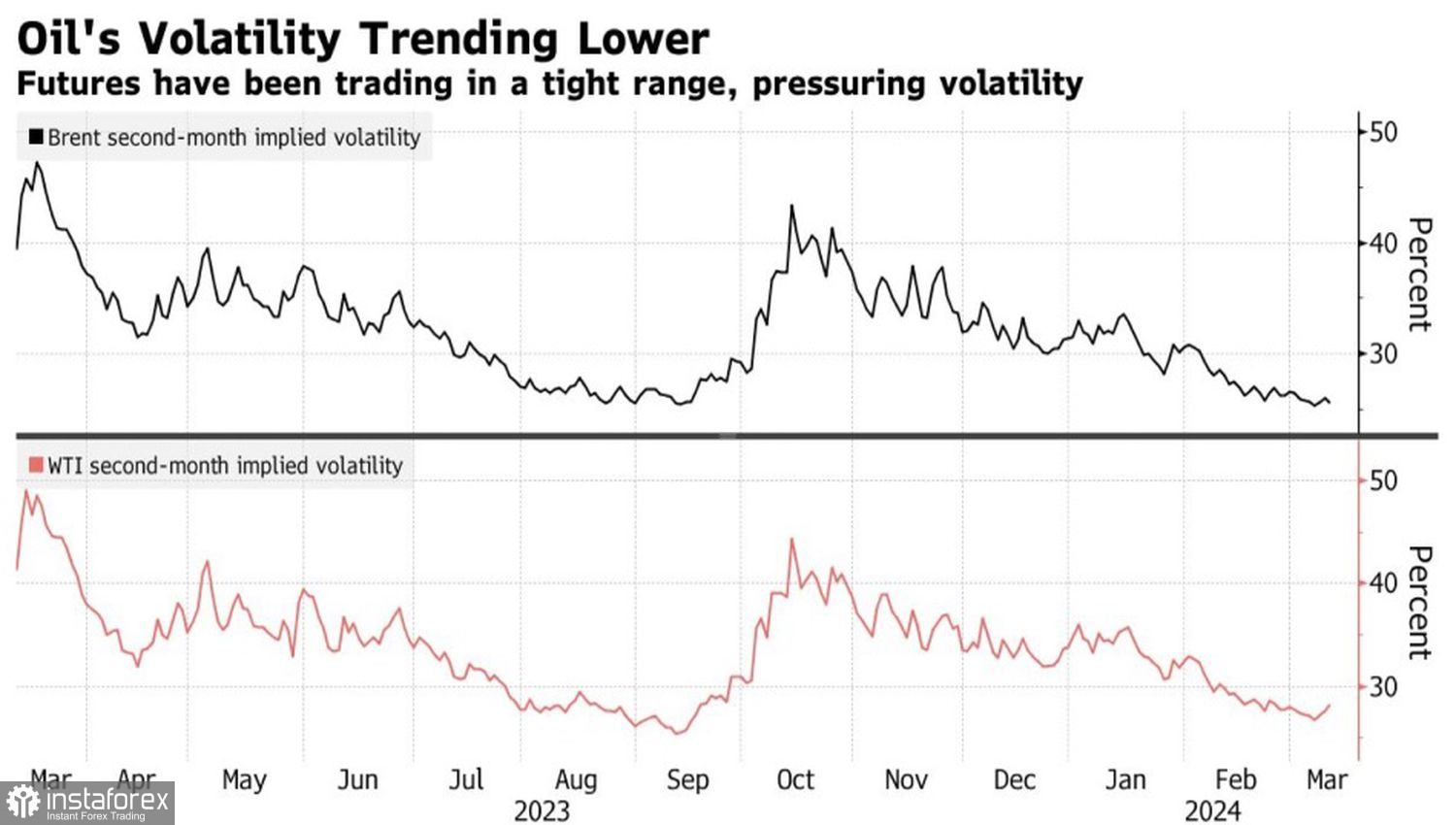

The recent easing of concerns over supply disruptions due to Houthi assaults in the Red Sea has resulted in a significant contraction of the spreads between Brent and WTI futures contracts, bringing market volatility to its lowest point since 2021.

Crude futures contracts spread

Notably, China's oil imports in the first two months of the year increased by 5.1% year-over-year to 10.74 million barrels per day. However, Brent investors are advised to remain cautious, as the increase might be temporary, influenced by the Lunar New Year celebrations, with expectations of a subsequent slowdown.

Oil market volatility

A concerning factor is the rise in Iranian oil exports to their highest level since 2018, following President Donald Trump's exit from the nuclear deal with Tehran and the re-imposition of sanctions.

The depreciation of the US dollar against major currencies is providing a tailwind to Brent bulls. Jerome Powell's indication of an imminent reduction in the federal funds rate and US labor market statistics showing a deceleration in the economy and easing inflation pressures have left the dollar vulnerable. This is in contrast to the European Central Bank and the Bank of England, which are delaying monetary easing, and the Bank of Japan, which plans to tighten monetary policy.

An additional hit to the dollar could stem from ongoing disinflationary trends in the US. If upcoming consumer price and core inflation data meet expectations, speculation about the Federal Reserve commencing monetary expansion in May could knock the USD index down, favoring oil prices.

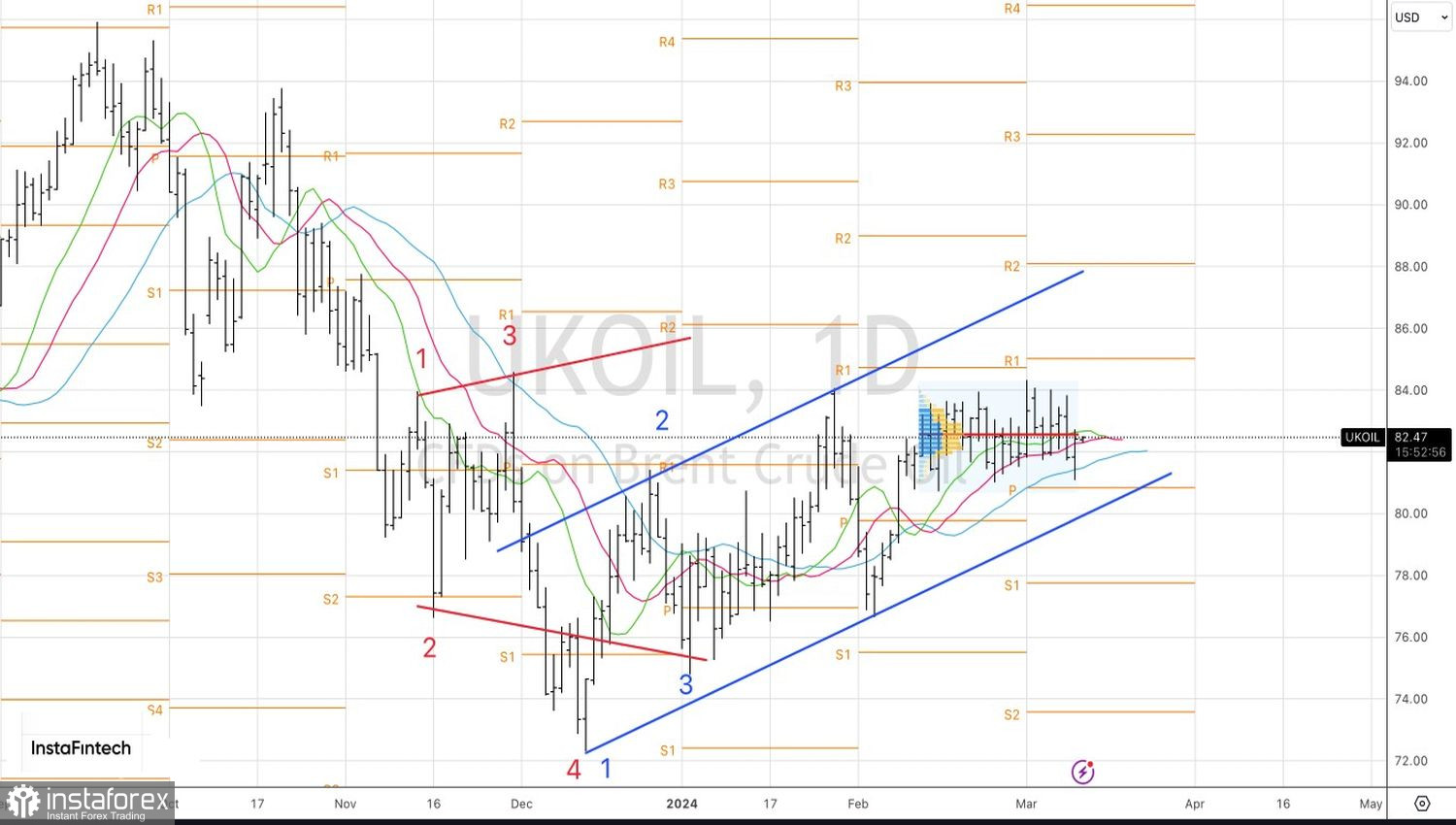

From a technical standpoint, Brent crude is experiencing a consolidation phase on the daily chart, with prices fluctuating between $81.5 and $84 per barrel. The false breach of the lower limit has paved the way for traders to initiate long positions as prices rebound above the fair value of $82.65.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română