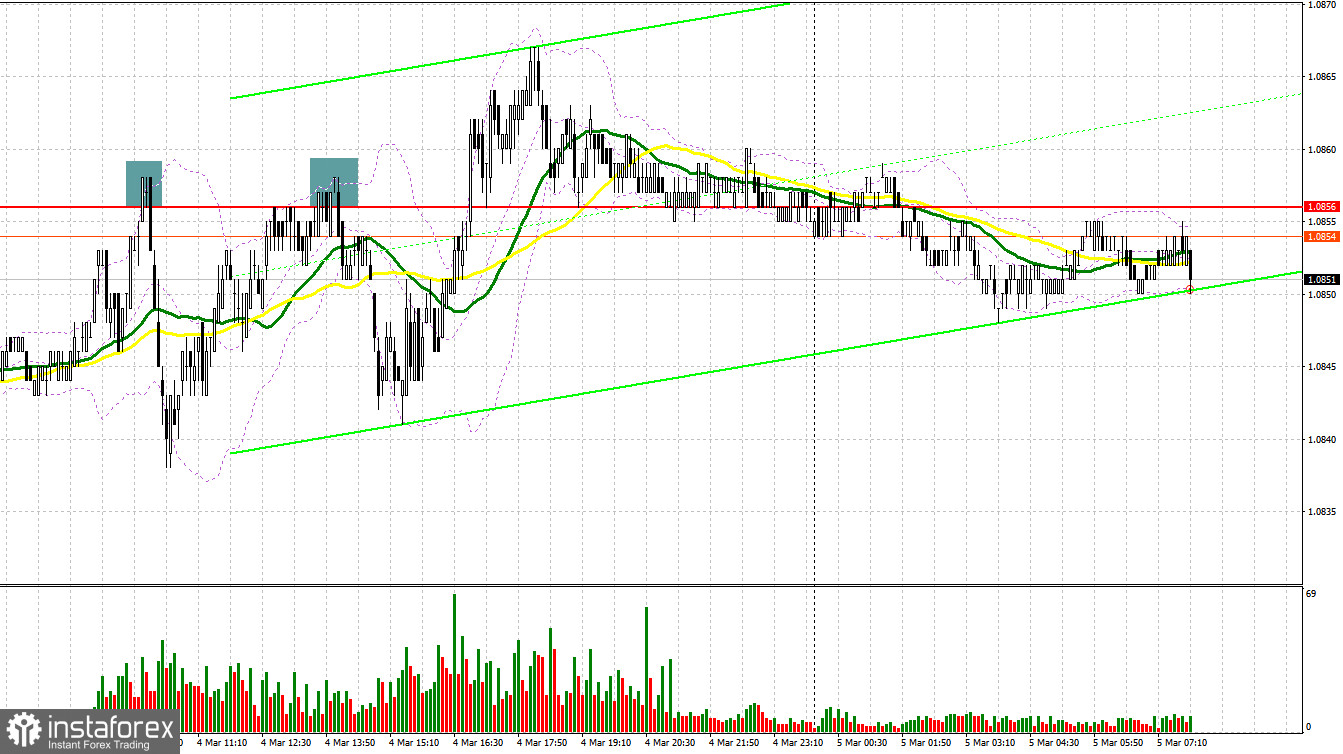

Yesterday, traders received several signals to enter the market. Let us focus on the 5-minute chart and figure out what happened. Earlier, I paid attention to the level of 1.0856 to decide when to enter the market. The growth and a false breakdown near 1.0856 led to a sell signal, but the downward movement totaled just 17 pips. In the second half of the day, the situation repeated. After that, the pair fell by the same 17 pips, and that was the end.

Conditions for opening long positions on EUR/USD:

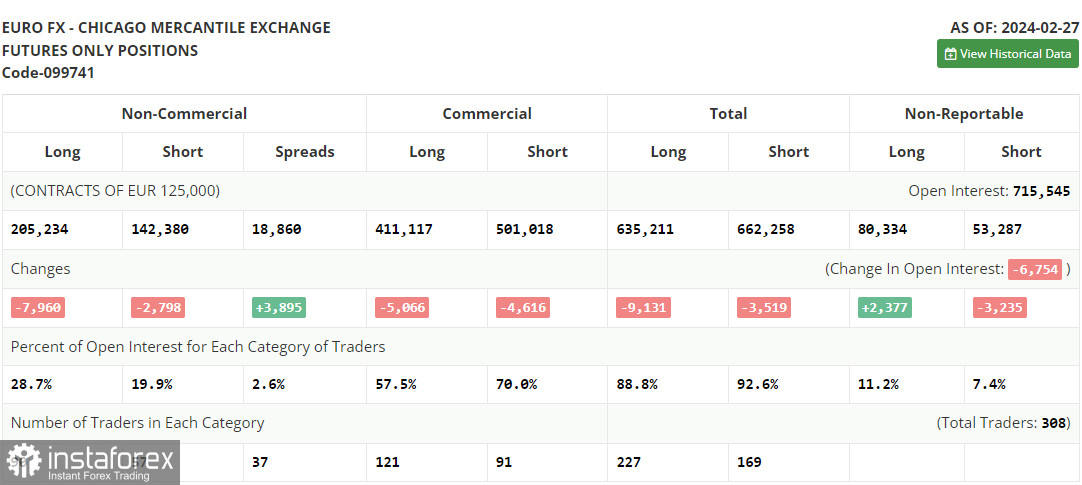

Let us first find out what happened in the futures market. According to the COT report (Commitment of Traders) from February 27, the number of both long and short positions dropped. Apparently, a pause before the meeting of the European Central Bank and the Federal Reserve affects market volatility and the positions of large traders, preventing traders from buying risky assets. With the weak European economy, many expect the European regulator to cut rates sooner than the Fed, limiting the euro's growth. However, the ECB officials are denying this by repeatedly stating that they are not going to cut interest rates, which keeps the market balanced. The COT report indicates that long non-commercial positions fell by 7,960 to 205,234 while short non-commercial positions fell by 2,798 to 142,380. As a result, the spread between long and short positions increased by 3,895.

Today, the eurozone will issue a lot of reports related to activity in the economy. They include the eurozone services PMI, composite PMI, and eurozone producer price index. The growth of all indicators will lead to the strengthening of the euro in an attempt to get out of the sideways channel. In case of weak data, the euro may lose value, and I will be ready for it. I would prefer to act after a decline and a false breakdown close to the nearest support at 1.0836. This will give an entry point into the market with the aim of recovering to 1.0866. A breakout and a downward test of this range is another chance to buy, expecting an update of the high near 1.0886. The farthest target will be the area of 1.0931, where I will lock in profits. If EUR/USD declines and there is no activity at 1.0836, trading will remain within the sideways channel. In this case, I will try to enter after a false breakdown near the next support at 1.0800. I will open long positions just after a rebound from 1.0763 with the target of an upward correction of 30-35 pips intraday.

Conditions for opening short positions on EUR/USD:

Today, in the first half of the day, it is very important for sellers to prevent the pair from going above the resistance of 1.0866. The problem is that this level has already been worked out once. Protection and a false breakdown at 1.0866 would be a suitable scenario for opening short positions in the development of a downward correction with a downside target to 1.0836, the middle of the sideways channel. Only after a breakout and settlement below this range, as well as an upward test, I expect to get another entry point for selling with the target at 1.0800. The furthest target will be the yearly low of 1.0763, where I will take a profit. A test of this level will bring back the downtrend. In case EUR/USD moves up during the European session and there are no bears at 1.0866, buyers will target the 1.0886 high. I will act there only on a false breakdown. I plan to open short positions after a rebound from 1.0931, expecting a downward correction of 30-35 pips.

Indicators' signals

Moving averages

The instrument is trading above the 30 and 50-day moving averages, which points to a rise in the euro.

Note: The period and prices of the moving averages are considered by the analyst on the 1-hour chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

If the pair declines, the lower limit, located at 1.0840, will act as support. In case of a rise, the limit of 1.0866 will act as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence—convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total number of long open positions of non-commercial traders.

- Short non-commercial positions represent the total number of short open positions of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română