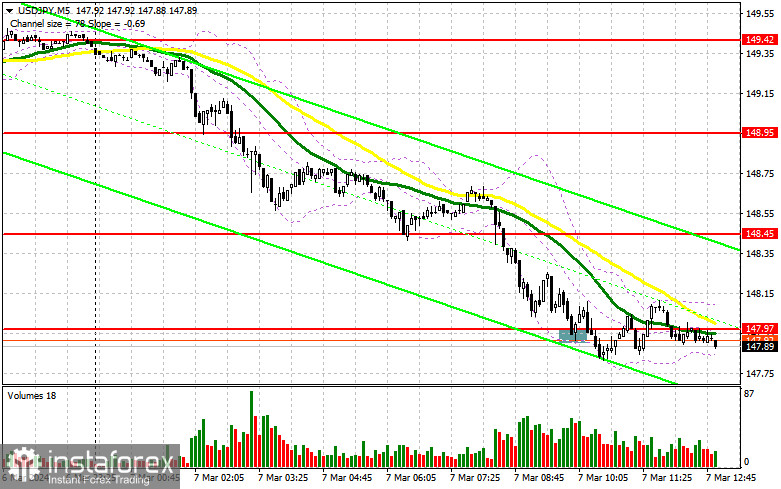

In my morning forecast, I paid attention to the level of 147.97 and planned to make decisions on entering the market from there. Let's look at the 5-minute chart and figure out what happened there. The decline and a false breakout there led to a buy signal. However, after an upward movement of 15 pips, USD/JPY again came under selling pressure. Nobody wants to buy the US dollar even at current prices, and there is a good reason for this. In the afternoon, the technical picture was revised.

What is needed to open long positions on USD/JPY

Expectations of a change in policy from the Bank of Japan continue to put pressure on the US dollar, which may continue to fall against the Japanese yen. This requires weak data on US initial unemployment claims and the US foreign trade balance. Speeches by Fed policymakers such as Fed Chairman Jerome Powell and FOMC member Loretta Mester are unlikely to help the dollar much. You need to act extremely carefully against the ongoing bear market. I plan to open long positions only after a false breakout has formed in the area of the nearest support 147.46, similar to what I discussed above. This will provide a suitable entry point for buying, bearing in mind the growth new resistance of 148.08, formed in the first half of the day. A breakout and consolidation above this range will allow the buyers to win back at least a little of their position in the market, giving a chance for growth to 148.73. The farthest target will be a high of 149.42, where the moving averages are located. I will take profits there. Given the scenario of a decline in the price and lack of buying activity at 147.46 in the afternoon, as well as dovish rhetoric from Fed policymakers, pressure on the US dollar will only increase. In this case, I will try to enter the market around 146.94. But only a false breakout there will be a suitable condition for opening long positions. I plan to buy USD/JPY immediately during a dip from 146.49, bearing in mind a correction of 30-35 pips within the day.

What is needed to open short positions on USD/JPY

The sellers remain in the market. Judging by the chart, they have no intention of leaving. In case of an upward correction, only a false breakout in the area of 148.08 will provide a good entry point for selling with another movement to support of 147.46. A breakout and reverse test from the bottom to the top of this range will cause a more serious blow to the positions of the bulls, which will lead to the removal of stop orders and open the way to 146.94. This will strengthen the bearish trend. A more distant target will be the area of 146.49, where I will take profits. If USD/JPY grows and there is no selling activity at 148.08 in the afternoon, larger profit-taking accompanied by growth of USD/JPY will begin. This will allow dollar buyers to win back their positions a little. Therefore, it is best to postpone selling until the test of the next resistance at 148.73. If there is no downward movement even there, I will sell USD/JPY immediately during a rebound from 149.42, but only in anticipation of a downward correction by 30-35 pips within the day.

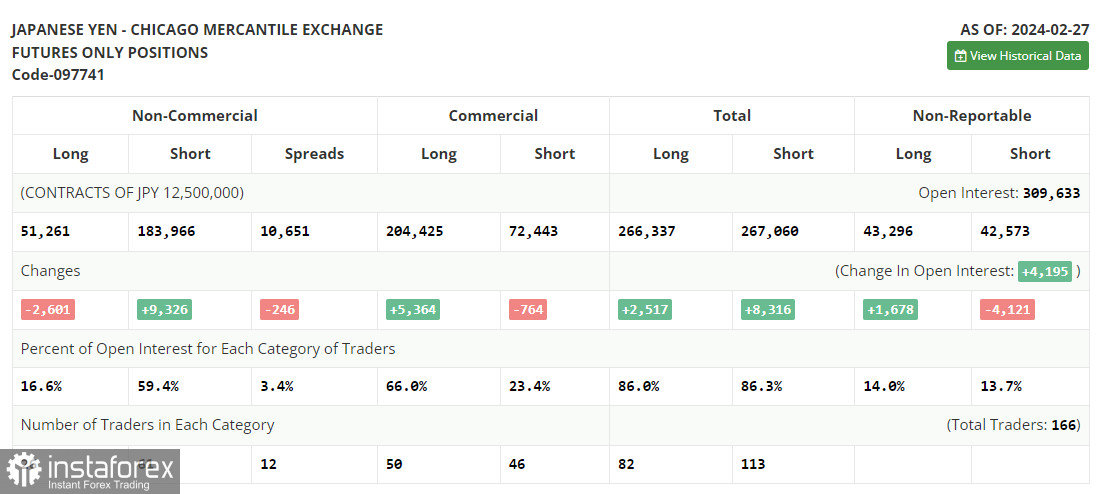

In the COT report (Commitment of Traders) for February 27, there was an increase in short positions and a decrease in long positions. The dollar at 150 yen remains a problem for traders. First of all, it is overvalued. Second, somewhere at this level the Bank of Japan begins its forex interventions. However, there are absolutely no reasons for selling yet. Recent statements from the BoJ's officials that monetary policy will be eventually tightened provoked robust buying of the yen and a fall in USD/JPY. The instrument was promptly bought during the fall in anticipation of further aggressive monetary policy by the Federal Reserve. The latest COT report said that long non-commercial positions fell by 2,601 to 51,261, while short non-commercial positions jumped by 9,326 to 183,966. As a result, the spread between long and short positions fell by 246.

Indicators' signals

Moving averages

The instrument is trading below the 30 and 50-day moving averages. It indicates a further drop in USD/JPY.

Note: The period and prices of the moving averages are considered by the analyst on the 1-hour chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

In case USD/JPY goes down, the indicator's lower border at about 147.60 will act as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română