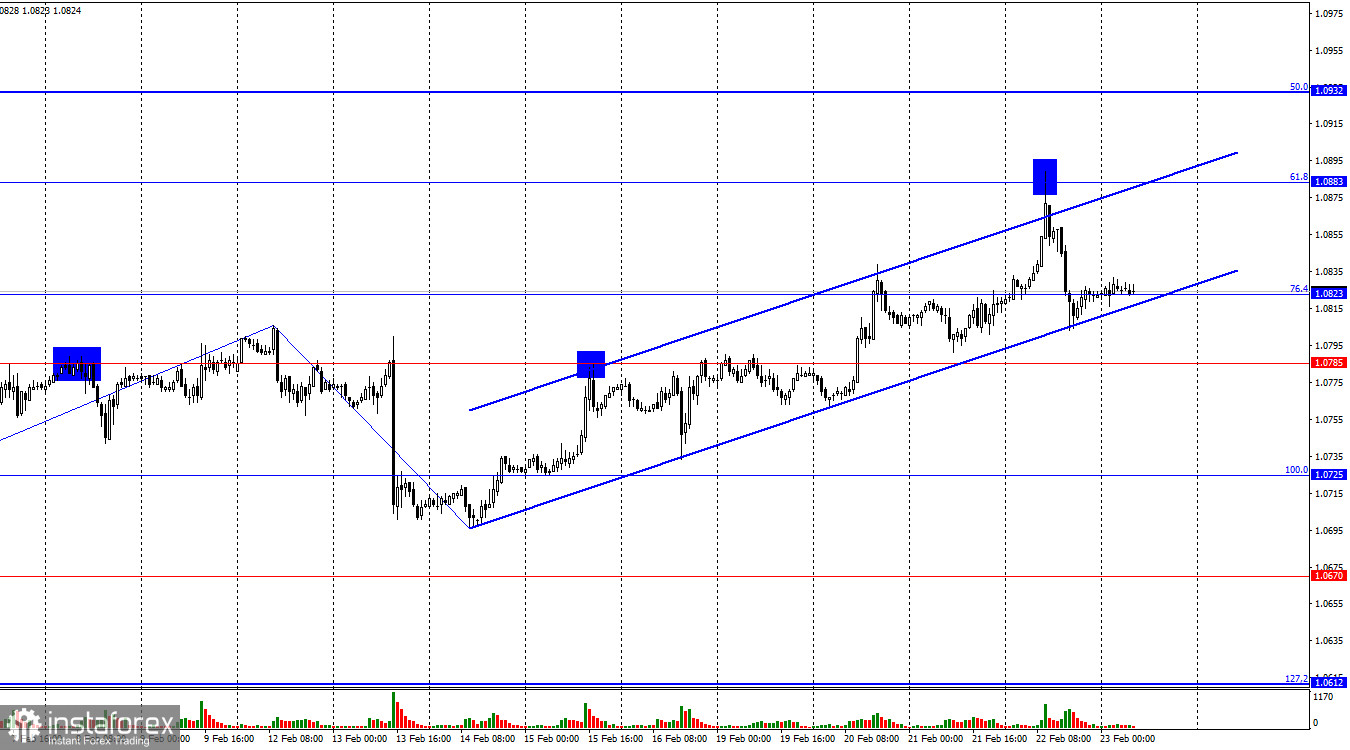

The EUR/USD pair on Thursday experienced an upward movement to the corrective level of 61.8% (1.0883), bounced off it, and returned to the Fibonacci level of 76.4% at 1.0823. The rebound of quotes from the lower line of the ascending trend channel indicates the preservation of the "bullish" sentiment in the market and the possibility of a new rise in the European currency. The consolidation of the pair's exchange rate below the corridor will work in favor of the US currency and indicate the completion of the "bullish" trend.

The wave situation is becoming more understandable. The last completed downward wave confidently broke the low of the previous wave, but the new upward wave surpassed the peak of the previous wave (from February 12). Thus, at the moment, we have a "bullish" trend, and there is no sign of its completion. If this is the case, then over the next few weeks, bullish traders may attack more actively than before, although, for example, this week the information background is so weak that it is quite difficult for me to assume based on what data the bulls are planning to launch an attack. Nevertheless, growth is present every day even without news and reports. The first sign of the completion of the "bullish" trend will be the closing below the corridor.

The information background on Thursday was quite extensive. In the morning, bullish traders launched a new offensive, expecting to see strong business activity indices in the European Union and Germany. However, these indices only disappointed the bulls, so they quickly retreated from the market. If the business activity index in the service sector can still be considered positive, as it grew to 50 in February, then the manufacturing sector again fell, showing a decline from 46.6 to 46.1. In Germany, things are even worse. In the manufacturing sector, activity fell from 45.5 to 42.3, and the service sector grew slightly. Thus, the decline of the European currency during the day was a natural reaction to weak reports.

On the 4-hour chart, the pair rose to the corrective level of 50.0% (1.0862) and bounced off it. Also, a "bearish" divergence was formed on the CCI indicator, which increases the likelihood of a reversal in favor of the US currency and the start of a decline in the pair towards the corrective level of 38.2% (1.0765). Earlier, the pair closed above the descending corridor, but in case of consolidation of quotes below the ascending corridor on the hourly chart, bears will again gain an advantage over bulls. The consolidation of the pair's exchange rate above the level of 1.0862 will increase the probability of a continuation of the rise toward the next correction level of 61.8%-1.0959.

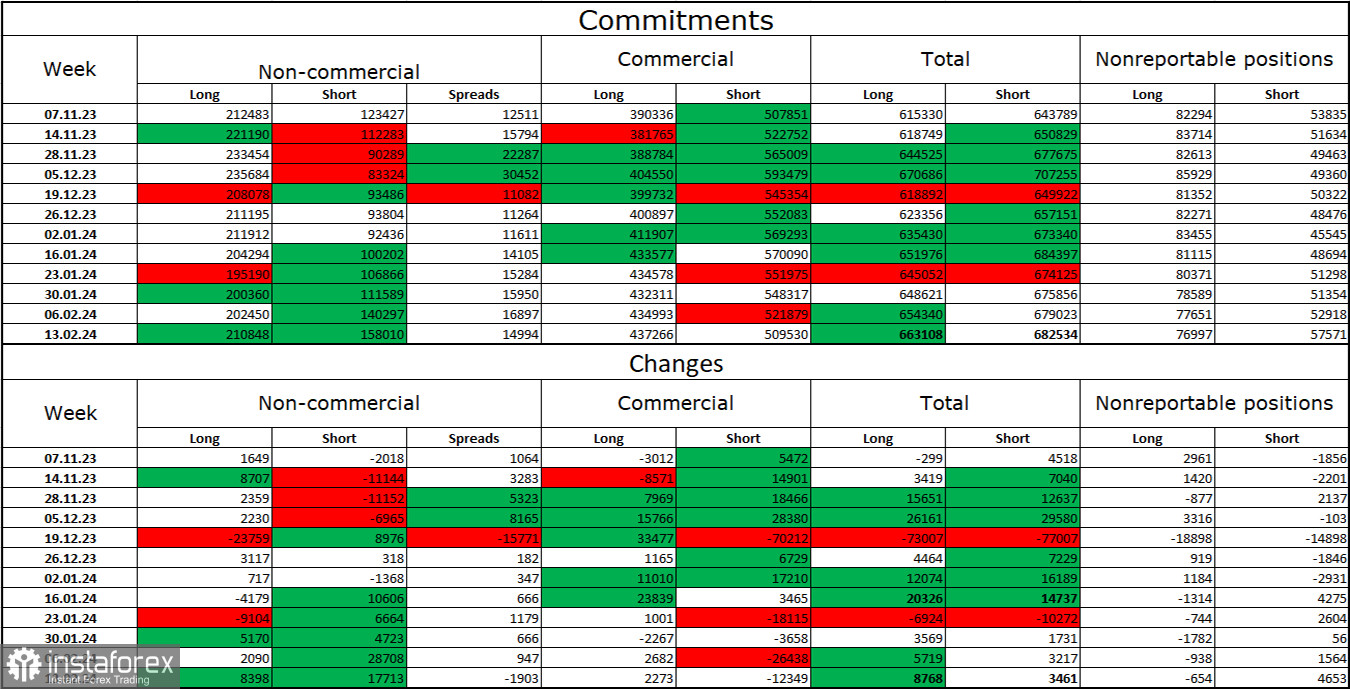

Commitments of Traders (COT) report:

During the last reporting week, speculators opened 8398 long contracts and 17713 short contracts. The mood of major traders remains "bullish" but continues to weaken. The total number of long contracts concentrated in speculators' hands is now 210 thousand, and short contracts - 158 thousand. I still believe that the situation will continue to change in favor of bears. Bulls have dominated the market for too long, and now they need a strong information background to maintain the "bullish" trend. I don't see such a background now. Professional traders may continue to close long positions (or open short positions) soon. I believe that the current figures allow for a continuation of the decline in the euro in the coming months.

US and EU News Calendar:

EU - German GDP in the fourth quarter (09:00 UTC).

EU - IFO German Business Climate Index (09:00 UTC).

On February 23, the economic events calendar contains only two not-very-important entries. The impact of the news background on trader sentiment today may be weak.

EUR/USD Forecast and Trader Tips:

Selling the pair is possible today with consolidation below the ascending corridor on the hourly chart with targets at 1.0785 and 1.0725. Purchases of the pair were possible when closing above 1.0823 with a target of 1.0883. This target was worked out yesterday. Today, you can buy on a rebound from the level of 1.0823 or the lower line of the corridor with a target of 1.0883.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română