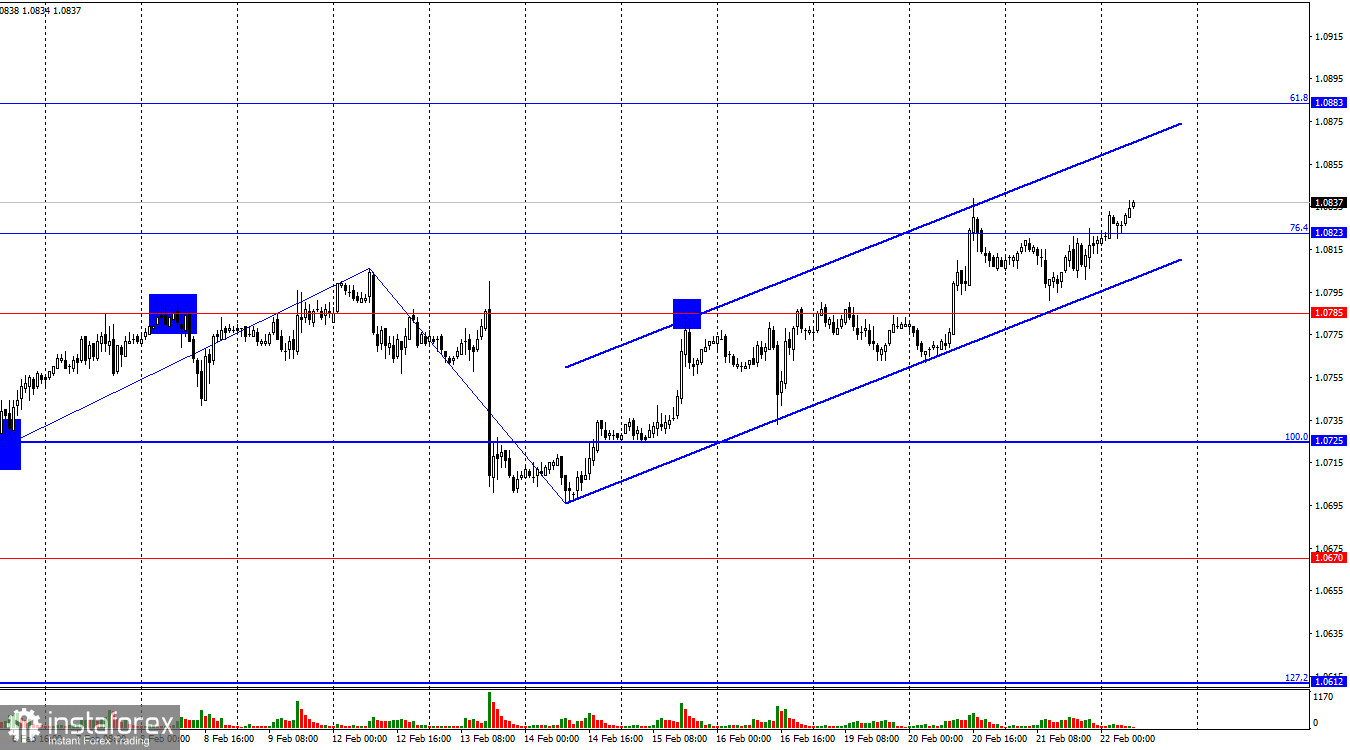

The EUR/USD pair maintained a "bullish" sentiment on Wednesday but traded within a narrow price range for almost the entire day. Today, the pair secured itself above the corrective level of 76.4% (1.0823), allowing for an expectation of further growth towards the next corrective level of 61.8%–1.0883. The ascending trend corridor characterizes trader sentiment as "bullish." Now, anticipating the resumption of the euro's decline can only happen after the quotes close below it.

The wave situation is becoming more clear. The last completed downward wave confidently broke the low of the previous wave, but the new upward wave broke the peak of the previous wave (from February 12). Thus, the first sign of the completion of the "bearish" trend and the beginning of a new "bullish" trend has appeared. If this is the case, bullish traders may attack more actively over the next few weeks. However, for example, this week, the information background is so weak that it is quite difficult for me to speculate on what data the bulls plan to use for their attack. Nevertheless, growth is present every day, even without news and reports.

The background information was absent again on Wednesday. The FOMC meeting minutes in January did not stimulate traders to trade more actively, but they do not need them now. Bears took a break after a month and a half of onslaught, and bulls are forming a new trend that does not require an information background. However, today, eleven reports will be released in the European Union and the US, and although some of them may affect trader sentiment, the overall picture is unclear.

On the 4-hour chart, the pair rose to the upper line of the descending trend corridor and secured above it. Thus, we have another sign of a trend change to "bullish." Now, the growth process can be continued towards the corrective level of 50.0%–1.0862. There are no emerging divergences for any indicators. The information background does not support buyers, but for some time, they may attack based on graphical factors. A rebound from the level of 1.0862 will favor the US dollar and cause some decline in quotes.

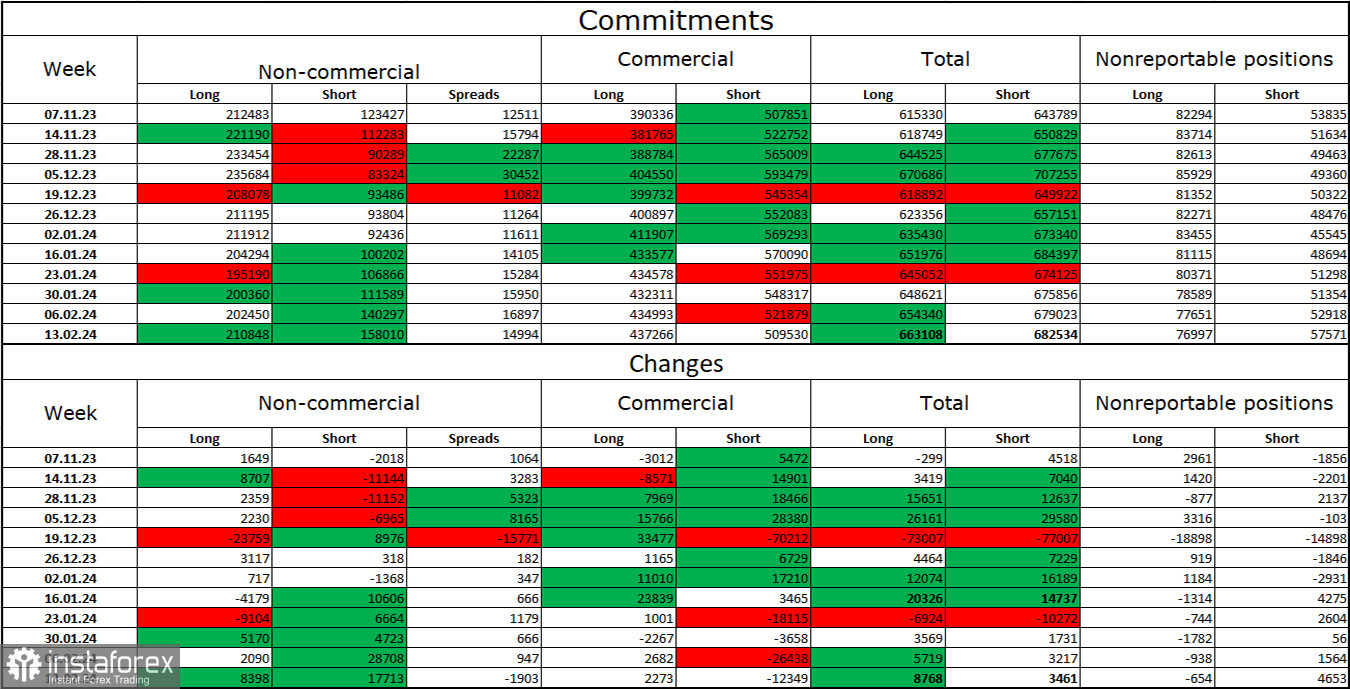

Commitments of Traders (COT) report:

During the last reporting week, speculators opened 8398 long contracts and 17713 short contracts. The sentiment of major traders remains "bullish" but continues to weaken. The total number of long contracts held by speculators is now 210 thousand, while short contracts are 158 thousand. I still believe that the situation will continue to change in favor of bears. Bulls have dominated the market for too long, and now they need a strong information background to maintain the "bullish" trend. I don't see such a background now. Professional traders may continue to close long positions (or open short positions) in the near future. I believe that the current figures allow for the continuation of the euro's decline in the coming months.

News calendar for the US and the European Union:

European Union – Services Purchasing Managers' Index for Germany (08:30 UTC).

European Union – Manufacturing Purchasing Managers' Index for Germany (08:30 UTC).

European Union – Composite Purchasing Managers' Index for Germany (08:30 UTC).

European Union – Services Purchasing Managers' Index (09:00 UTC).

European Union – Manufacturing Purchasing Managers' Index (09:00 UTC).

European Union – Composite Purchasing Managers' Index (09:00 UTC).

European Union – Consumer Price Index (10:00 UTC).

US – Initial Jobless Claims (13:30 UTC).

US – Services Purchasing Managers' Index (14:45 UTC).

US – Manufacturing Purchasing Managers' Index (14:45 UTC).

US – Composite Purchasing Managers' Index (14:45 UTC).

On February 22, the economic events calendar contains numerous reports. The impact of the news background on trader sentiment today can be moderate.

EUR/USD Forecast and Trader Advice:

Sales of the pair are possible today if it consolidates below the ascending corridor on the hourly chart, with targets at 1.0785 and 1.0725. Purchases of the pair were possible when consolidating above the descending trend corridor on the 4-hour chart, with targets at 1.0823 and 1.0862. The first target has been reached. New purchases are possible when closing above 1.0823, with a target of 1.0883.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română