The USD/JPY pair has been holding above the 150.00 mark for the second consecutive week. Corrective pullbacks are minimal and more of a formal nature. The pair is trapped in the range of 150.30 – 150.70, and this fact disrupts the straightforward trading strategy of USD/JPY buyers (longs on downward pullbacks).

Opening long positions from current levels is extremely risky, as there is increasing talk in the market about the risks of currency intervention. Therefore, the conditional upward target of 151.50 looks suicidal, not to mention higher price levels. Traders were forced to "sit on the shore" and wait for calm weather, which lasted for the second week. However, this likely is the "calm before the storm," as key inflation growth data will be published in Japan tomorrow. The release is quite capable of triggering increased volatility in the pair.

Recall that following the last (January) meeting of the Bank of Japan, the head of the central bank, Kazuo Ueda, stated that the probability of reaching the inflation target is gradually increasing, but it is difficult to assess quantitatively "how close we have come."

Of course, tomorrow's release will not be decisive – it will play the role of just one puzzle piece that will complement the overall picture. The decisive role in the question of exiting ultra-loose policies will be played by the "spring offensive," that is the annual negotiations between unions and employers on wage increases.

Last year, as a result of the "offensives," wages increased on average by 3.65%. Although the Bank of Japan does not announce the result it finds "acceptable" (which will pave the way for the normalization of monetary policy), many experts agree that this result should be no less than 3.75% (according to other estimates – 4%).

Tuesday's release of Consumer Price Index inflation data is expected to show that inflation is within the Bank of Japan's annual target. This fact will reduce the incentive for aggressive policy tightening. If the release is in the "green zone," the yen will receive substantial support: according to some analysts, the Japanese regulator may lift negative rates as early as this spring if it deems that inflationary pressures are intensifying (but only if annual wage negotiations are successful).

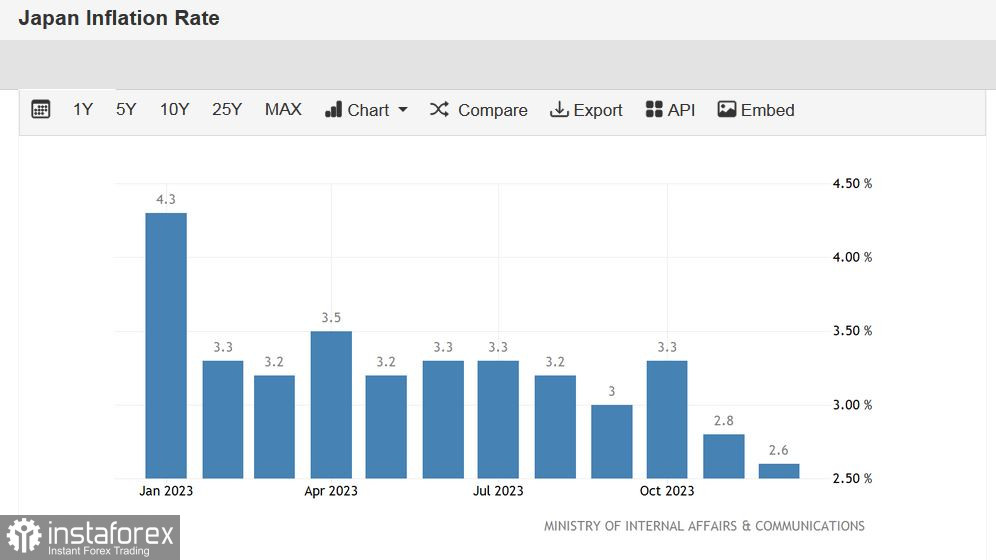

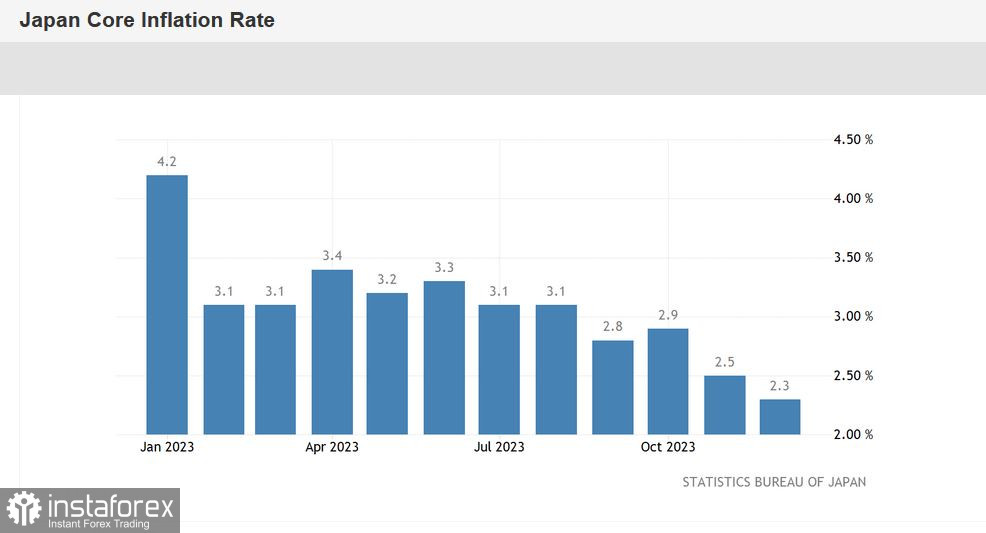

According to preliminary forecasts, Japan's overall Consumer Price Index will decline to 2.1%. The indicator has been steadily decreasing for two consecutive months, and January is expected to be the third month in this series. The CPI, excluding fresh food prices, is also expected to demonstrate a downward trend, dropping immediately to 1.9% (the lowest value since April 2022). For comparison, this indicator was at 2.9% in October but sharply declined in November (2.5%) and December (2.3%).

It is worth noting that the Tokyo Consumer Price Index (CPI) was previously published, which is considered a leading indicator to determine the price dynamics across the country. Based on the published figures, it can be concluded that Tuesday's release will not favor the Japanese currency. The overall Consumer Price Index in the Japanese capital dropped to 1.6%, while most experts expected it to be higher—at 2.2%. The indicator demonstrates a consistent downward trend for the third consecutive month.

For the first time in the last 20 months, the Tokyo CPI fell below the two percent mark. Excluding fresh food prices, the index also entered the "red zone," reaching 1.6% against a forecast of 1.9% (the indicator has been declining similarly for the third consecutive month).

Thus, with a high degree of probability, Tuesday's inflation growth report in Japan will put pressure on the yen. Logically, it would be recommended to go long on the USD/JPY pair. But – no!

The pair is at extreme price levels, so for relatively safe longs, a price pullback to the 149 area is necessary. But currently, the pair is holding in the middle of the 150 figure, and its further growth could have serious consequences.

Since the pair reached the target of 150.00, there have been increasingly veiled warnings about currency intervention from the Japanese Ministry of Finance. So far, such considerations sound like "thinking out loud." For example, Japanese Finance Ministry official Atsushi Mimura suddenly stated last week that the ministry always supports communication and coordinates its actions with other countries in the event of currency intervention. So, there is no direct warning yet, but the hint is quite clear. It is also clear that if the pair approaches and (most importantly) consolidates around the 151 figure, the threat of intervention will become real.

All this suggests that it is advisable to maintain a wait-and-see position on the pair until there is "room for maneuver," that is, until the price retreats to the 149 figure area (preferably to the support level of 149.30, which corresponds to the middle line of the Bollinger Bands indicator on the daily chart). In this price range, long positions can be considered with the previous targets: 150.00 and 150.50-150.70. "Playing" with the 151 figure is strongly not recommended.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română