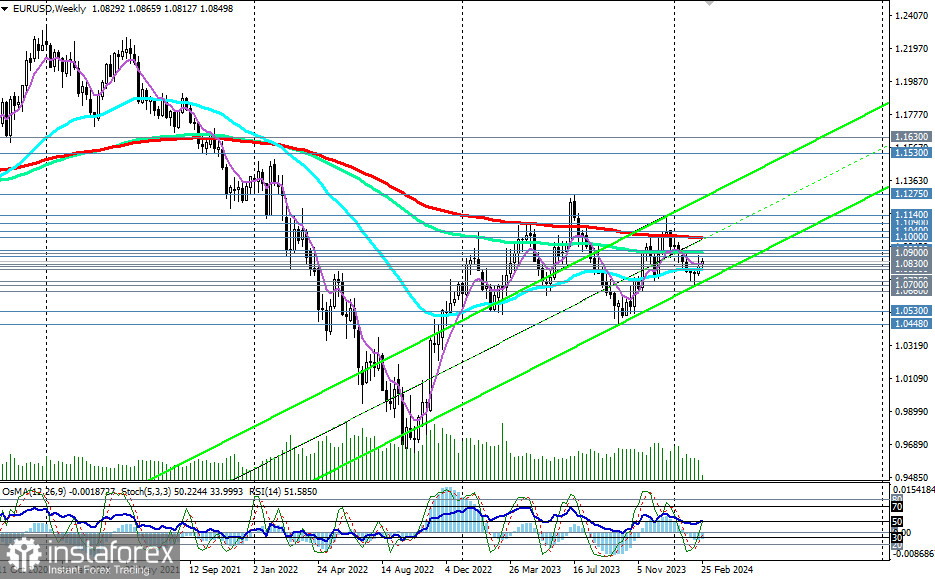

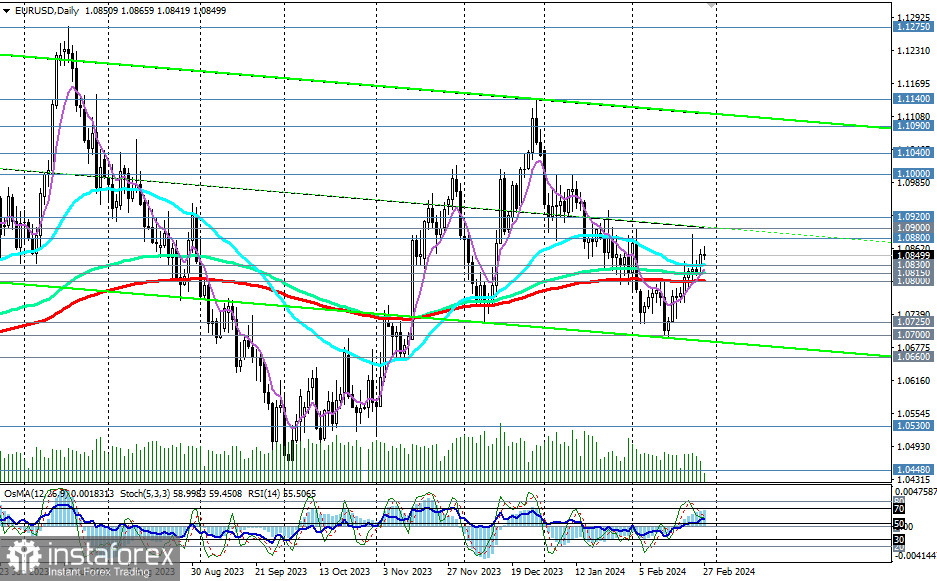

Bouncing off the local (since November 2023) low near the 1.0700 mark in the middle of the month, EUR/USD today continues to develop an upward correction above the key support level of 1.0800 (200 EMA on the daily chart).

At the same time, the pair remains in the zone of the long-term bearish market—below the key resistance level of 1.1000 (200 EMA on the weekly chart).

Technical indicators RSI, OsMA, and Stochastic on the daily chart are in favor of buyers. If the macro data expected from the U.S. this week turns out to be disappointing, further growth of EUR/USD can be anticipated.

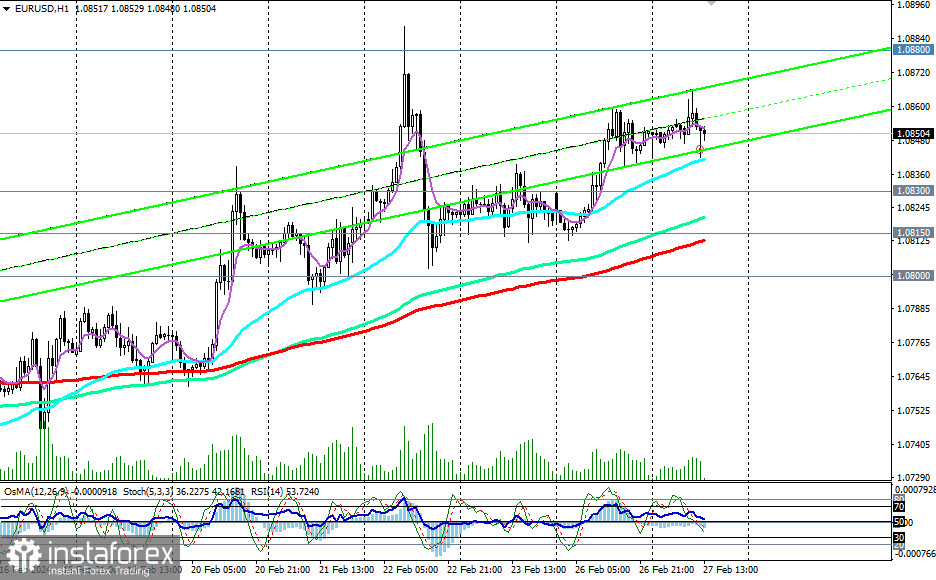

In this case, the very first signal to open long positions could be the breakout of the local resistance level of 1.0880, with the growth targets being the resistance zone near the important level of 1.0900 (144 EMA on the weekly chart).

Further growth and the breakthrough of resistance levels at 1.1000 (200 EMA on the weekly chart), 1.1040 (50 EMA on the monthly chart) would bring EUR/USD into the zone of the long-term bullish market, making long-term long positions with targets at the global resistance level of 1.1630 (200 EMA on the monthly chart) preferable.

In an alternative scenario and after breaking the key support level of 1.0800, EUR/USD will return to the zone of the medium-term bearish market and continue to decline within the long-term bearish trend.

The targets for a decline, if this scenario is realized, are local support levels of 1.0530, 1.0450 with intermediates near the local support level of 1.0700.

The breakout of today's intraday low of 1.0842 could be the earliest signal for the start of the realization of this scenario.

Support levels: 1.0830, 1.0815, 1.0800, 1.0725, 1.0700, 1.0660, 1.0600, 1.0530, 1.0500, 1.0450, 1.0400, 1.0300

Resistance levels: 1.0880, 1.0900, 1.0920, 1.1000, 1.1040, 1.1090, 1.1100, 1.1140, 1.1200, 1.1275, 1.1300, 1.1400, 1.1500, 1.1530, 1.1600, 1.1630

Trading Scenarios

Alternative Scenario: Sell Stop 1.0820. Stop-Loss 1.0880. Targets 1.0800, 1.0725, 1.0700, 1.0660, 1.0600, 1.0530, 1.0500, 1.0450, 1.0400, 1.0300

Main Scenario: Buy Stop 1.0880. Stop-Loss 1.0820. Targets 1.0900, 1.0920, 1.1000, 1.1040, 1.1090, 1.1100, 1.1140, 1.1200, 1.1275, 1.1300, 1.1400, 1.1500, 1.1530, 1.1600, 1.1630

"Targets" correspond to support/resistance levels. This also does not mean that they will necessarily be reached, but can serve as a guide in planning and placing your trading positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română