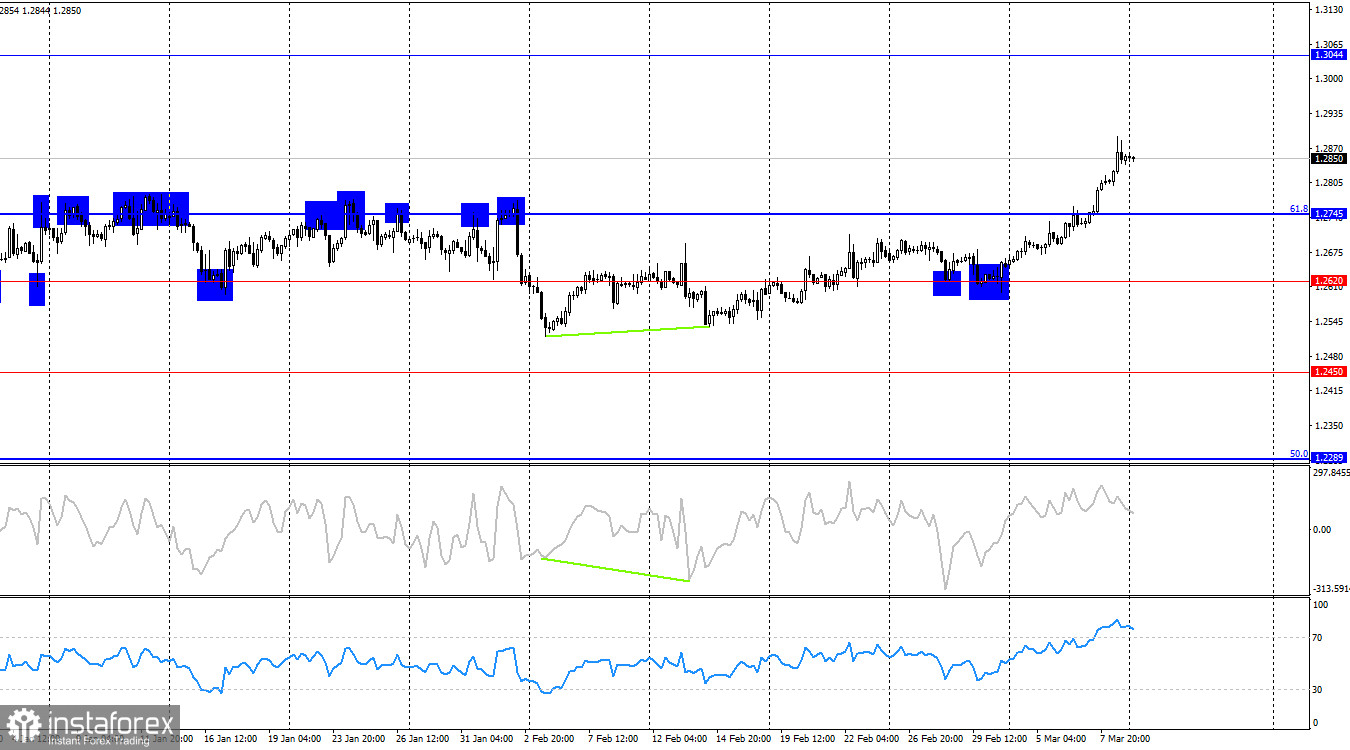

On the hourly chart, the GBP/USD pair on Friday consolidated above the zone of 1.2788–1.2801 and rose to the corrective level at 76.4%–1.2876. The rebound of quotes from this level worked in favor of the US dollar, leading to a decline towards the zone of 1.2788–1.2801. The ascending trend corridor characterizes the current sentiment of traders as "bullish." Only a consolidation below it will allow counting on a shift of initiative to the bears and the US dollar. The consolidation of the pair's rate above the level of 1.2876 increases the likelihood of further growth towards the next level at 1.2931.

The wave situation has become somewhat clearer. Recently, the bulls have switched to an active offensive, and we have seen three consecutive upward waves. The last upward wave managed to break through the peak of February 22, so there are no signs of a trend change to "bearish" at the moment. The sideways movement seems to be complete since the pound has risen above all the peaks of the last few months. However, the danger of a renewed flat remains if bears launch an offensive from current levels. In any case, in the current circumstances, a decline in the pair below the support zone of 1.2584–1.2611 is required for me to speak about a trend change to "bearish."

On Friday, there was no news for the British pound, but there was enough news for the American one, and traders and bulls continued their attack. Nonfarm payrolls in February turned out to be better than traders' expectations, but for some reason, more attention was paid to the January value, which was revised downward. The unemployment report was the only disappointment, showing an acceleration to 3.9%. Wages were within the forecast. The bulls had the right to continue their offensive on Friday, but in the previous 5–6 days, the information background was not on their side. On Friday morning, the pound had no reason to rise, and yet we observed growth. Thus, the pound is currently growing, not because it has informational support.

On the 4-hour chart, the pair consolidated above the correction level at 61.8% (1.2745). This consolidation allows for further growth towards the level of 1.3044. The pound has risen very strongly over the past few weeks, practically without informational support. The strength of the bulls may be running out. There are no signs of impending divergences with any indicator today. Consolidation below the ascending corridor on the hourly chart will allow for a more justified rise in the American dollar.

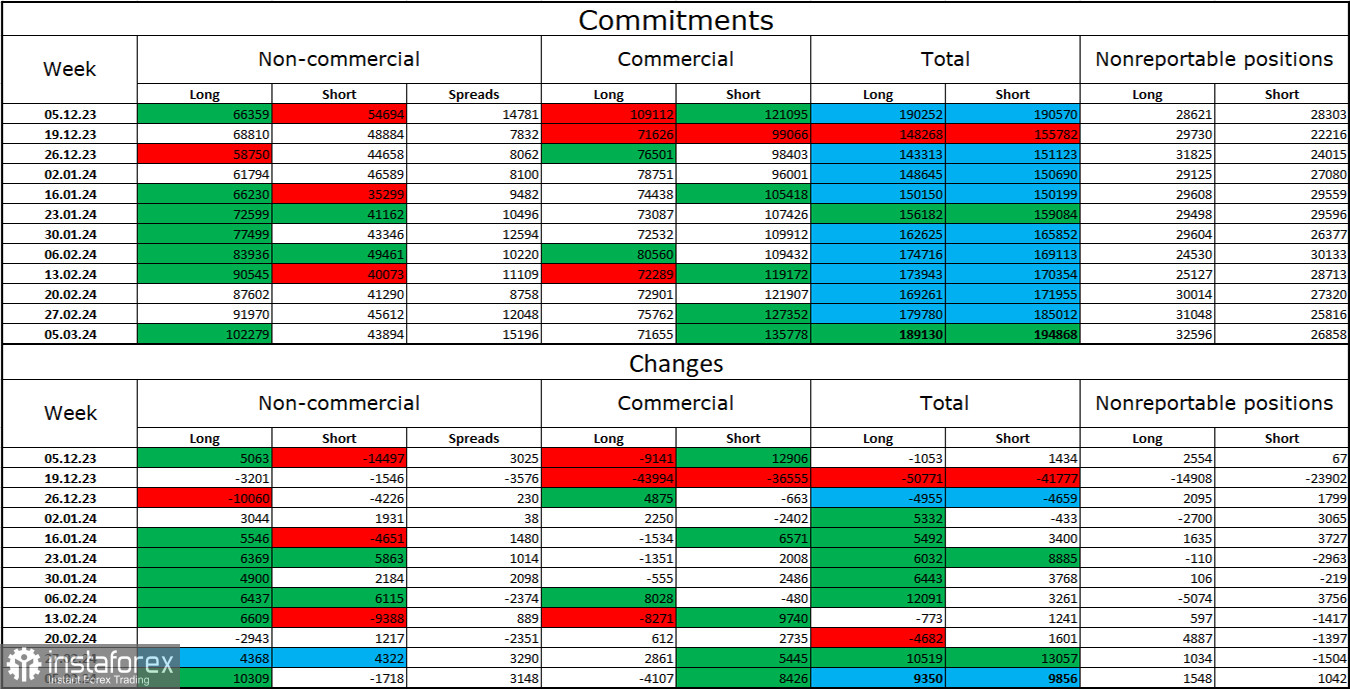

Commitments of Traders (COT) report:

The sentiment of the "non-commercial" trader category for the last reporting week has become more "bullish." The number of long contracts held by speculators increased by 10,309 units, while the number of short contracts decreased by 1,718 units. The overall sentiment of large players remains "bullish" and continues to strengthen, although I do not see any specific reasons for this. There is more than a two-fold gap between the number of long and short contracts: 102 thousand versus 44 thousand.

In my opinion, the prospects for a fall remain excellent for the British pound. I believe that over time, bulls will start getting rid of buy positions, as all possible factors for buying the British pound have already been worked out. However, bears continue to demonstrate their weakness. I also want to note that the total number of long and short positions has coincided for several months now, indicating market balance.

News calendar for the United States and the United Kingdom:

On Monday, the economic events calendar did not contain any interesting entries. The influence of the information background on market sentiment will be absent today.

GBP/USD forecast and trader tips:

Selling the British pound can be considered a rebound from the level of 1.2876 on the hourly chart, with a target zone of 1.2788–1.2801. Or when closing below the ascending trend corridor with the target zone of 1.2705–1.2715. Purchases were possible when closing on the hourly chart above the zone of 1.2788–1.2801, with a target of 1.2876. This target has been worked out. New purchases are possible on a rebound from the zone of 1.2788–1.2801 or when consolidating above 1.2876.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română