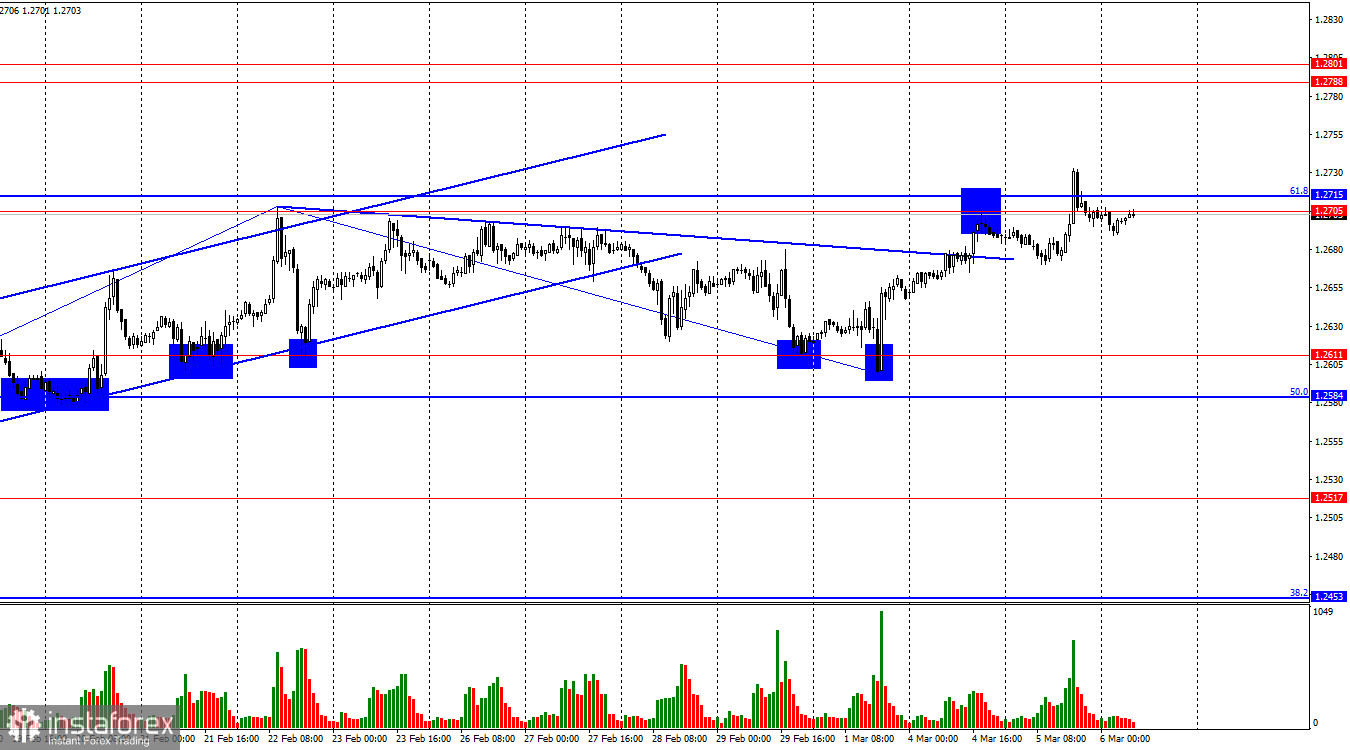

On the hourly chart, the GBP/USD pair showed growth on Tuesday towards the resistance zone of 1.2705–1.2715. I cannot say that there was a clear bounce from this zone, but there was no consolidation above it either. The situation is very ambiguous, but the British pound has been in a sideways trend for quite some time, as evident on the 4-hour chart. And a sideways trend is always inconvenient for traders, whose activity, by the way, is currently very low. Therefore, we do not see attractive movements and precise signals at the moment.

The wave situation remains very ambiguous. We continue to observe horizontal movement, within which single waves or triplets are almost always forming, alternating with each other and having approximately the same size. I have no confidence in the completion of the sideways trend. The last upward wave managed to break the peak on February 22, so there are no signs of a shift to a "bearish" trend (within the sideways trend) at the moment. However, I will repeat: the graphical picture for the British pound is currently very ambiguous.

On Tuesday, bull traders received support from America. Recall that bull traders are buyers of the British pound, not the American dollar. The ISM business activity index in the service sector in February was 52.6, although the market expected a value not less than 53.0. The S&P service sector business activity index, on the contrary, turned out to be better than forecasts and the January value, but no one paid attention to it. The British business activity index for the service sector was worse than traders' expectations, but again, no one paid attention to it. Instead, the ISM index was worked out with a margin, and bears retreated again, further complicating the graphical picture.

On the 4-hour chart, the pair consolidated above the trend line and rebounded from the level of 1.2620, which allows us to count on further growth towards the corrective level of 61.8%–1.2745. However, at this time, I would not seriously count on a new "bullish" trend. On all charts, a horizontal vector of movement is perfectly visible now. Only consolidation above the level of 1.2745 will allow counting on the further growth of the British pound. There are no impending divergences with any indicators today.

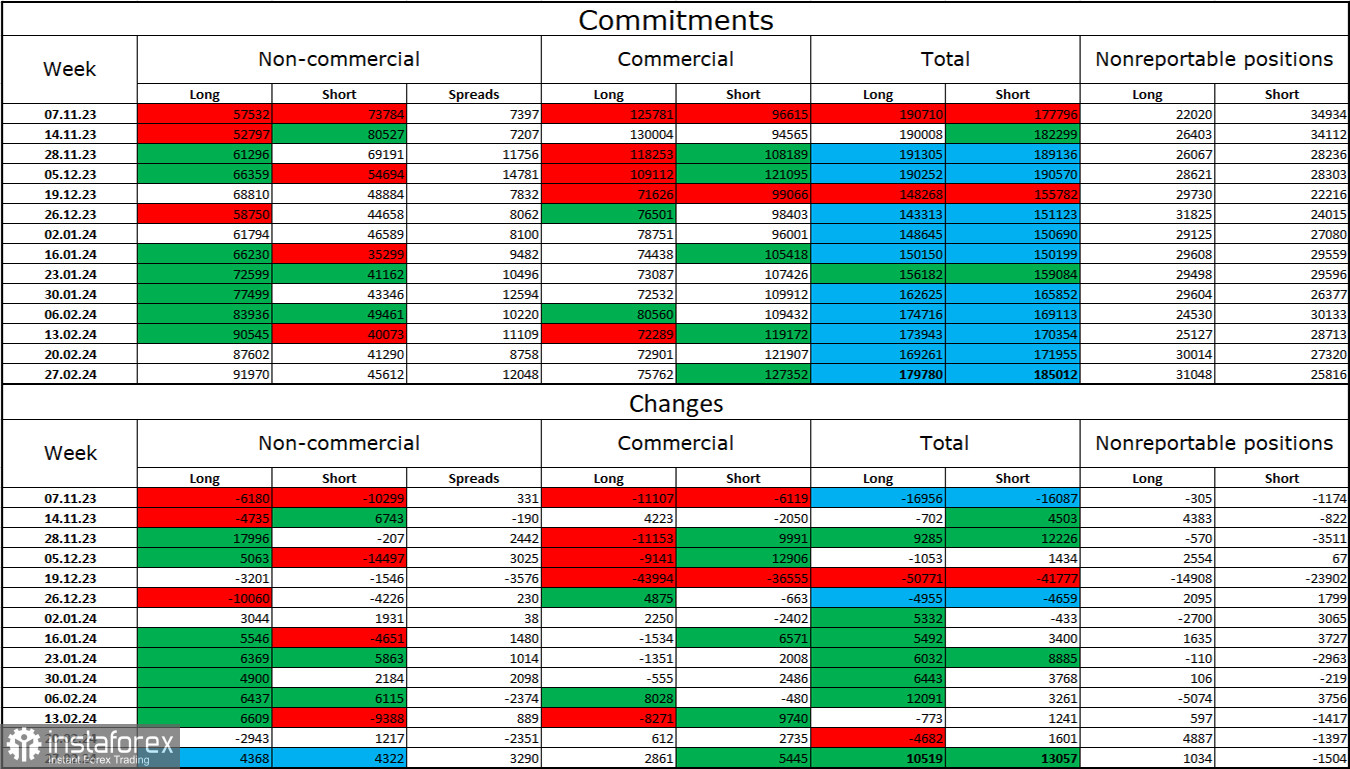

Commitments of Traders (COT) report:

The sentiment in the "non-commercial" trader category did not change during the last reporting week. The number of long contracts held by speculators increased by 4368 units, and the number of short contracts increased by 4322 units. The overall sentiment of major players remains "bullish" and continues to strengthen, although I do not see any specific reasons for this. Between the number of long and short contracts, there is a more than twofold gap: 92 thousand against 45 thousand.

In my opinion, the prospects for a fall in the British pound are excellent. I believe that over time, bulls will start getting rid of buy positions since all possible factors for buying the British pound have already been worked out. For three months, bulls have been unable to push through the level of 1.2745, but bears are also not in a hurry to go on the offensive and are generally very weak at the moment. I also want to note that the total number of long and short positions has coincided for several months, indicating market equilibrium.

News calendar for the US and the UK:

UK – Construction Sector Business Activity Index (09:30 UTC).

US – ADP Nonfarm Employment Change (13:15 UTC).

US – Speech by Fed Chairman Jerome Powell (15:00 UTC).

US – JOLTS Job Openings (15:00 UTC).

On Wednesday, the economic events calendar contains several interesting entries, with the most important being Jerome Powell's speech. The impact of the information background on market sentiment today can be quite strong.

Forecast for GBP/USD and trader recommendations:

Sales of the British pound can be considered with a clear bounce of the pair from the zone of 1.2705–1.2715 on the hourly chart to the target zone of 1.2584–1.2611. Purchases will become possible after closing above the zone of 1.2705–1.2715 on the hourly chart with a target of 1.2788–1.2801, but I would be cautious about buying the British pound. Although bulls may receive support from Powell and two US labor market reports today.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română