EUR/USD

Higher Timeframes

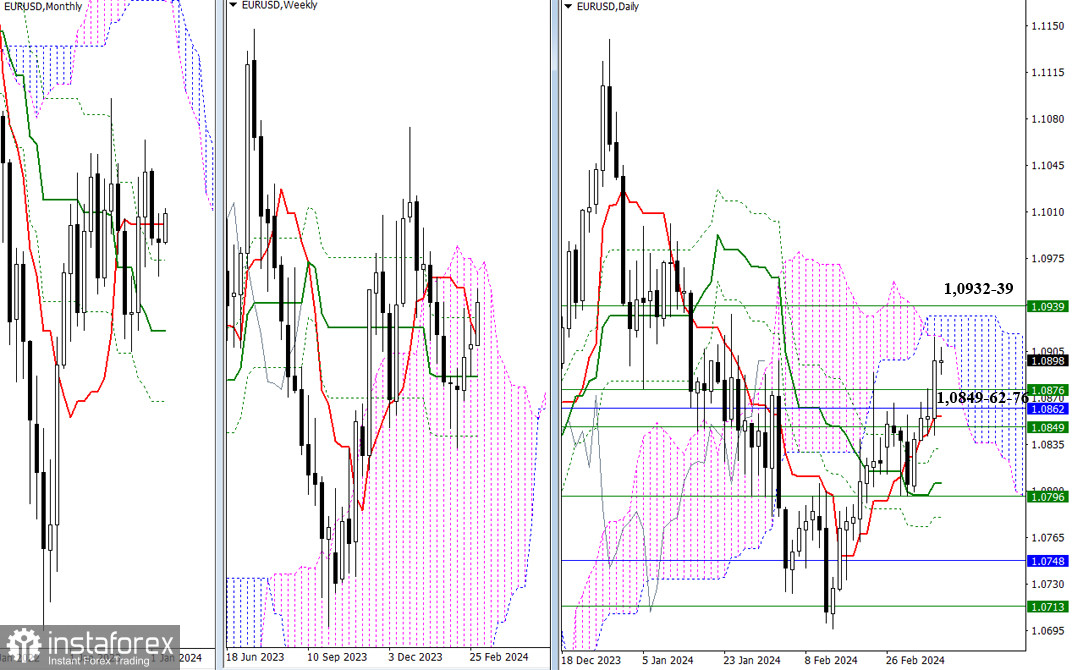

Bullish players successfully managed to surpass the resistance zone of 1.0849–1.0862–1.0876 yesterday. These resistance levels had been holding back the development of the movement for quite some time, so maintaining the achieved result will allow the bulls to focus on new tasks. The levels breached yesterday now play the role of supports, and during market declines, any of them may counteract bearish interests. Today's immediate upward plans include breaking through the daily cloud (1.0916 – 1.0932) and establishing a position in the bullish zone relative to the daily (1.0932) and weekly (1.0939) Ichimoku clouds.

H4 – H1

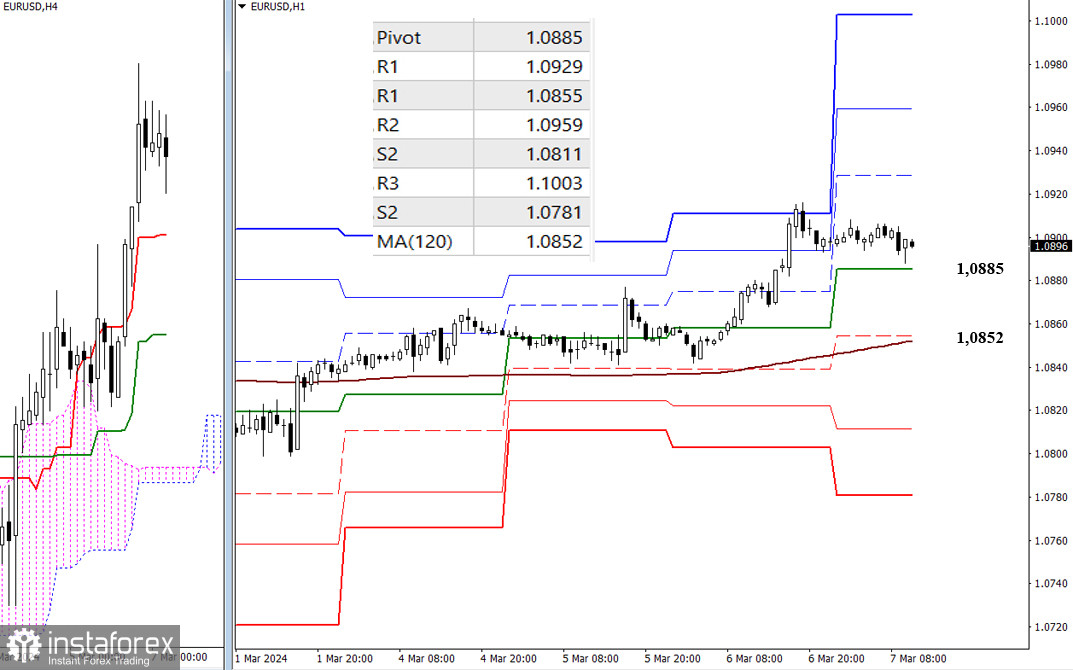

On the lower timeframes, the pair is once again trading within a correction zone, but the main advantage remains on the bulls' side. Intraday bullish targets today can be noted at 1.0929 – 1.0959 – 1.1003. Key levels serve as benchmarks for the development of the correction; today, they are positioned at 1.0885 (central pivot point of the day) and 1.0852 (weekly long-term trend). Losing these key levels will shift the primary advantage to bearish players, and the development of bearish sentiments intraday will pass through the supports of classic pivot points (1.0811 – 1.0781).

***

GBP/USD

Higher Timeframes

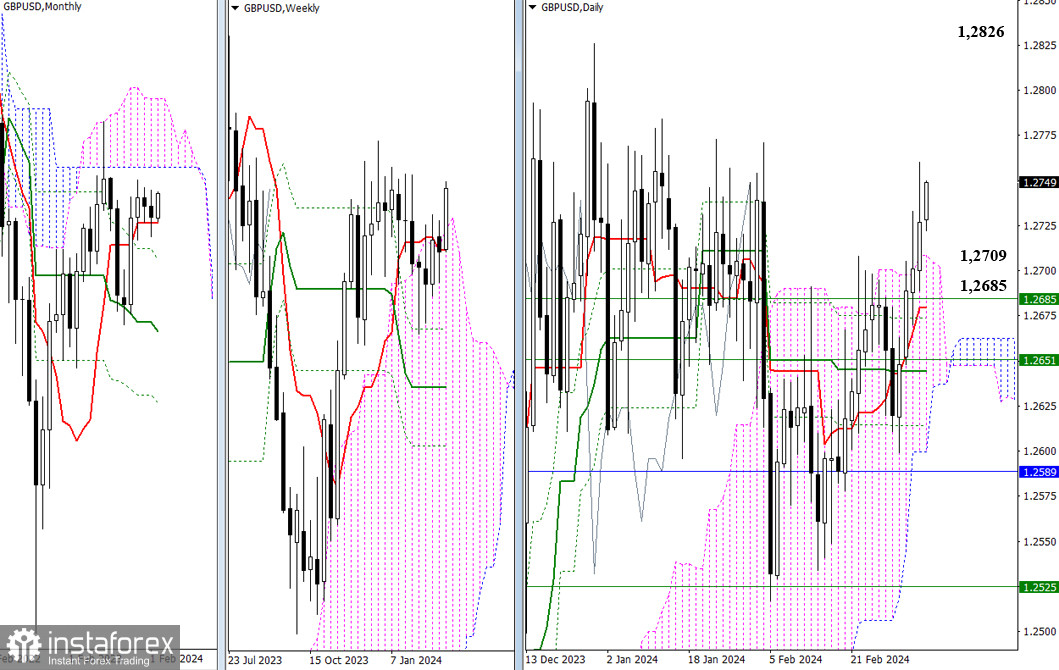

As a result of the previous day, the bulls managed to establish themselves above the Ichimoku cloud. Now, their task is to solidify the result on the weekly timeframe. Afterward, bullish plans will include exiting the weekly correction zone (1.2826) and rising towards the lower boundary of the monthly cloud (1.2893). The levels breached yesterday, which are the boundaries of the daily (1.2709) and weekly (1.2685) Ichimoku clouds, can now act as supports in the event of a change in priorities and the development of a decline.

H4 – H1

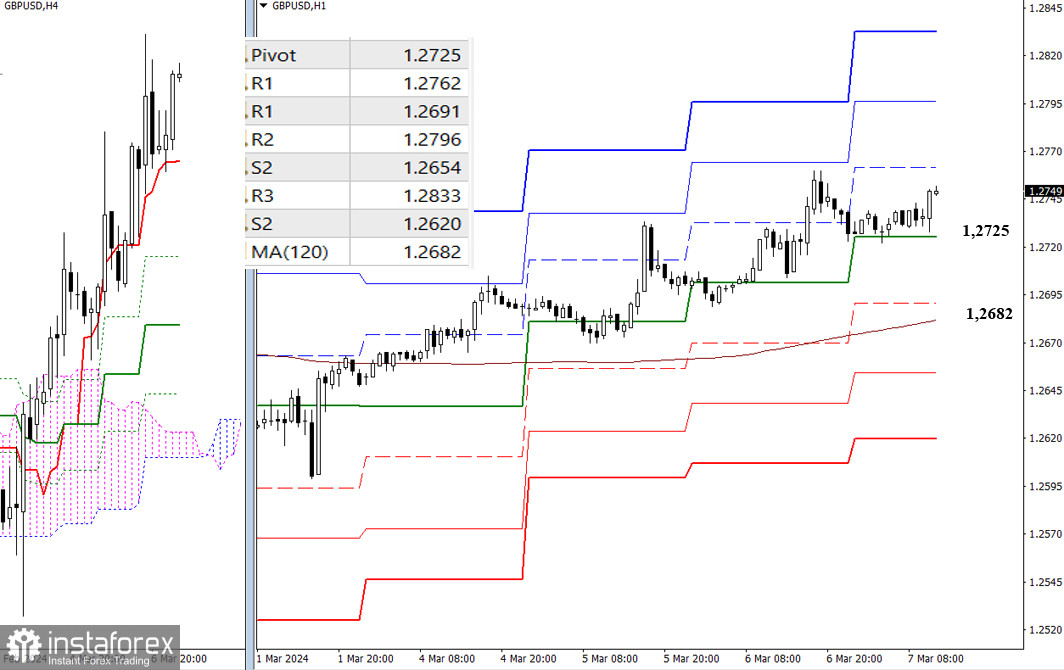

On the lower timeframes, the market has long been supported by the central pivot point of the day (1.2725). Upon a resumption of the ascent, intraday attention will be focused on overcoming the resistances of classic pivot points (1.2762 – 1.2796 – 1.2833). However, if the bulls fail to continue the movement and lose the weekly long-term trend (1.2682), the opponent will seize the current advantage. Strengthening bearish sentiments on the lower timeframes is possible through breaching the supports of classic pivot points (1.2654 – 1.2620).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română