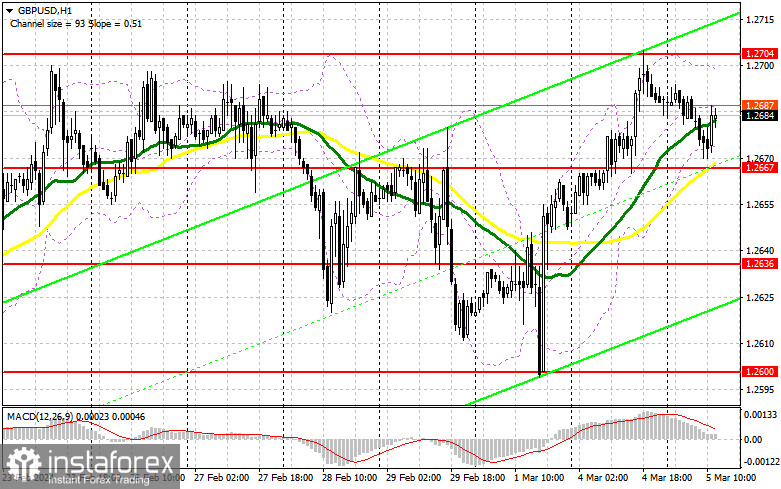

In my morning forecast, I paid attention to the 1.2667 level and planned to make decisions on entering the market from it. Let's look at the 5-minute chart and figure out what happened there. The decline occurred, but it never reached the formation of a false breakdown at 1.2667. It was not possible to get suitable signals to enter the market. In the afternoon, the technical picture was not revised.

To open long positions on GBP/USD, you need:

Weak data on the UK services sector, which turned out to be worse than economists' forecasts, exerted only minor pressure on the pair, which large buyers managed to take advantage of in the continuation of the bull market. We have similar data ahead, but for the USA. Figures are expected for the ISM business activity index in the service sector, the composite PMI index and changes in the volume of production orders. Weak data will help pound buyers continue to rise, while strong reports will lead to a pair's decline. If the pound reacts to the data with a drop, the development of a downward correction is not excluded. However, buyers will do everything possible to prevent a fall below the nearest support at 1.2667, where I plan to act. The formation of a false breakout there will provide an entry point with the target of rising to resistance at 1.2704, formed at the end of yesterday. A breakthrough and testing of this range from top to bottom will strengthen the chance of further recovery for GBP/USD, leading to new purchases and allowing it to reach 1.2741. If it goes beyond this range, we can talk about a surge to 1.2769, where I plan to take a profit. In the scenario of GBP/USD falling and the absence of buyers at 1.2667 in the second half of the day, sellers will have a chance to drop the pound to around 1.2536. Buying there will only occur on a false breakout. I plan to open long positions on GBP/USD immediately on the rebound from 1.2600, with the target of a correction within the day of 30-35 points.

For opening short positions on GBP/USD, the following is required:

Sellers tried to capitalize on poor statistics, but it did not lead to anything interesting. Volatility remained extremely low, which buyers took advantage of to further develop the bullish market. And although bears have every chance of regaining the initiative, strong data is needed for this. Along with the formation of a false breakout around the resistance level of 1.2704, this will be a good time to start short positions, betting on a drop that will test support at 1.2667, where moving averages are located, which is in favor of buyers. A breakout and a reverse test from bottom to top of this range will increase pressure on the pair, giving bears an advantage and another entry point for selling with the target of updating 1.2636, where I expect more active buying. The ultimate target will be the minimum of 1.2600, where I will take a profit. In the scenario of GBP/USD rising and the absence of bears at 1.2704 in the second half of the day, bulls will strengthen their advantage, leading to the development of a new uptrend and upward movement towards the next resistance at 1.2741. I will also only enter short positions on a false breakout there. If there is no activity there as well, I recommend opening short positions on GBP/USD from 1.2769, counting on a pair rebound down by 30-35 points within the day.

Indicator Signals:

Moving Averages:

Trading is carried out around the 30 and 50-day moving averages, indicating a sideways market.

Note: The author examines the period and prices of moving averages on the hourly chart H1, differing from the general definition of classic daily moving averages on the daily chart D1.

Bollinger Bands:

In the event of a decrease, the lower boundary of the indicator will act as support around 1.2670.

Description of Indicators:

- Moving Average (MA): Determines the current trend by smoothing volatility and noise. Period 50. Marked on the chart in yellow.

- Moving Average (MA): Determines the current trend by smoothing volatility and noise. Period 30. Marked on the chart in green.

- MACD Indicator (Moving Average Convergence/Divergence): Fast EMA period 12, Slow EMA period 26, SMA period 9.

- Bollinger Bands: Period 20.

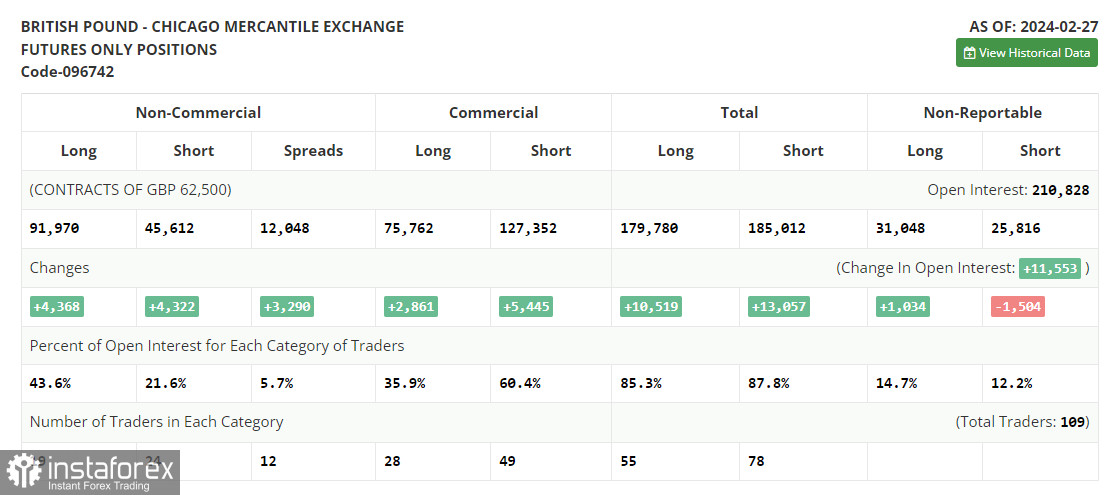

- Non-commercial Traders: Speculators, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and meet certain requirements.

- Long Non-Commercial Positions: Represent the total long open position of non-commercial traders.

- Short Non-Commercial Positions: Represent the total short open position of non-commercial traders.

- Total Non-commercial Net Position: The difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română