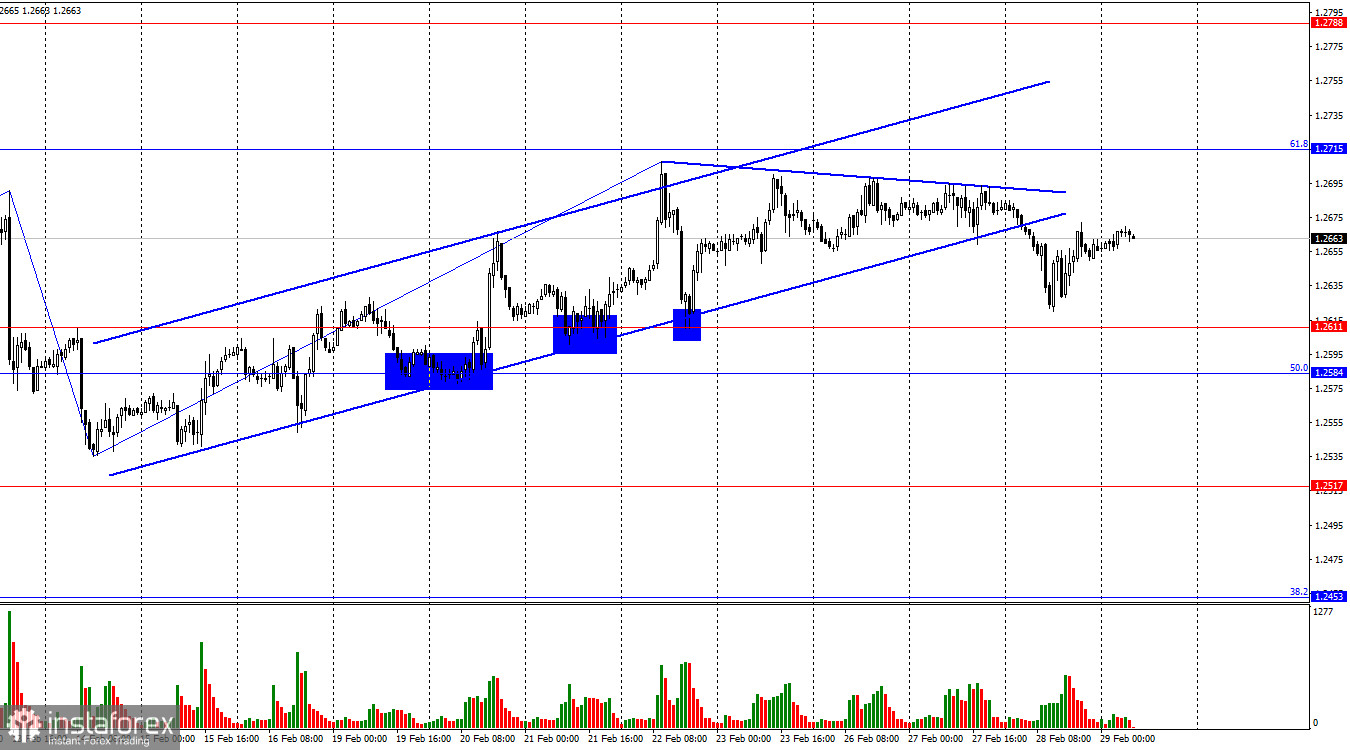

Good afternoon, dear traders! On the hourly chart, the GBP/USD pair consolidated under the ascending trend corridor, which allows us to expect the formation of a new bearish trend. Today, the pair may resume falling toward the support zone of 1.2584–1.2611. The price settlements under this zone will increase the probability of a deeper drop, which I expect.

The situation with the waves remains very ambiguous. For a long time, we observed a horizontal movement, within which single waves or triplets were formed almost all the time. These waves alternated with each other and were approximately of the same size. The sideways movement is complete, and we still see the same single waves and triplets, which are constantly alternating. In addition, confidence in the completion of the sideways cycle is decreasing every day. At this time, the next upward triple is presumably completed, but there are no signs of a trend change to a bearish one. It will take at least a few days for them to appear. The only sign of bears' increased activity is the price closing under the corridor.

On Wednesday, there were no interesting events in Britain. Meanwhile, the US issued the second GDP estimate, which I have already mentioned. It was this report that made bears retreat in the second half of the day, thus negatively affecting the US dollar. However, I believe that after the exit from the bullish corridor, the pound sterling will continue losing value. Look how long it took for the last upward wave to form. What is more, the pound sterling was trading sideways for three more days. The movements now are very slow and weak. That is why the price may fall to the zone of 1.2584–1.2611 for a few days. Today, the US reports should not prevent the greenback from strengthening.

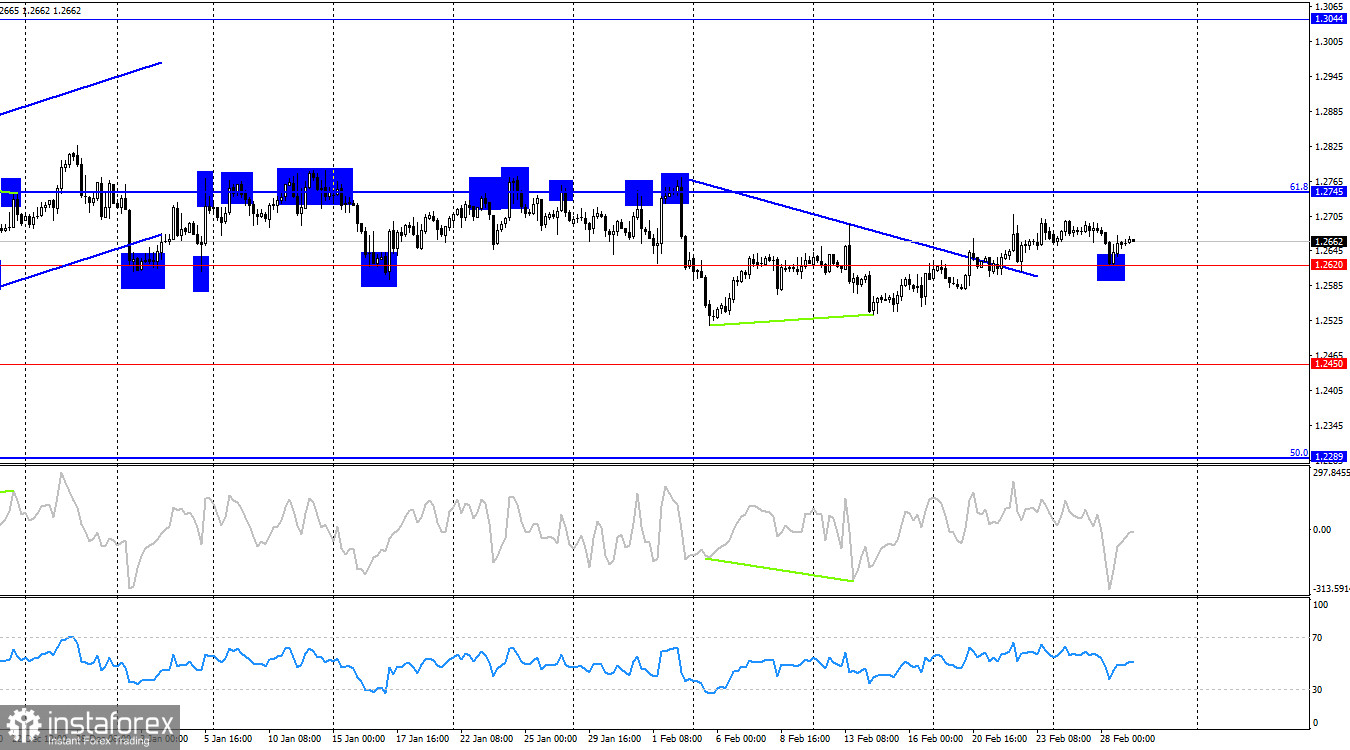

On the 4-hour chart, the pair consolidated above the trend line and rebounded from the level of 1.2620, which allows us to count on the continuation of growth to the 61.8% correction level located at 1.2745. However, we should not count on a new bullish trend at this time. The horizontal vector is now perfectly visible on all charts. The bullish trend could have already ended, as bears have closed under the ascending corridor on the hourly chart. There are no divergences looming today in any indicator.

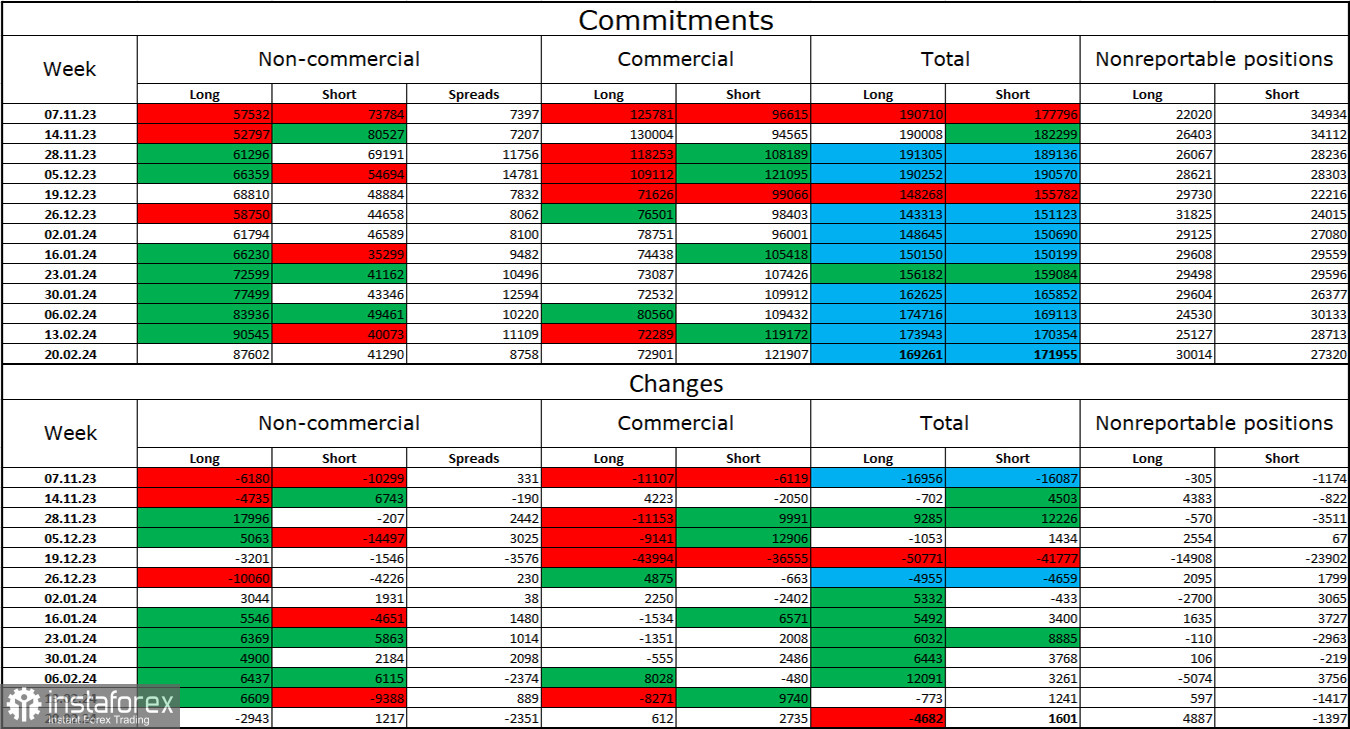

Commitments of Traders Report (COT):

The sentiment in the non-commercial trader category did not change much in the last reporting week. The number of long contracts decreased by 2,943, while the number of short positions increased by 1,217. The general sentiment among big traders remains bullish and continues to intensify, although I do not see any specific reason for this. There is more than a twofold gap between the number of long and short contracts: 87 thousand vs. 41 thousand.

In my opinion, the British pound still has excellent downside prospects. I believe that some time later, bulls will start to get rid of buy positions, as all possible buying factors for the British pound have already been worked out. Bulls have not been able to exceed the level of 1.2745 for two months now, but bears are not in a hurry to take measures and are generally very weak right now. I would also like to note that the total number of long and short positions has been the same for several months now, which shows the equilibrium in the market.

Macroeconomic events in the US and the UK:

US – Personal Consumption Expenditure Price Index (13-30 UTC).

US - Personal Income and Expenditures (13-30 UTC).

US - Unemployment Claims (13-30 UTC).

On Thursday, the macroeconomic calendar contains several events, among which it is difficult to single out the most important one. All reports are of medium importance. The influence of the information background on market sentiment will be weak.

Outlook for GBP/USD and tips for traders:

Traders may consider selling opportunities when the pair settles under the uptrend line on the hourly chart with a target of 1.2584. Now these positions could be kept open. Traders may go long if the pair rebounds from the 1.2584–1.2611 zone on the hourly chart with a target of 1.2715.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română