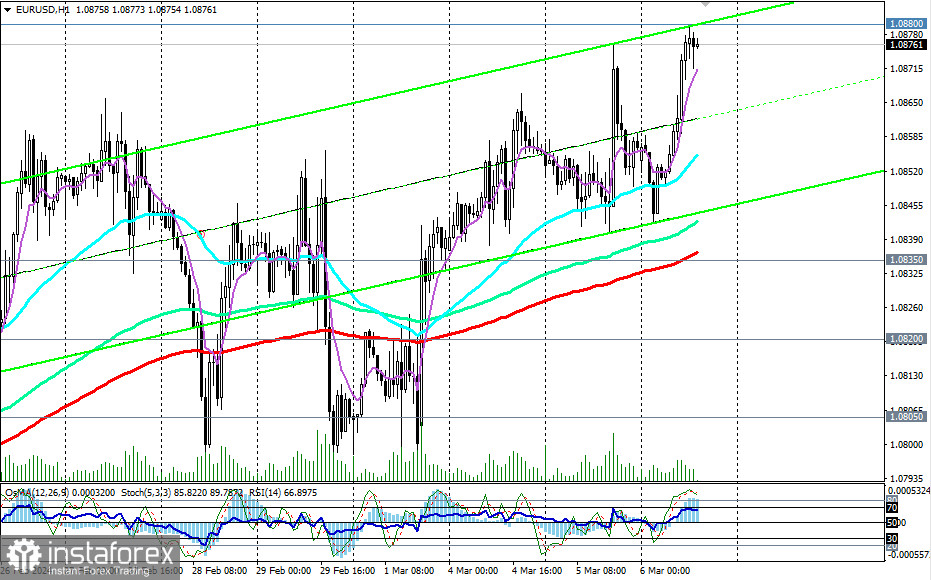

EUR/USD continues to develop an upward correction, moving within the medium-term bullish market zone—above the key support level of 1.0805 (200 EMA on the daily chart). Technical indicators RSI, OsMA, and Stochastic on the daily and weekly charts are favoring buyers.

To solidify success and enter the long-term bullish market zone, the price needs to not only surpass the key resistance level of 1.1000 (200 EMA on the weekly chart) but also break through a strong resistance zone formed at levels 1.0880, 1.0900 (144 EMA on the weekly chart), and 1.0920.

In an alternative scenario, and after breaking the key support level of 1.0805, EUR/USD will return to the medium-term bearish market zone and continue its decline within the framework of the long-term bearish trend.

If this scenario unfolds, targets for a decline include local support levels at 1.0530 and 1.0450, with interim support near the local support level of 1.0700.

A breakthrough of today's intraday low at 1.0843 and the important support level of 1.0835 (50 EMA on the daily chart) could be the earliest signal of the beginning of the realization of this scenario.

Support levels: 1.0843, 1.0835, 1.0820, 1.0805, 1.0725, 1.0700, 1.0660, 1.0600, 1.0530, 1.0500, 1.0450, 1.0400, 1.0300

Resistance levels: 1.0880, 1.0900, 1.0920, 1.1000, 1.1040, 1.1090, 1.1100, 1.1140, 1.1200, 1.1275, 1.1300, 1.1400, 1.1500, 1.1530, 1.1600, 1.1630

Trading Scenarios:

Alternative Scenario: Sell Stop 1.0830. Stop-Loss 1.0890. Targets 1.0820, 1.0800, 1.0725, 1.0700, 1.0660, 1.0600, 1.0530, 1.0500, 1.0450, 1.0400, 1.0300

Main Scenario: Buy Stop 1.0890. Stop-Loss 1.0830. Targets 1.0900, 1.0920, 1.1000, 1.1040, 1.1090, 1.1100, 1.1140, 1.1200, 1.1275, 1.1300, 1.1400, 1.1500, 1.1530, 1.1600, 1.1630

"Targets" correspond to support/resistance levels. This does not necessarily mean they will be achieved, but they can serve as a guide when planning and placing trading positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română