Demand for the euro continues to gradually fall, which aligns with the current wave pattern. The economic background occasionally works against the US dollar's potential to strengthen, which holds back the formation of wave 3 or C. On Friday, two relatively important reports turned out weaker than the market expected, preventing market participants from selling the EUR/USD instrument. Therefore, it is very important to understand the upcoming news background and what to expect from it.

There won't be many significant events in the European Union. Business activity indices in the service sectors of Germany and the EU will be released in final estimates for February, which rarely generates interest in the market. Most likely, the market will await preliminary March values and draw conclusions based on them. The Producer Price Index is not a report that leads to long-term conclusions. There are very few concerns about inflation at the moment. Consumer prices in the European Union are declining quite rapidly, and the European Central Bank may switch to easing measures as early as June. The PPI index is unlikely to have much impact on this.

The retail sales report for January also has extremely low chances of attracting market interest. Volumes may increase by just 0.1-0.2% after a 1.1% decline the previous month. All the aforementioned events are secondary of importance. However, the ECB meeting will take place on Thursday, the second meeting this year. Unfortunately, we don't expect much from it. The interest rates will remain unchanged as it is still too early to ease the policy. However, ECB President Christine Lagarde may soften her tone against the backdrop of the latest inflation report. The more dovish signals we get from the central bank, the higher the chance the euro will depreciate.

Friday brings a couple of interesting events in the EU. The final estimate of the eurozone Q4 GDP and industrial production in Germany. The European Union's economy may contract by another 0.1%, but more likely, a value of 0% will be recorded. This is a positive value for the euro, as there is no recession, and there is a good chance of avoiding it, as interest rates will likely start to fall as early as this summer. After the start of this process, pressure on the economy will weaken.

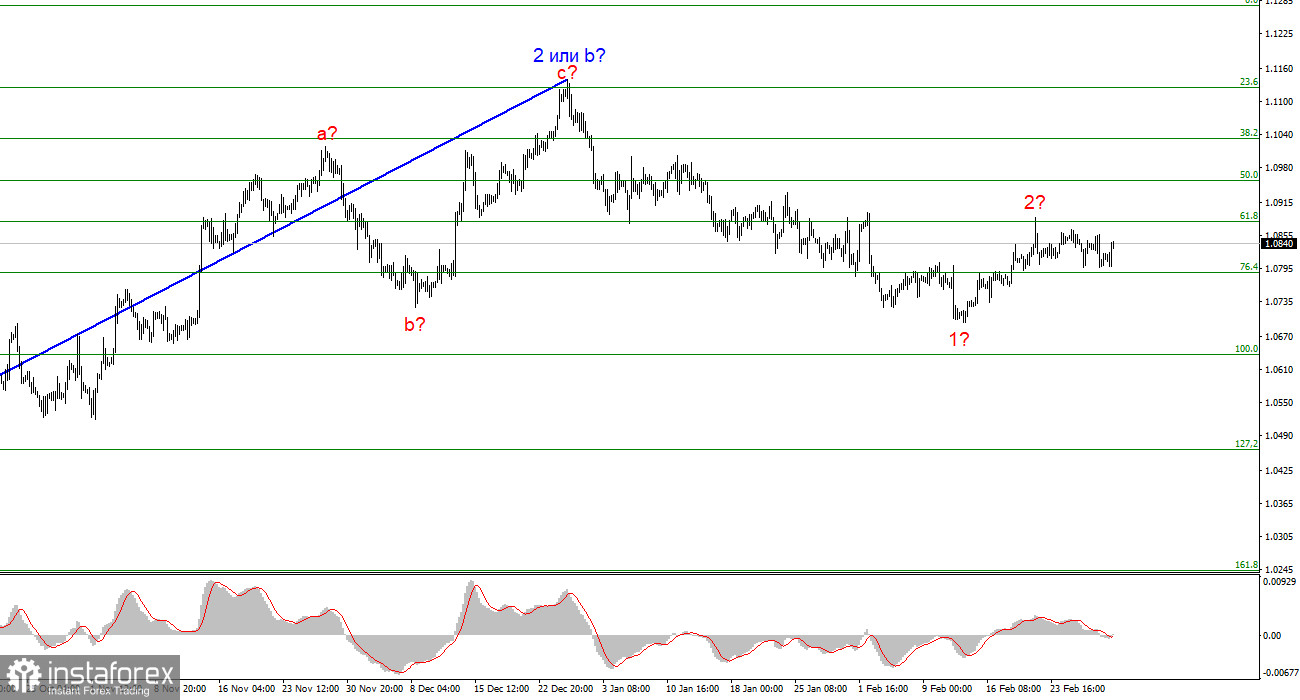

Wave pattern for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. Wave 2 or b is complete, so in the near future, I expect an impulsive downward wave 3 or c to form with a significant decline in the instrument. An internal corrective wave is currently being formed, which may already have a complete form. I am considering short positions with targets around the level of 1.0462, which corresponds to 127.2% according to Fibonacci.

Wave pattern for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, as I believe that wave 3 or C will eventually gain momentum. A successful attempt to break through the 1.2627 level generated a sell signal, but at the moment, I can also identify a new sideways movement with the lower boundary at the 1.2500 level. In my opinion, this level currently acts as a limit for the pound's decline. Wave 3 or C from the downward trend has not yet started.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română