EUR/USD

Yesterday, the markets were divided – stock markets and government bond yields fell, while safe-haven currencies strengthened. I think this is a temporary effect. Tomorrow, Purchasing Managers Index (PMI) figures for the euro area and the US will be released. Forecasts suggest that US PMI data will show a decline. We expect the stock market to fall further and the euro show weakness amid a general risk-off sentiment.

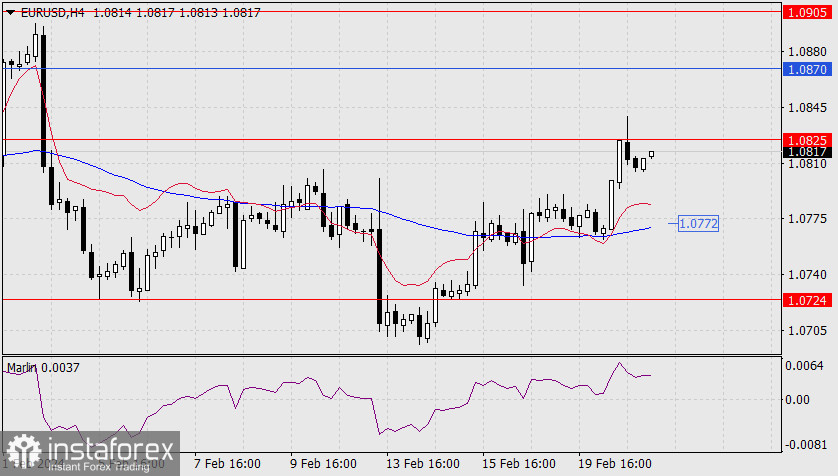

Our technical outlook for the euro has changed significantly, but not radically. Cyclical periods have been eliminated, and the price overcame the descending price channel, along with resistance of the Marlin oscillator. However, since the price is still moving below the balance and MACD indicator lines, it is still too early to speak of a trend reversal.

Before attacking the MACD line (1.0870), the price must settle above the target level of 1.0825. If this doesn't happen, a reversal could occur as early as today, for instance, during the FOMC minutes in the evening.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română