Following the January meeting, the Bank of Japan maintained the parameters of its credit and monetary policy unchanged.

Immediately after the Bank of Japan's decision announcement, the yen moderately but significantly weakened, and the USD/JPY pair surged to an intraday high of 148.55.

Subsequently, the pair's growth continued, reaching its highest point this month above the 150.85 mark, the highest since mid-November.

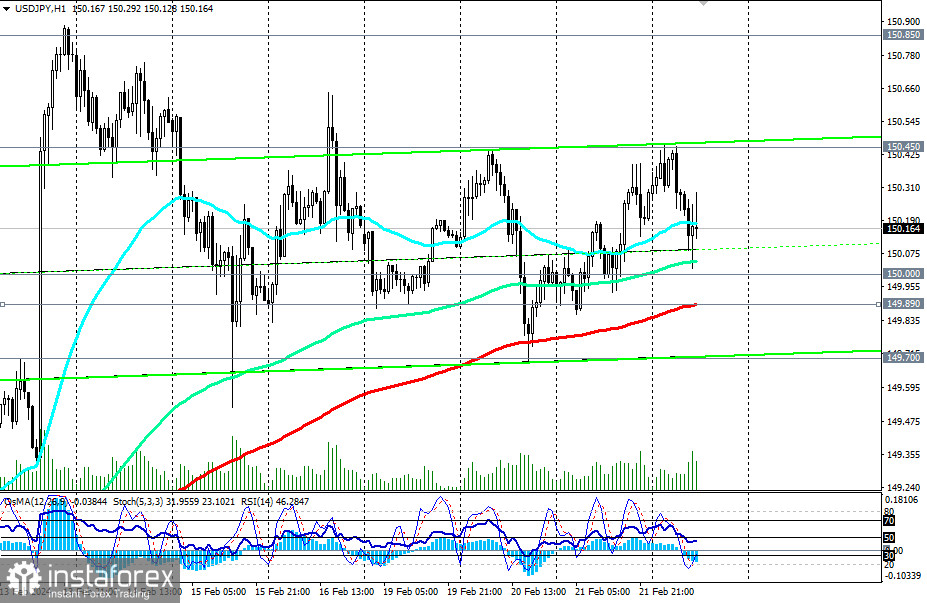

As of writing, the pair is trading near the 150.00 mark, while market participants are focused on discussing the protocols from the January meeting of the Federal Reserve, published on Wednesday evening. Investors also cautiously approach the possibility of further purchases, fearing the likelihood of currency intervention by the Bank of Japan to maintain the yen's exchange rate, especially if the USD/JPY pair rises above the 150.00 mark.

Market participants, monitoring the dynamics of the yen, ignored today's verbal intervention by the Bank of Japan's leadership, and the USD/JPY pair continued to trade in a narrow range, slightly above the 150.00 mark, remaining within the intraday flat.

It is evident that the pair lacks new drivers to move in either direction to break out of the range between the levels of 150.85 and 149.70. A narrower range has formed between the levels of 150.45 and 149.89 (200 EMA on the 1-hour chart).

Therefore, a break below the 149.89 mark could be the first signal, and a break of 149.70 would confirm it when the pair starts moving downward.

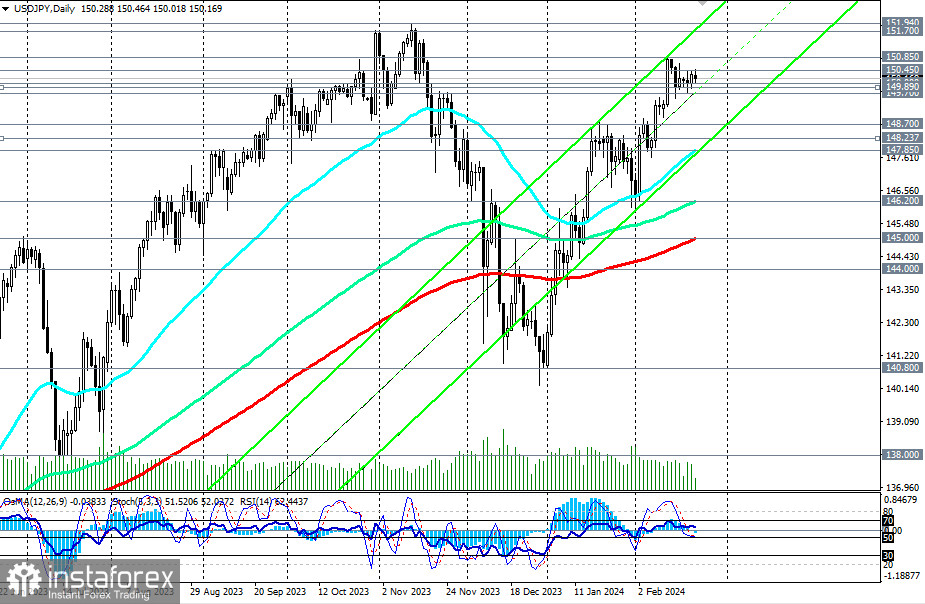

Correction targets are located near support levels at 148.24 (200 EMA on the 4-hour chart), 147.85 (50 EMA and the lower line of the upward channel on the daily chart).

Considering the overall upward trend, expecting a deeper correction is premature.

In the main scenario, a resumption of growth is anticipated. A breakthrough of the 150.45 mark will be the first signal, and a breakthrough of 150.85 will confirm it.

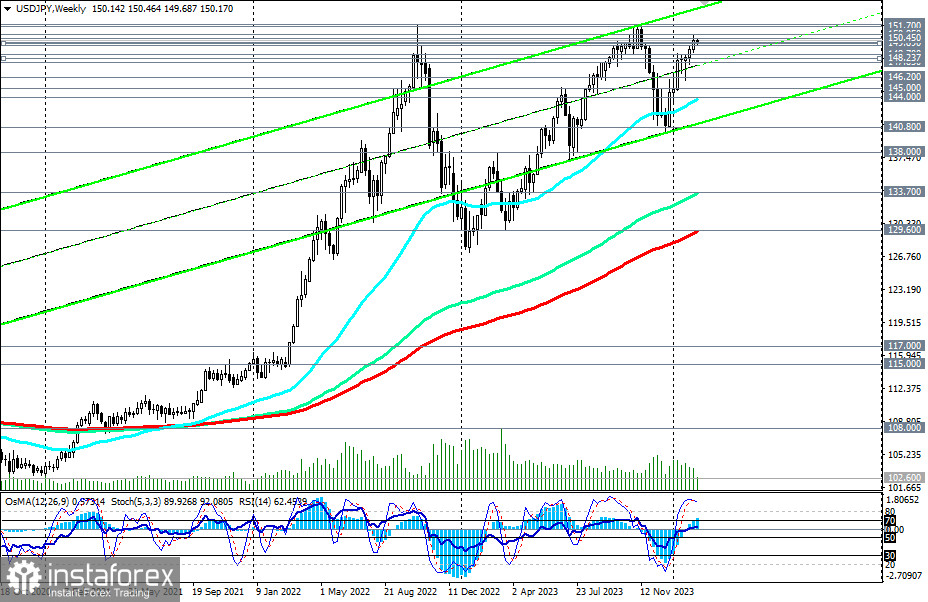

From a technical point of view, USD/JPY continues to trade in a bullish market zone, medium-term—above the key support level of 145.00 (200 EMA on the daily chart), and long-term—above the key support level of 129.60 (200 EMA on the weekly chart). Thus, both from a technical and fundamental point of view, long positions remain preferable for now.

Upside targets are located near the highs of 2023 and the levels of 151.70, 152.00.

Support levels: 150.00, 149.89, 149.70, 149.00, 148.70, 148.24, 147.85, 146.20, 145.00, 144.00, 140.80, 138.00, 133.70, 130.00, 129.60

Resistance levels: 150.45, 150.85, 151.00, 151.70, 151.95, 152.00, 153.00

Trading Scenarios

Main Scenario

Aggressively: Buy at the market. Stop Loss 149.80

Moderately: Buy Stop 150.60. Stop Loss 149.60

Targets 150.85, 151.00, 151.70, 151.95, 152.00, 153.00

Alternative Scenario

Aggressively: Sell Stop 149.80. Stop Loss 150.60

Moderately: Sell Stop 149.60. Stop Loss 150.60

Targets 149.00, 148.70, 148.24, 147.85, 146.20, 145.00, 144.00, 140.80, 138.00, 133.70, 130.00, 129.60

"Targets" correspond to support/resistance levels. This also does not mean that they will necessarily be reached, but can serve as a guide when planning and placing trading positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română