The hawkish minutes of the FOMC meeting, published on Wednesday, along with comments from influential representatives of the Federal Reserve System, indicates that the U.S. central bank is not in a hurry to lower interest rates. As a result, the price of gold continued to decline. The idea of maintaining high interest rates for a longer period continues to support the rise in yields of U.S. Treasury bonds.

The recent increase in risks in global financial markets remains unchanged, further contributing to the outflow of funds from the unprofitable yellow metal.

The U.S. dollar, attempting to attract buyers, remains within reach of its lowest three-week level. The restrained price movement of the U.S. dollar also requires caution before placing aggressive bearish bets on gold.

Alongside geopolitical risks arising from conflicts in the Middle East, this may serve as support for the price of gold as a safe-haven asset. Geopolitical risks limit the losses of gold.

In the absence of any significant economic data affecting the market, the yield of U.S. bonds and the dynamics of the U.S. dollar may continue to play a key role in stimulating demand for XAU/USD.

To take advantage of short-term opportunities on the last day of the week, traders today can only rely on a broader risk sentiment.

From a technical perspective, the bulls are not ready to give up. The key level is at $2,000. The 50-day SMA, currently tied to the $2,032 area, followed by the $2,035 area, or almost a two-week high reached on Thursday, could pose an immediate obstacle. Considering that oscillators on the daily chart have just started gaining positive momentum, gold has the potential to rise to the $2,045 mark on the way to the supply zone at $2,065.

On the other hand, the $2,020 area has become immediate support, followed by the 100-day SMA around the psychological level of $2,000, which will expose the monthly low around $1,984 in the case of a decisive breakdown.

Subsequent declines will push the price of gold towards further overcoming the 200-day SMA near the $1,966–1,965 zone.

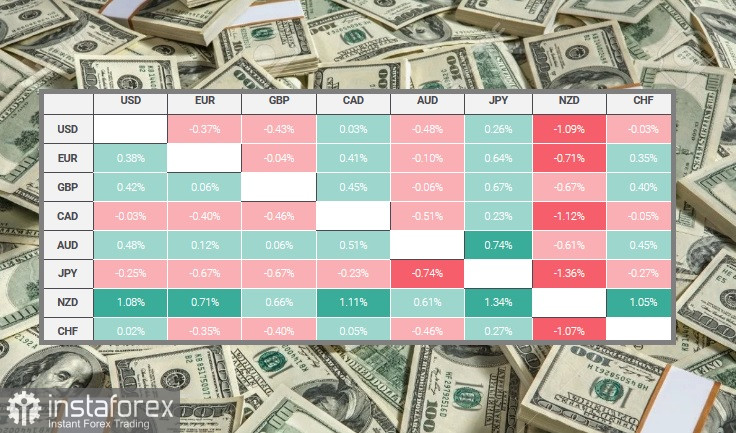

The table below shows the percentage change in the U.S. dollar exchange rate against major currencies listed this week. The U.S. dollar was the strongest against the Japanese yen.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română