Unfortunately, there will be very few news releases in the United Kingdom. Even with a significant number of important events, the British pound has been experiencing plain boredom in recent weeks and months. When there is no news background, it tends to stagnate. In my opinion, this time, it will end quite uneventfully, and even important news may not be needed. However, it's worth acknowledging that the chances of concluding the horizontal movement this week are extremely low.

A few speeches by Bank of England members and the report on business activity in the manufacturing sector for February—such is the news verdict for the pound this week. Undoubtedly, someone like Bank of England Chief Economist Huw Pill may make an interesting statement, but in Britain, they adhere to a conservative approach and avoid discussing future decisions or plans.

Moreover, there is not much to talk about at the moment. Inflation in the United Kingdom continues to remain high. Only the GDP indicator is concerning, but Governor Andrew Bailey's recent statement suggested that it is crucial for the Bank of England to bring inflation back to 2%, and the pace of economic growth can be overlooked. Based solely on this, one can conclude that Pill, Mann, Ramsden, and company are unlikely to talk about rate cuts in the near future. On the contrary, they may talk about high inflation, forcing the Bank of England to keep rates at peak levels.

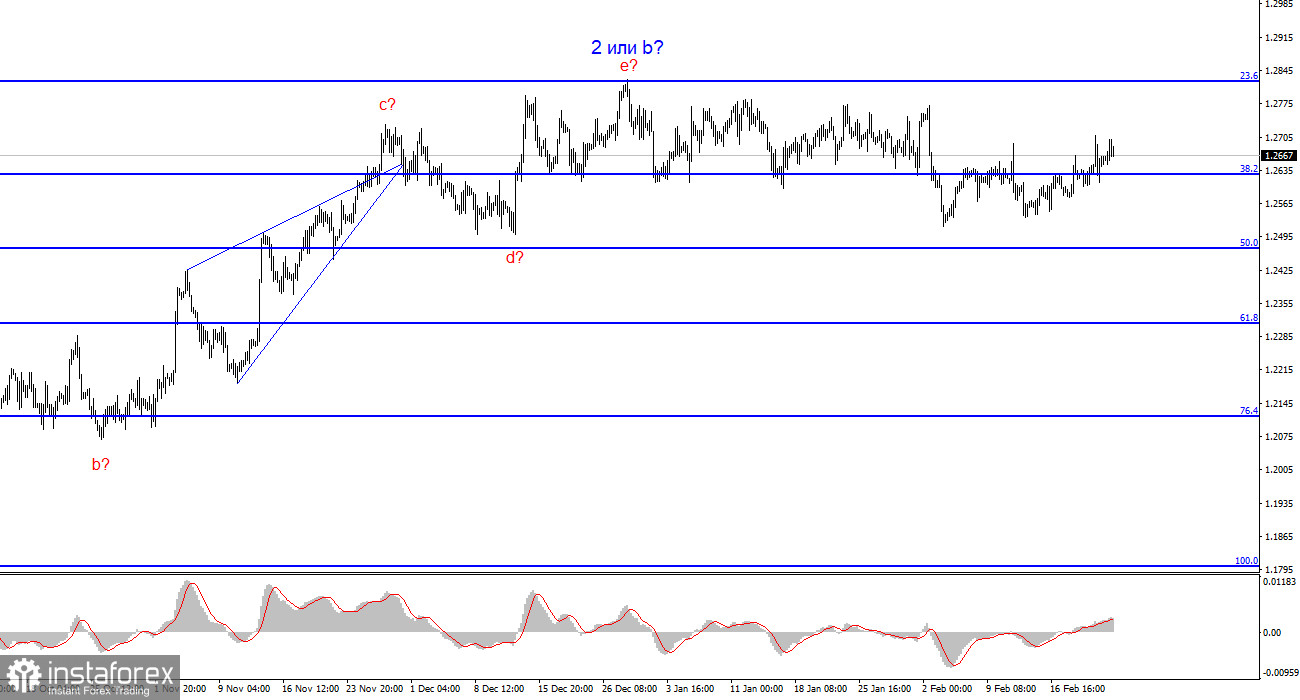

The only report of the week - the business activity index - is a drop in the ocean. If the market has found no reasons for buying or selling over the past few months, this index has no chance of influencing the current market sentiment. Last week, demand for the pound increased, but this week, it may start declining again, back to the 50.0% Fibonacci level, which I currently consider the lower limit of the horizontal corridor.

The wave pattern of the GBP/USD instrument still suggests a decline. Currently, I am considering selling the instrument with targets below the level of 1.2039 because wave 2 or b cannot last forever, just like a sideways trend. A successful attempt to break through the level of 1.2627 became a signal for sales. However, at the moment, I can also identify a new sideways trend with the lower boundary at the level of 1.2500. This level is currently the limit for the decline of the British pound. Wave 3 or c of the downtrend has not yet begun.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română