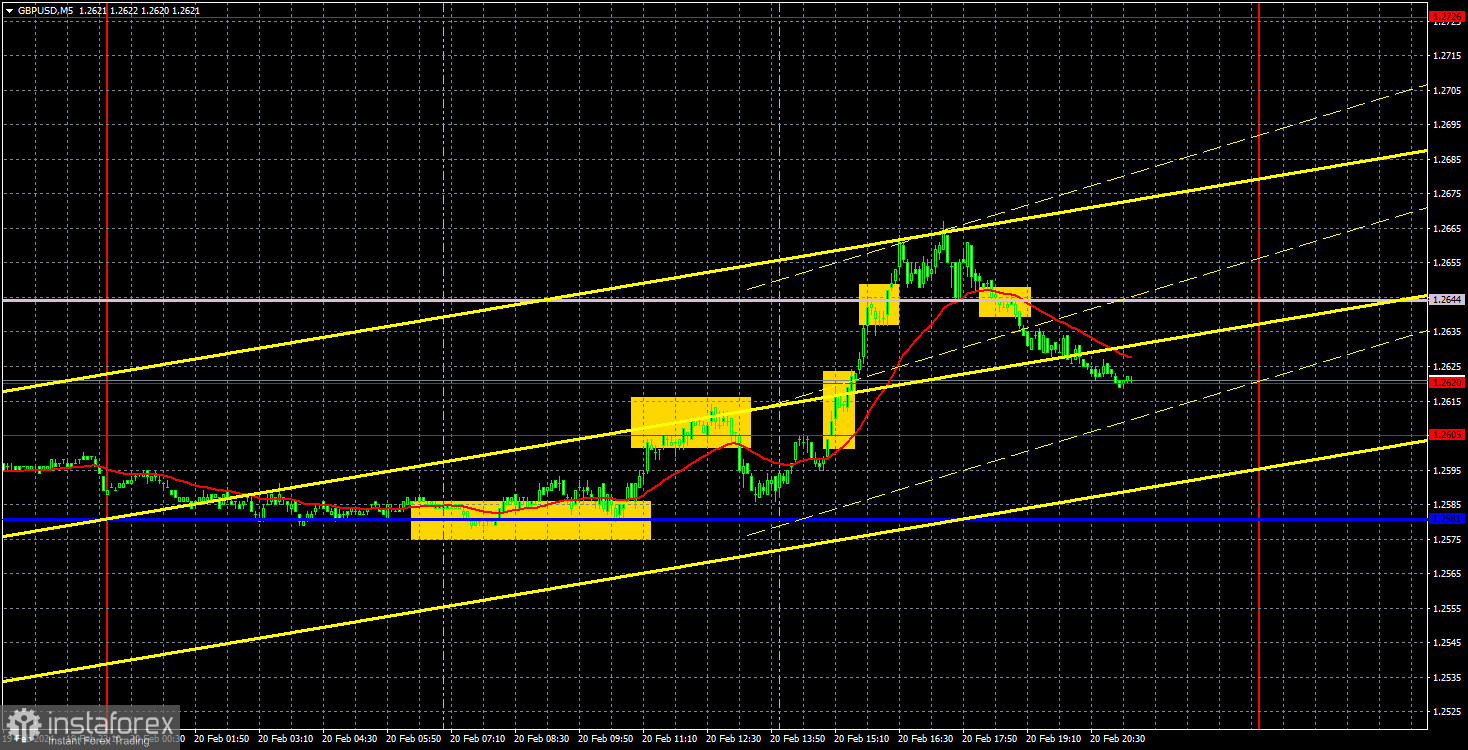

Analysis of GBP/USD 5M

GBP/USD showed positive trades on Tuesday, but we cannot consider this a trend, a brewing trend, or even a significant movement. In short, the pound simply demonstrated another upward move within the limited range it has been in for over two months. A new formal trend line has formed, which, generally, means nothing. Such trends are formed every week, and right now, you can highlight several trend lines on the chart. The main conclusion is that the pound is mostly moving sideways.

On Tuesday, Bank of England Governor Andrew Bailey spoke in the British Parliament. Despite his comments on the prospects of rate cuts and the weakness of the UK economy, the market somehow interpreted this information as a new reason to buy the British pound. By the evening, market participants probably realized their mistake as well as the lack of prospects for buying the pound, so they started selling it (or taking profits on short-term long positions). Either way, there was no logic behind the movements. Once again, the British currency increased when it should have been decreasing.

Formally, the pair is following an uptrend, but we still expect a decline from the pair. We hope that the market will eventually get tired of riding on unpromising "swings" and will start forming a new downtrend, which is more logical.

Several trading signals were formed on the 5-minute timeframe, which could be executed. However, take note that there were two important trend lines and two important levels in the area where the price was. As soon as any signal was formed, the price immediately reached the nearest target. It is up to you to decide whether you would open positions in such conditions. Out of the five trading signals, only one turned out to be a false signal, so traders could gain profit.

COT report:

COT reports on the British pound show that the sentiment of commercial traders has frequently changed in recent months. The red and blue lines, which represent the net positions of commercial and non-commercial traders, constantly intersect and, in most cases, remain close to the zero mark. According to the latest report on the British pound, the non-commercial group opened 6,600 buy contracts and closed 9,300 short ones. As a result, the net position of non-commercial traders increased by 15,900 contracts in a week. Despite the fact that the net position of speculators is growing again, the fundamental background still does not provide a basis for long-term purchases of the pound sterling.

The non-commercial group currently has a total of 90,500 buy contracts and 40,000 sell contracts. The advantage of the bulls is almost twofold. However, in recent months, we have repeatedly encountered such situations: the net position either increases or decreases, the advantage passes from bulls to bears and vice versa. Since the COT reports do not provide an accurate forecast of the market's behavior at the moment, we need to pay close attention to the technical picture and economic reports. The technical analysis suggests that there's a possibility that the pound could show a pronounced downward movement (but there are no clear sell signals yet), and for a long time now, the economic reports have also been significantly stronger in the United States than in the United Kingdom, but this has not benefited the dollar.

Analysis of GBP/USD 1H

On the 1H chart, GBP/USD left the sideways channel and it still has the potential to form a downtrend. However, recently, we've noticed that the market is not in a rush to sell the pound. The price has been moving sideways instead of moving upwards or downwards. The British pound is still a currency that tends to move sideways, trading in a somewhat illogical and confusing manner.

As of February 21, we highlight the following important levels: 1.2215, 1.2269, 1.2349, 1.2429-1.2445, 1.2516, 1.2605-1.2620, 1.2726, 1.2786, 1.2863, 1.2981-1.2987. The Senkou Span B line (1.2644) and Kijun-sen line (1.2602) lines can also serve as sources of signals. Don't forget to set a Stop Loss to breakeven if the price has moved in the intended direction by 20 pips. The Ichimoku indicator lines may move during the day, so this should be taken into account when determining trading signals.

Today, there are no important reports scheduled in the UK. The US Federal Reserve Minutes will be released on Wednesday evening. Even if this event turns out to be important, it will not have any impact on the pair's movement during the day.

Description of the chart:

Support and resistance levels are thick red lines near which the trend may end. They do not provide trading signals;

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, plotted to the 1H timeframe from the 4H one. They provide trading signals;

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals;

Yellow lines are trend lines, trend channels, and any other technical patterns;

Indicator 1 on the COT charts is the net position size for each category of traders;

Indicator 2 on the COT charts is the net position size for the Non-commercial group.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română