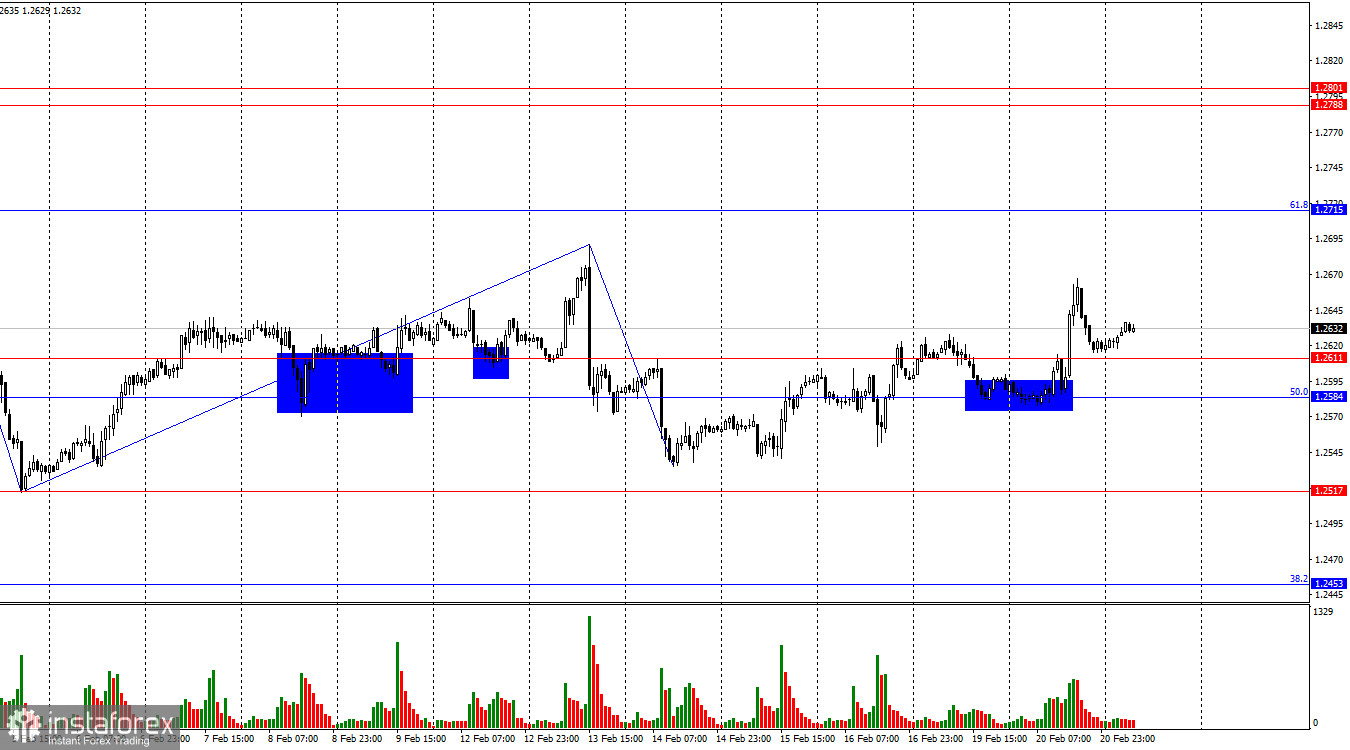

On the hourly chart, the GBP/USD pair on Tuesday rebounded from the support zone of 1.2584–1.2611 and started a new upward process towards the corrective level of 61.8% (1.2715). Trends are currently very short-term, so the rise of the pound may be short-lived. The support zone of 1.2584–1.2611 is weak; a re-establishment below it will again work in favor of the US dollar and some decline towards the level of 1.2517.

The situation with waves remains very ambiguous. For a long time, we observed horizontal movement, within which almost all the time single waves or triplets were formed, alternating with each other and having approximately the same size. The flat has ended, and we continue to see the same single waves and triplets. And even confidence in the completion of the flat decreases every day. Traders' sentiment has changed to "bearish," which allows us to count on a prolonged decline of the pound. However, bears are showing weakness again. The last downward wave failed to break the previous low (from February 5), and we got the first sign of the completion of the "bearish" trend, which never really started.

Yesterday, the Governor of the Bank of England, Andrew Bailey, spoke at parliamentary hearings in the UK. He stated that inflation is falling quite rapidly, but there are three areas where he would prefer to achieve more progress before moving on to interest rate cuts. These areas are: inflation in the services sector, wage growth rates, and the labor market. He also added that the Bank of England does not have to wait for inflation to reach 2% to start easing monetary policy. The pound showed growth at this event, but it was short-lived, as it remained unclear whether the regulator plans to start easing policy soon. The question of the recession and its impact on the Bank of England's plans also remains unclear.

On the 4-hour chart, the pair returned to the level of 1.2620 and the trendline. A rebound from these two barriers will work in favor of the US dollar and a resumption towards the correction level of 1.2450. The CCI indicator is showing a "bearish" divergence, which can help activate sellers. Consolidation above the trendline will allow expecting a continuation of the pound's growth towards the Fibonacci level of 61.8% at 1.2745.

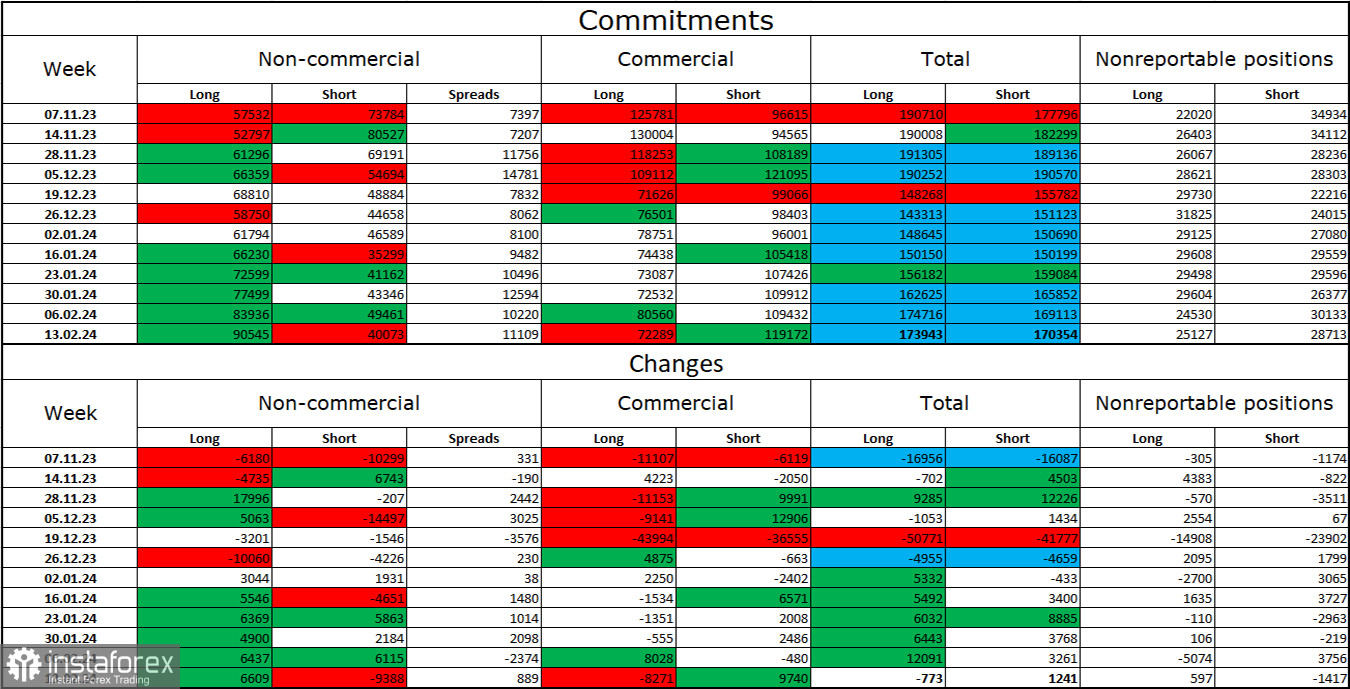

Commitments of Traders (COT) report:

The sentiment of the "Non-commercial" trader category changed quite strongly over the past reporting week. The number of long contracts in the hands of speculators increased by 6609 units, while the number of short contracts decreased by 9388 units. The overall sentiment of large players remains "bullish" and continues to strengthen, although I don't see any specific reasons for this. There is more than a two-fold gap between the number of long and short contracts: 90 thousand versus 40 thousand.

In my opinion, the pound still has excellent prospects for a decline. I believe that over time, bulls will start getting rid of buy positions, as all possible factors for buying the British pound have already been exhausted. For two months, bulls have been unable to push the level of 1.2745, but bears are also not in a hurry to go on the offensive and are generally very weak right now.

News calendar for the US and the UK:

US – FOMC Meeting Minutes (19:00 UTC).

On Wednesday, the economic events calendar contains only one entry. The impact of the information background on the market sentiment today may be very weak.

GBP/USD forecast and trader tips:

Today, one can consider selling on a rebound from the trendline on the 4-hour chart with a target of 1.2517. Purchases will be possible if closing above the trendline on the 4-hour chart with a target of 1.2715.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română