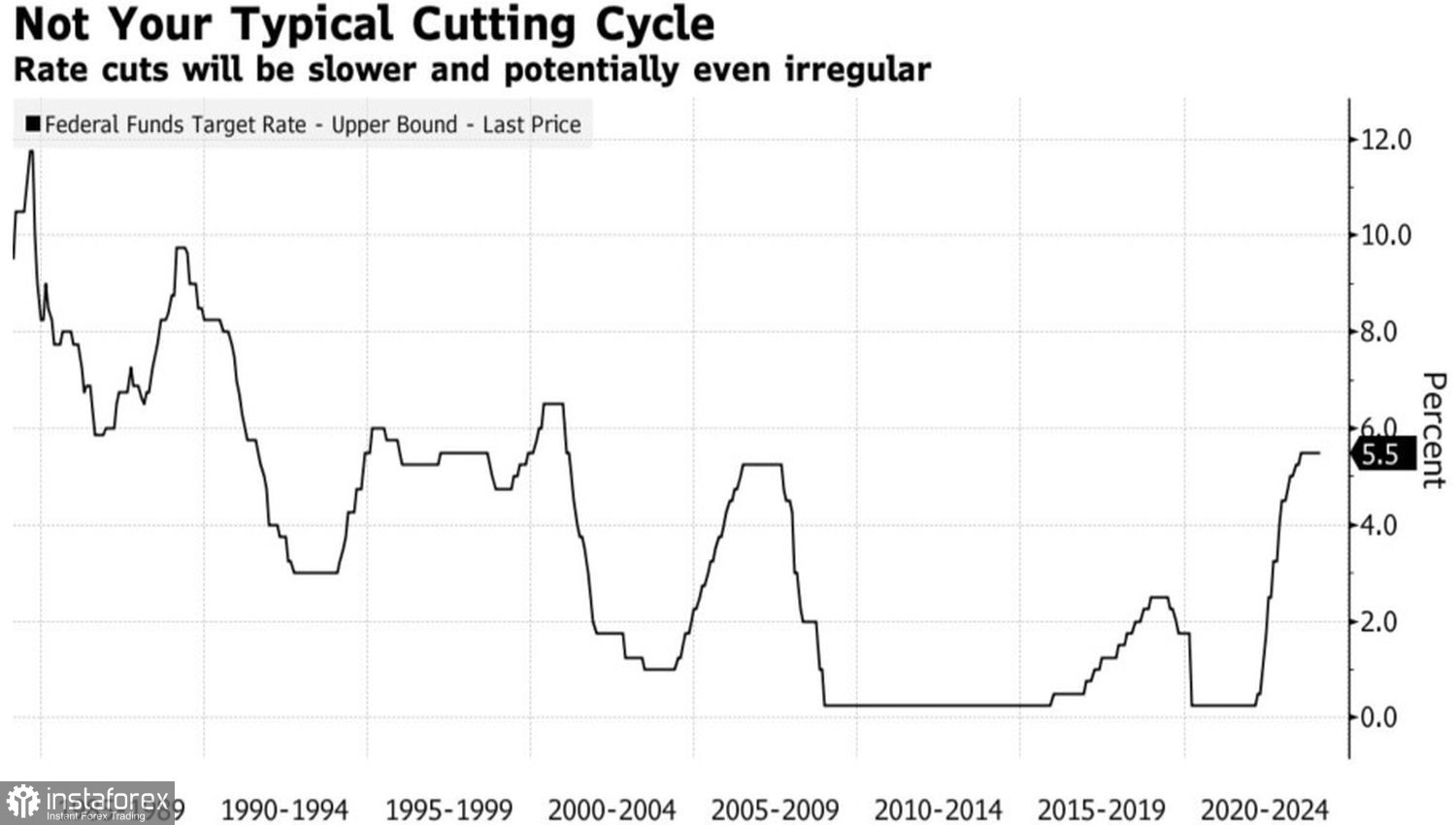

The conventional practice of the U.S. Federal Reserve involves a gradual ascent in interest rates, often likened to an escalator, when aiming to gently moderate economic activity. Conversely, when confronted with an economic recession demanding swift intervention, the Federal Reserve swiftly lowers rates, comparable to an elevator's rapid descent. However, the anticipated scenario in 2024-2025 suggests an unconventional approach, where the pace of interest rate adjustments is uncertain. Whether the borrowing costs ascend gradually or not, this unpredictability would be welcomed news for those bearish on EUR/USD.

Federal Funds Rate Dynamics

The current cycle is unique, happening against the backdrop of an economy unwilling to slow down its GDP growth. Instead of a soft landing, investors are increasingly discussing a new economic acceleration. This is facilitated by both a strong labor market and favorable financial conditions. However, these factors simultaneously pose the risk of accelerating consumer prices. The risks are quite high. It's not surprising that officials from the Federal Reserve are considering lowering rates only by the end of the year.

Furthermore, Federal Reserve Vice Chair Philip Jefferson drew parallels with the soft landing in the 1990s. Back then, the Federal Reserve reduced borrowing costs not once in two meetings, as the current futures market predicts. It eased monetary policy, paused three meetings, and then resumed the cycle of monetary expansion.

In any case, the more positive economic indicators the U.S. receives, the less likely the rate-cutting process will start in June. Nordea Markets forecasts that it will only happen in September. By that time, the European Central Bank (ECB) will already have eased its monetary policy in June. Whoever acts first will lose. Such timelines for the start of monetary expansion provide grounds to sell EUR/USD.

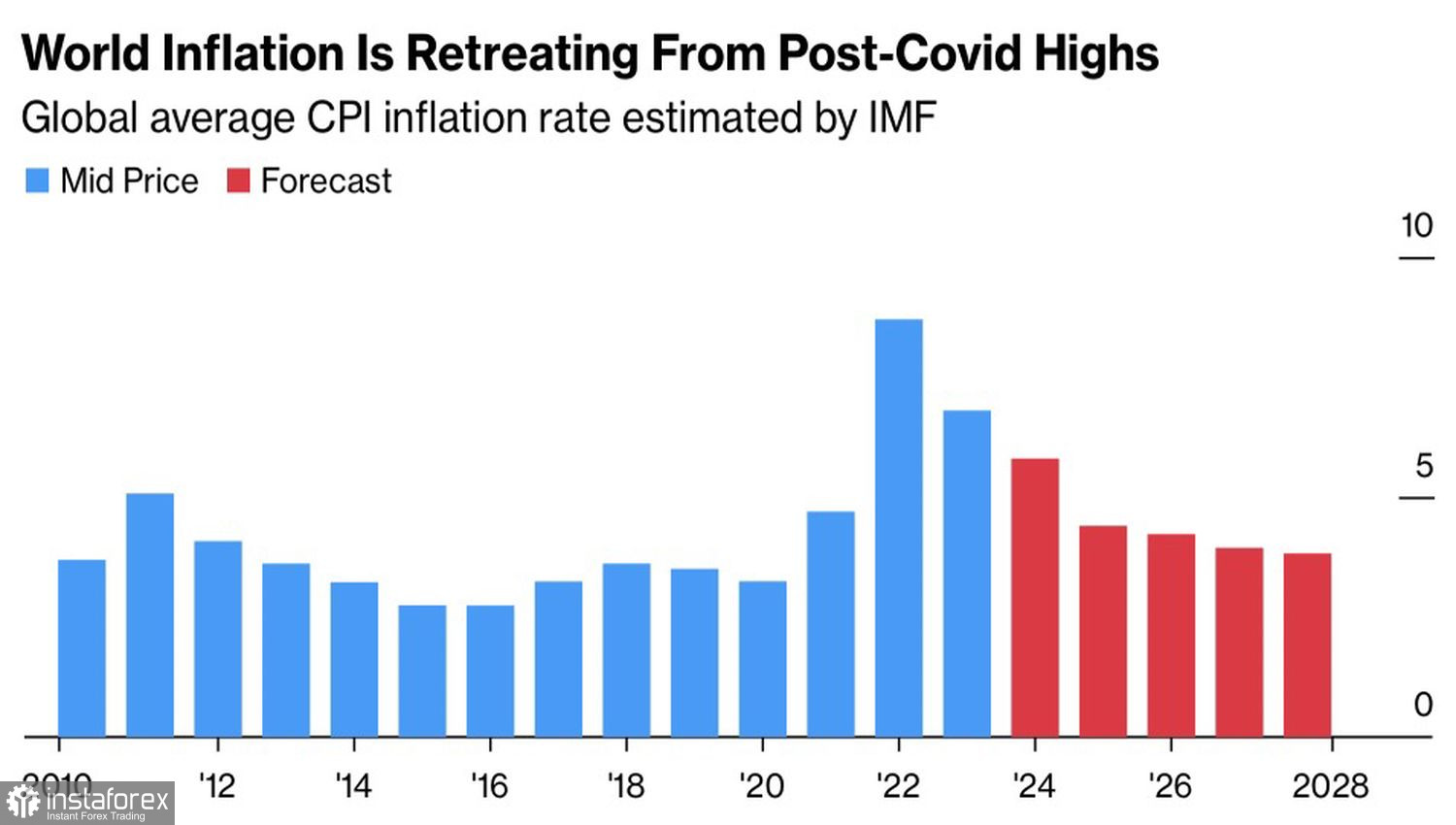

On the other hand, the euro may benefit from the strength of the U.S. economy. Along with it, the Eurozone is recovering, as is China. The regional currency is pro-cyclical, reacting positively to good news about global GDP. In this regard, the conclusion from the G20 finance ministers' meeting that the likelihood of a soft landing for the global economy is increasing is good news for EUR/USD bulls. The main risk is the rapid development of deflationary processes.

Global Inflation Dynamics

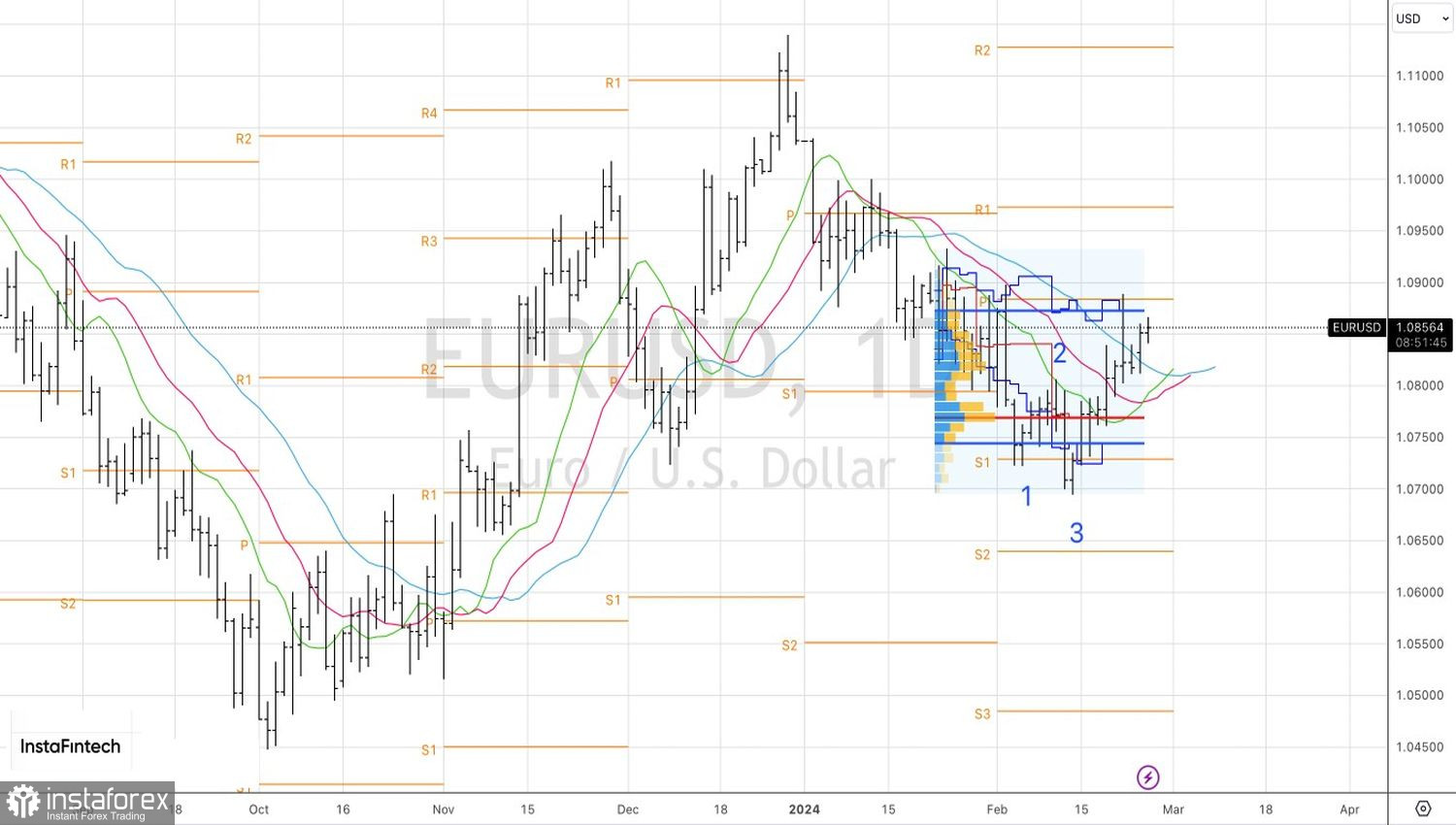

Thus, the euro no longer looks like an easy target as before, but the robust U.S. economy leaves no doubt about the strength of the dollar. It's not surprising that Danske Bank recommends selling EUR/USD on upward pullbacks. Ideally, these pullbacks should be driven by expectations of important macroeconomic data from the United States. In this regard, the euro rally ahead of the release of data on U.S. durable goods orders and inflation is an excellent opportunity to implement this strategy.

Technically, on the daily chart of EUR/USD, the pair failed to approach the upper boundary of the fair value range 1.0745–1.0875. The inability to do so will be a sign of weakness for the bulls and a reason to sell the euro towards $1.0815.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română