Bitcoin

Higher Timeframes

The past week unfolded in uncertainty. The ascent was halted, and Bitcoin consolidated to ultimately form a signal for the continuation of the trend. Yesterday, with the resumption of bullish activity, the market surged towards the historical highs of 2021 at 64,768.80 and 68,959.73. The outcome of interactions with these levels will determine the further potential of Bitcoin as a whole.

The inability to sustain the upward movement and the loss of current positions will bring back bearish perspectives. In the event of a decline, the market will encounter support from the golden cross of the daily Ichimoku cloud at 53,921 – 51,563 – 49,779 – 47,994, now reinforced by the weekly short-term trend (47,926).

H4 – H1

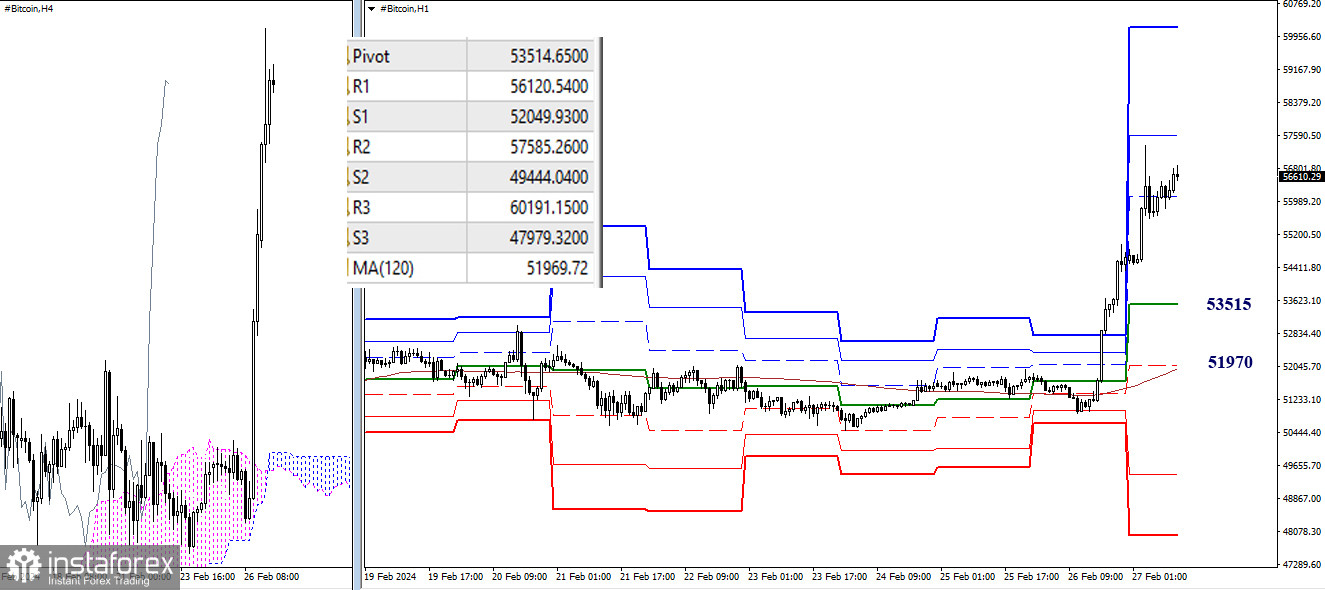

On lower timeframes, an upward movement is developing. Bulls have already tested the first resistance of classic pivot points (56,121) today and are currently in a correction zone. The resumption of the upward trend within the day will lead to testing the next resistances at R2 (57,585) and R3 (60,191). However, if the correction updates its lows and the decline continues, the next intraday targets can be marked at the boundaries of key levels 53,515 (central pivot point of the day) and 51,970 (weekly long-term trend).

A breakthrough of key levels may alter the current balance of power. Furthermore, a decline of this magnitude could provide a solid foundation for concluding the ascent on higher timeframes and for the formation of a reversal candlestick pattern on the daily and weekly timeframes.

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română