The EUR/USD currency pair traded slightly more actively on Wednesday. Several significant reports on the US labor market and unemployment, as well as Jerome Powell's speech in Congress, had an impact on this. We will discuss these events in detail in our upcoming articles. For now, let's focus on more global issues and questions.

First, it is worth noting that the European currency continues to rise. It is rising very slowly because volatility remains extremely low. Yes, there are days when volatility spikes, but these are isolated cases. So, the European currency continues to rise, and this rise remains corrective. The preceding decline was more pronounced, and on the 24-hour timeframe, it is clear that a new downtrend started last summer. Thus, each upswing in the upward movement is a correction. The euro is not falling as sharply as we would like, but there is nothing to be done about it; the market balances itself.

Second, the fundamental background for the EUR/USD pair, if it has changed, has not changed in favor of the euro. Recall that for a long time, the market expected the Fed to lower rates in March and the ECB to lower rates no earlier than in the autumn. Now the situation has changed drastically. Now the Fed is expected to make the first easing of monetary policy no earlier than June, and some experts suggest that it may happen much later. The US economy is doing well and there is still high inflation, which favors a rate cut by the Fed later. The Fed simply has no reason to rush and hurry with rate cuts.

The situation is different for the ECB. Inflation has already dropped to 2.6%, and the economy has been on the brink of recession for over a year. Thus, both of the most important factors in determining monetary policy parameters indicate that it is time to lower rates. The ECB simply has no reason to keep rates at the maximum level since inflation has already approached the target.

This week will see the second ECB meeting this year, so why doesn't the regulator start lowering rates this week? The thing is, the ECB doesn't want to rush events either. Inflation is a "capricious" indicator; it may start accelerating again against the backdrop of an unstable geopolitical situation. Therefore, the monetary committee wants to first ensure that consumer prices return to the necessary level and then proceed to easing.

ECB Vice President Luis de Guindos stated this week, "We need more data indicating a gradual movement of inflation towards the target." "Once we are confident that headline and core inflation will inevitably return to 2%, we will be ready to lower rates," said the ECB Vice President. Recall that Christine Lagarde spoke earlier about the beginning of the summer.

And all the above tells us only that expectations from the ECB are becoming more "dovish," while those from the Fed are more "hawkish." Such a setup in the fundamental background should support the US dollar, not the other way around. We cannot call the current rise in the euro logical and justified.

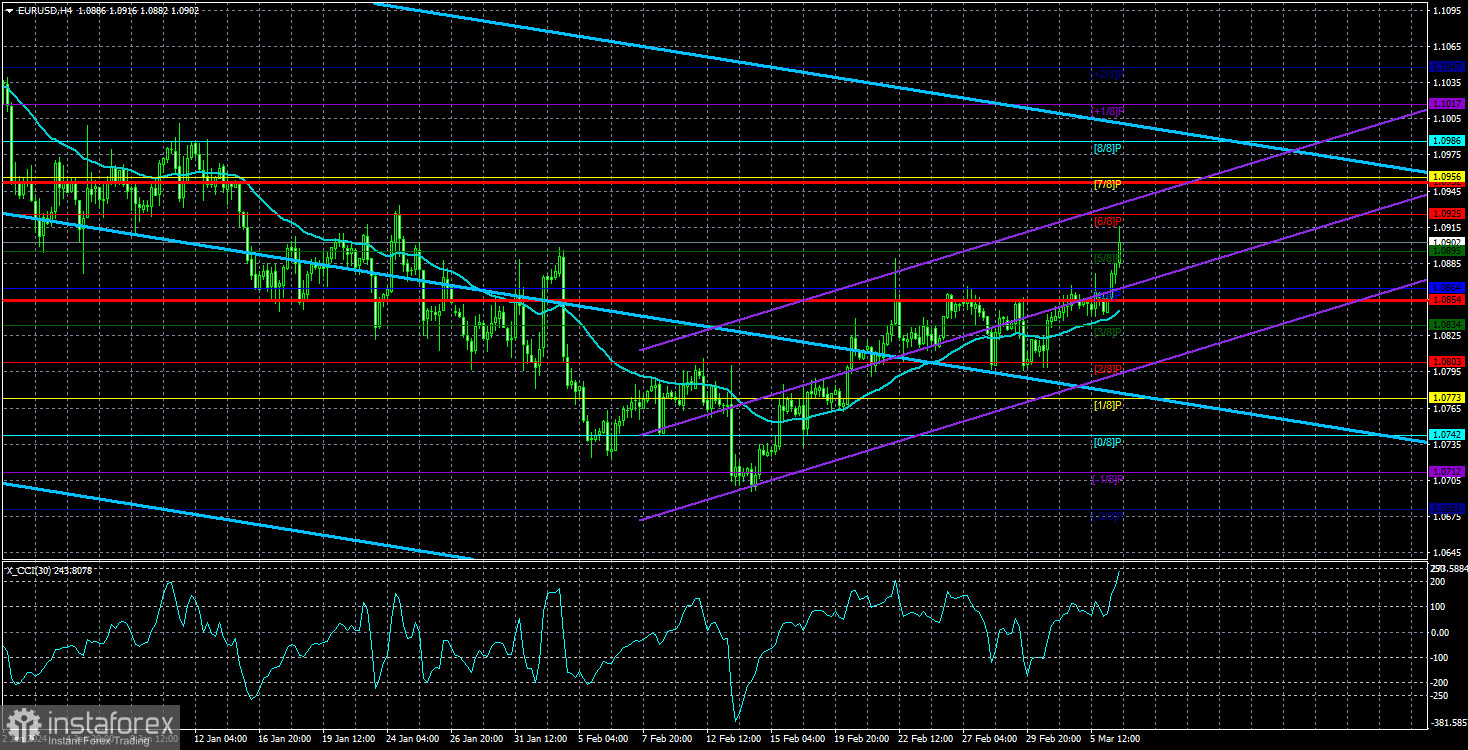

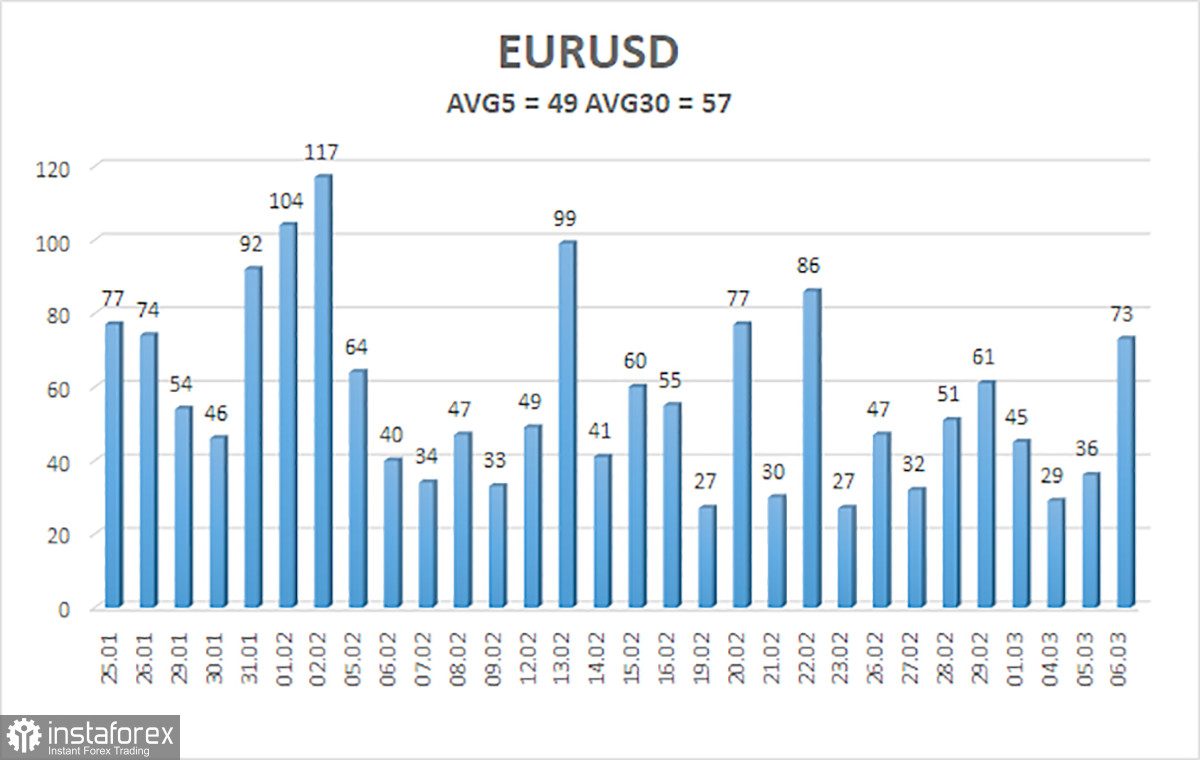

The average volatility of the EUR/USD currency pair for the last 5 trading days as of March 7 is 49 points and is characterized as "low." Thus, we expect the pair to move between the levels of 1.0854 and 1.0952 on Thursday. The senior linear regression channel is still downward, so the downtrend persists. The oversold condition of the CCI indicator has caused a slight upward correction, which may end soon as the indicator enters the overbought zone.

Nearest support levels:

S1 – 1.0895

S2 – 1.0864

S3 – 1.0834

Nearest resistance levels:

R1 – 1.0925

R2 – 1.0956

R3 – 1.0986

Trading recommendations:

The EUR/USD pair continues to stay above the moving average line, but we continue to look towards short positions with a target of 1.0681, at least. The correction is still ongoing, and with the current volatility, it may continue for some time. Whichever way the pair moves in the near future, these movements are extremely difficult to work with because they are very weak. We see no reasons for a global rise in the euro. Long positions can be formally considered until the price consolidates below the moving average. Targets are 1.0925 and 1.0956.

Explanations for the illustrations: Linear regression channels - help determine the current trend. If both are directed in the same direction, it means the trend is strong.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold zone (below -250) or the overbought zone (above +250) indicates that a trend reversal towards the opposite side is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română