Dollar bulls have been retreating from the market for several days now. In the case of the EUR/USD instrument, this looks like a temporary measure, as an upward corrective wave should be constructed within wave 3 or C. In the case of the GBP/USD instrument, the wave layout is unreadable, and there is no confirmation regarding the formation of wave 3 or C. However, over the past few days, demand for the dollar has decreased, but the market did not have any particular reasons behind this. The eurozone PMIs did not turn out to be as strong (if not more), and the US PMIs were not as weak. Therefore, I believe that the upward movement of the euro and the pound will have a temporary effect.

The Federal Reserve remains firm: it's not yet time to lower rates yet. This is supported by the FOMC minutes. Committee members believe that rates need to be kept at the peak level for some time because there are risks of a re-acceleration in inflation. In addition, inflation may stall, and there is no confidence in maintaining the trajectory of slowing to 2%.

The president of the Fed Bank of Atlanta Raphael Bostic also said that the central bank does not need to lower rates "right now." "A strong economy is on our side. It allows us to safely keep rates at the peak level for as long as needed,". Bostic repeated his earlier stated view that he does anticipate rate reductions later this year. "We have made substantial and gratifying progress in slowing the pace of inflation," Bostic said in a speech. As a result, it could take a while before the Fed is on a path that will allow a rate cut.

Based on everything mentioned above, I believe that demand for the US dollar may rise again in the near future. The trading instruments may continue their corrective phases this week, but we can see that the news background does not strongly support the British pound and the euro.

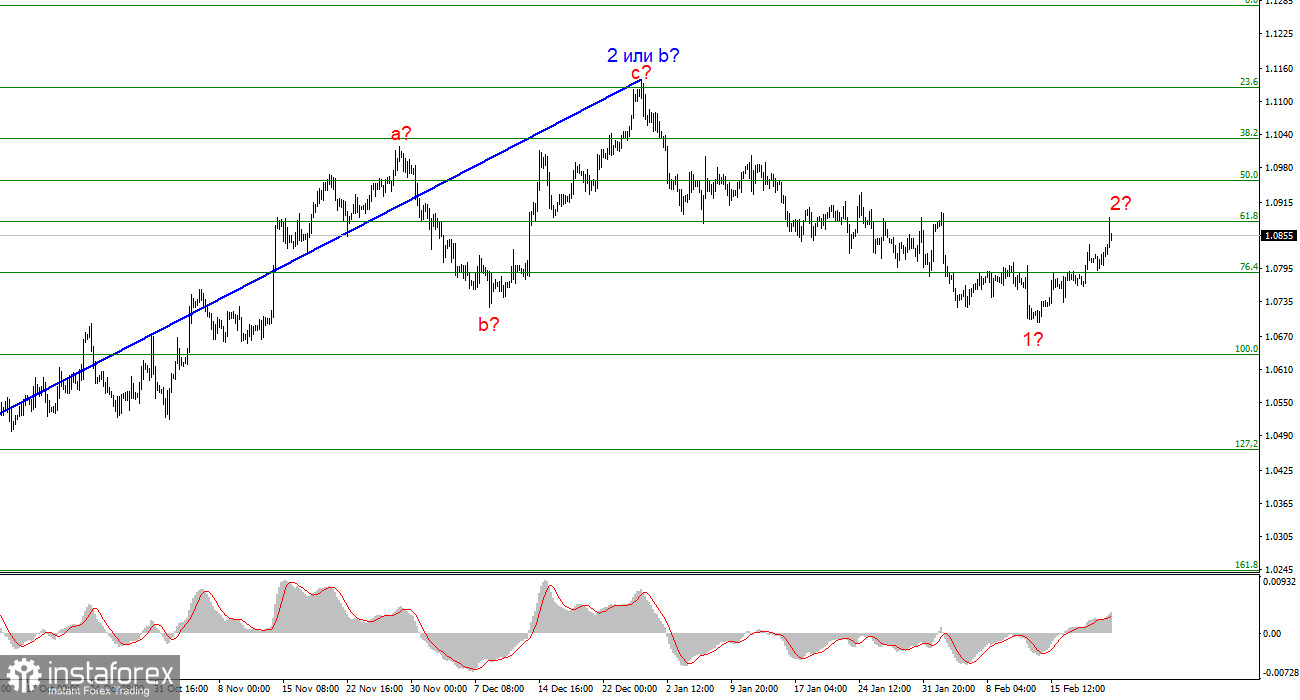

Wave picture for EUR/USD:

Based on the analysis, I conclude that a bearish wave pattern is being formed. Wave 2 or b appears to be complete, so in the near future, I expect an impulsive descending wave 3 or c to form with a significant decline in the instrument. Another internal corrective wave is currently being formed, which may end in the next few days. I am currently considering short positions with targets around the level of 1.0462, which corresponds to 127.2% according to Fibonacci.

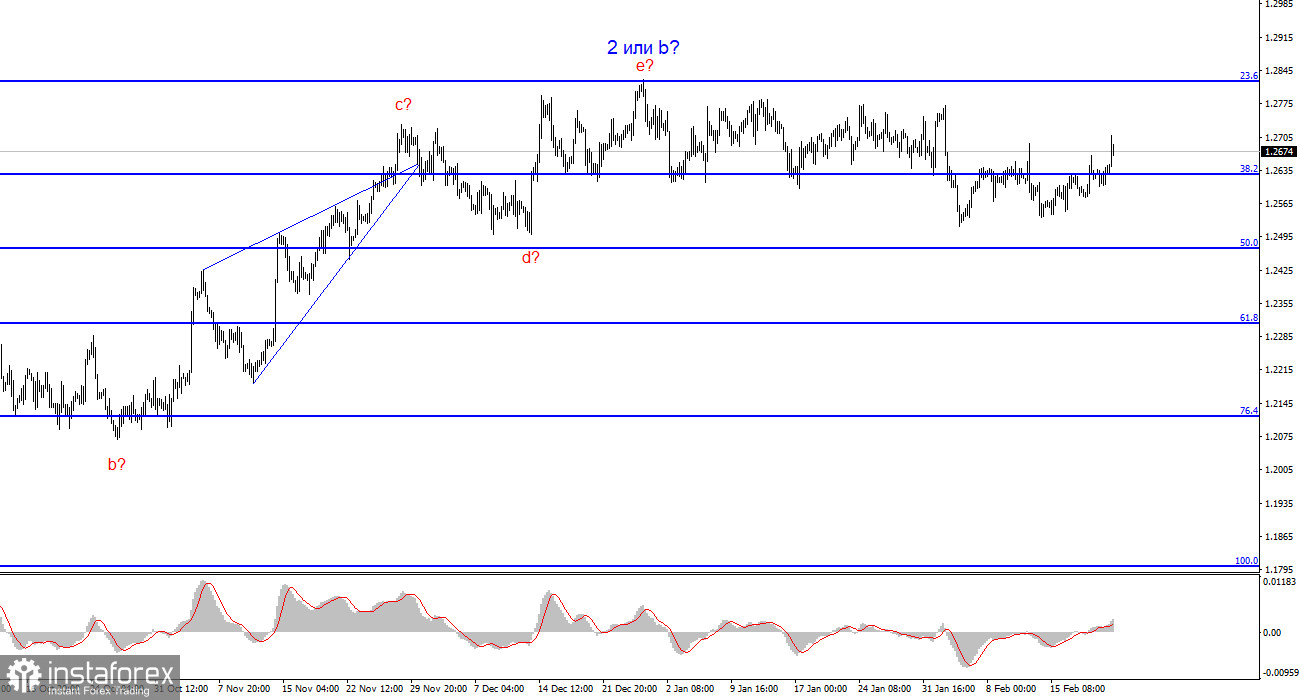

Wave picture for GBP/USD:

The wave pattern of the GBP/USD instrument still suggests a decline. Currently, I am considering selling the instrument with targets below the level of 1.2039 because wave 2 or b cannot last forever, just like the sideways movement. A successful attempt to break the level of 1.2627 generated a sell signal. However, at the moment, I can also highlight a new sideways movement with the lower boundary at the level of 1.2500. This level is currently the limit for the pound's decline. Wave 3 or C of the downtrend has not started yet.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română