The pound is surprisingly reluctant to fall against the US dollar. Some analysts claim that the US dollar will weaken against its major counterparts in 2024, but they don't explain why this will happen. To briefly remind you, the Federal Reserve will start lowering rates (most likely) this summer, and the Bank of England will also start lowering rates in 2024. Perhaps just a couple of months later than the Fed. So why should the US dollar weaken?

The British economy has officially entered a recession, and it doesn't matter what it is called within the BoE. A technical recession is still a recession. The fact is that while the US economy continues to grow and thrive amid the enthusiastic cries of many experts about an inevitable collapse, the British economy is falling under the same enthusiastic cries about its strength in a challenging period of high BoE rates. In my opinion, it's all about perception. In the market, any news, event, or indicator can be interpreted in any direction. You can always say that inflation is not decreasing fast enough, and therefore, it's negative. Or that the economy could have contracted much more, but the BoE made the right decisions, so a deep recession was avoided.

In my opinion, the market continues to believe in the pound and the strength of the UK economy. And the central bank is fueling this belief. For instance, last week, one of the members of the BoE, Megan Greene, said news that Britain had fallen into recession had not shifted her views on policy by much. Therefore, the BoE's attitude toward the recession is now like "the economy is contracting, but don't worry, nothing serious is happening".

At the same time, the US economy grows every quarter, but the market doesn't care. Perhaps it's all about the money supply, but both the Fed and the BoE are actively reducing it as part of the QT programs. Based on all the above and if we consider the wave analysis, I still expect the pound to decline because there is nothing more to expect from it. It doesn't have any substantial reason to support its growth.

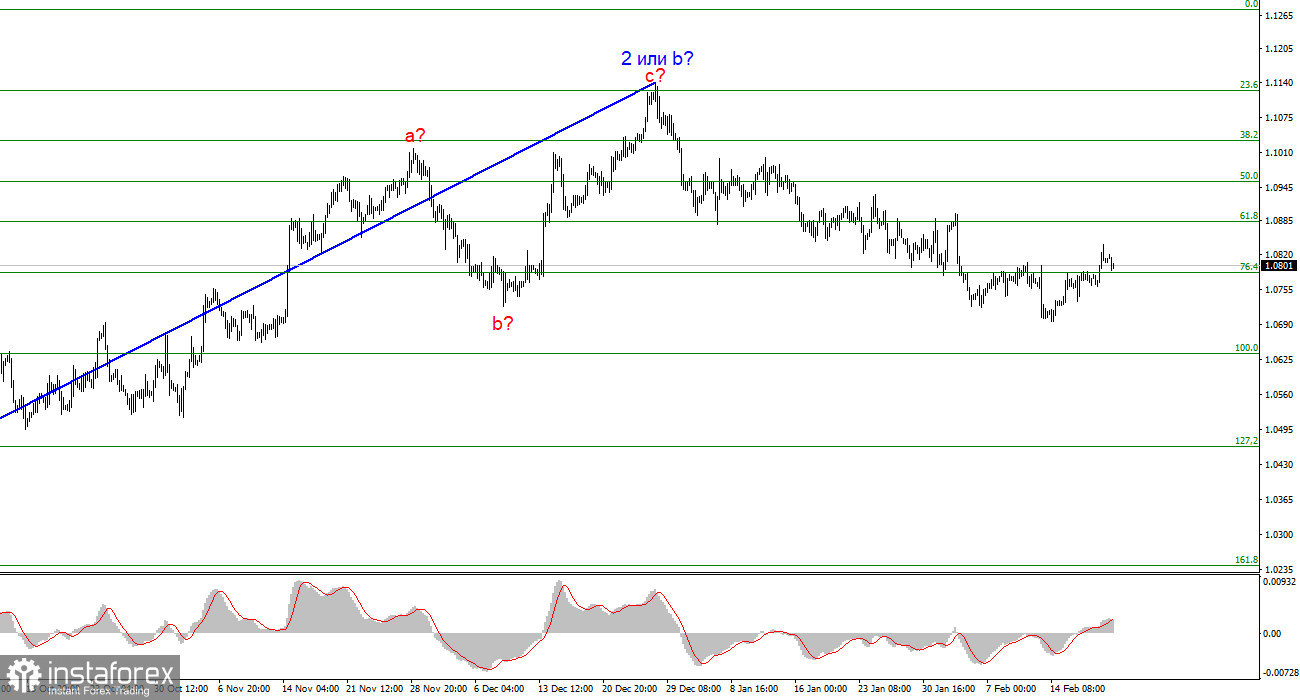

Based on the analysis, I conclude that a bearish wave pattern is being formed. Wave 2 or b appears to be complete, so in the near future, I expect an impulsive descending wave 3 or c to form with a significant decline in the instrument. Another internal corrective wave is currently being formed, which may be completed in the next few days. I am currently considering short positions with targets around the level of 1.0462, which corresponds to 127.2% according to Fibonacci.

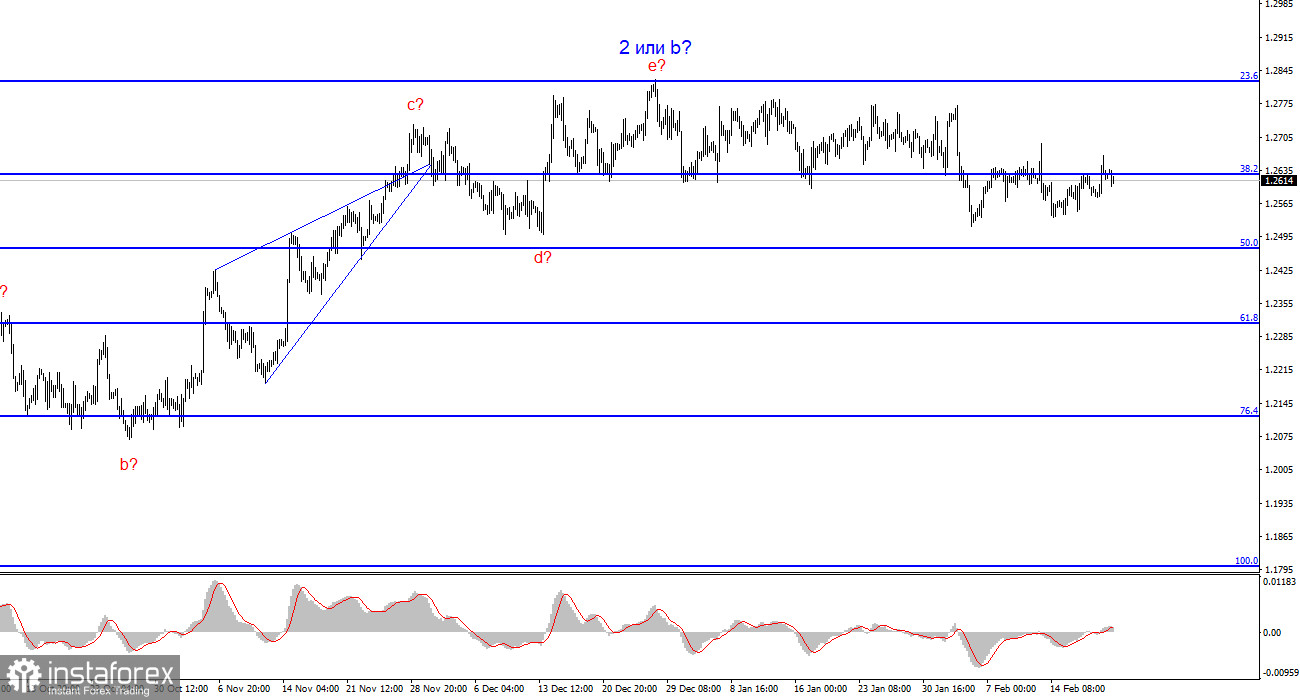

The wave pattern for the GBP/USD pair suggests a decline. At this time, I am considering selling the instrument with targets below the 1.2039 mark because wave 2 or b will eventually end, just like the sideways trend. A successful attempt to break through the 1.2627 level acted as a sell signal. Another signal was formed, in the form of an unsuccessful attempt to break this level from below. Now I am quite confident about the instrument's decline, at least to the 1.2468 level, which would already be a significant achievement for the dollar, as the demand for it remains very low.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română