The single currency managed to break out of the flat phase it had been in for almost two weeks. This is despite the extremely weak eurozone retail sales data, which fell by a less-sharp 1.0%, while a slowdown to -0.3% was expected. Therefore, consumer activity in Europe continues to decline. But it is the main engine of economic growth.

Apparently, the euro had two reasons to rise. Firstly, in anticipation of the U.S. employment data. Secondly, today's European Central Bank meeting.

Speaking of employment, the data came out better than expected but was still relatively weak. Private sector employment increased by 140,000 jobs in February, which is significantly more than the expected 90,000, but in order to maintain labor market stability, average monthly employment should rise by 250,000. Whereas, over the past seven months, the best result was recorded in December when employment increased by about 150,000. So, the situation in the U.S. labor market is not that great. Considering that the U.S. data is much more important for the markets compared to others, sometimes even if they are grouped together, it is not surprising that the dollar fell, despite the weak eurozone data.

The ECB meeting is quite interesting. We have noticed that leading publications have not highlighted such an important event. Partly because the results of the meeting are already predetermined. Obviously, interest rates will remain unchanged. However, Lagarde's press conference will follow, and she may outline the approximate timing of the start of the monetary easing process. It is quite possible that rates will be lowered this spring. That is, the first rate cut will take place in just a month and a half. This may exert significant pressure on the single currency. And it is quite possible that by the end of the trading day, the market will return to the same range in which it was in for almost two weeks.

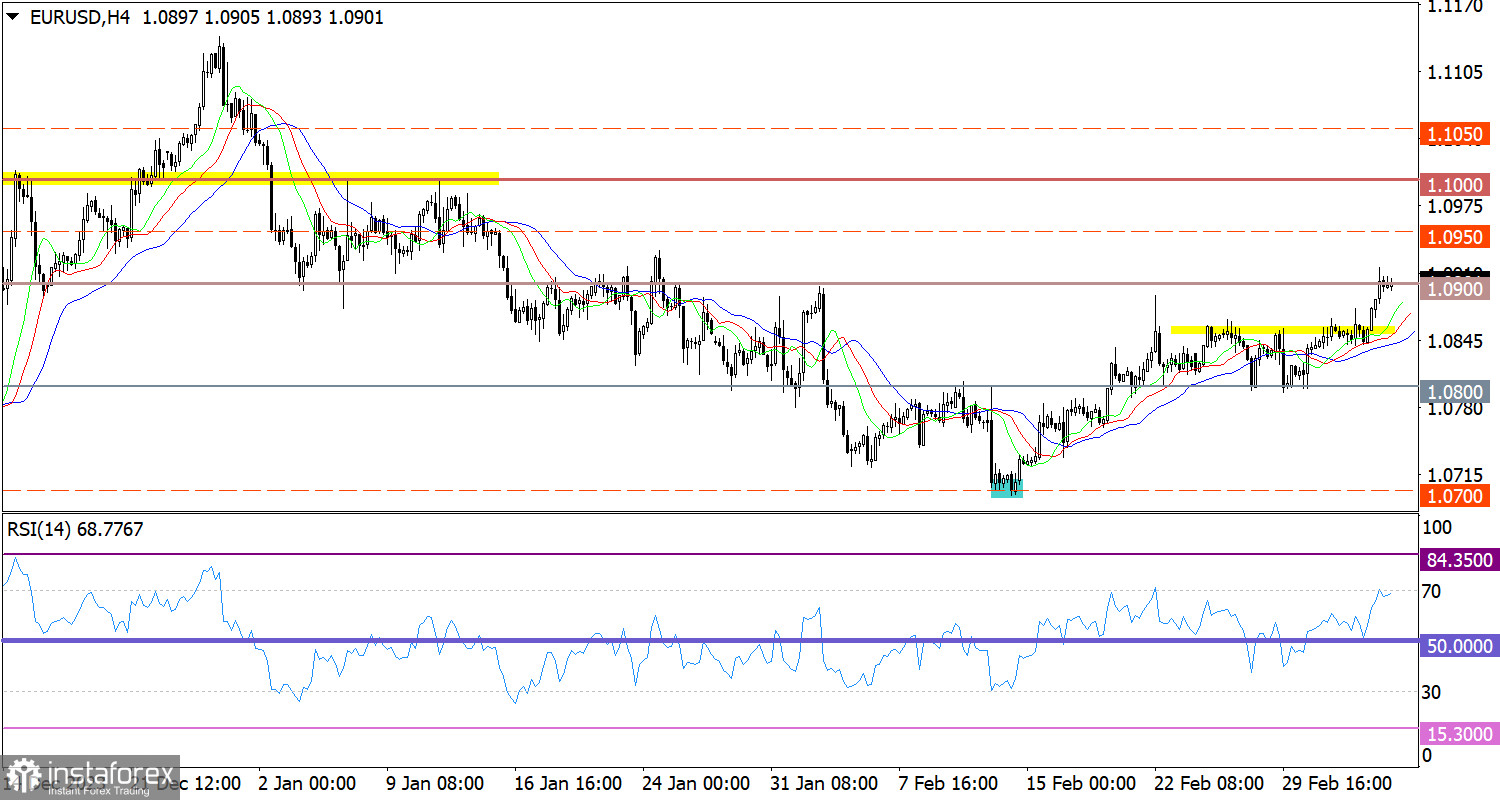

EUR/USD, upon leaving the sideways range of 1.0800/1.0850, increased the volume of long positions, leading to a bullish momentum. As a result, the quote rose above the level of 1.0900.

On the 4-hour chart, the RSI has reached the overbought zone, pointing to the overvalued state of the trading instrument, indicative of short-term price movements.

On the same chart, the Alligator's MAs are headed upwards, indicating an upward cycle.

Outlook

In this situation, the information and news background play a crucial role in the market. For this reason, technical analysis may temporarily deviate from the logical sequence, which indicates that the euro could rise further.

In terms of complex indicator analysis, an upward movement is likely in the short term and intraday periods, which is in line with the price moving towards the level of 1.0900.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română