The statements of ECB and Fed representatives, as well as the contents of the FOMC's minutes of the meeting, did not make any impression on the market because they did not bring anything new, especially regarding the likely timing of the start of monetary policy easing. This led to euro and pound remaining stagnant.

Today, inflation data for the eurozone will be released, and it will likely confirm the preliminary estimate already taken into account by the market. Forecasts say it will show an increase in the indicator, similar to that of the UK's. Meanwhile, a decrease may be seen in the US, which will provoke further growth in pound. Additional factors for its rise will be an increase in US jobless claims.

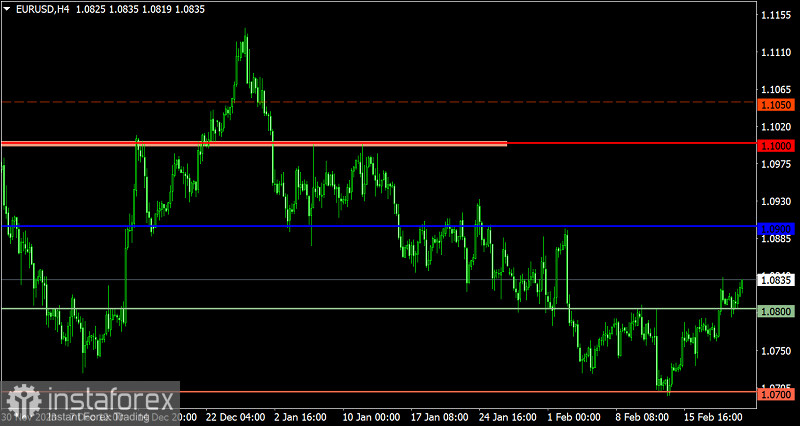

EUR/USD gained 150 pips since rebounding from the support level of 1.0700. This partially recovered the earlier decline, and staying above the level of 1.0800 will likely provoke further growth.

GBP/USD rose above the level of 1.2600, indicating an increase in the volume of long positions. If the upward sentiment persists in the market, the pair will likely reach the level of 1.2700. But if the price falls below 1.2600, pound will begin to move downward.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română