EUR/USD

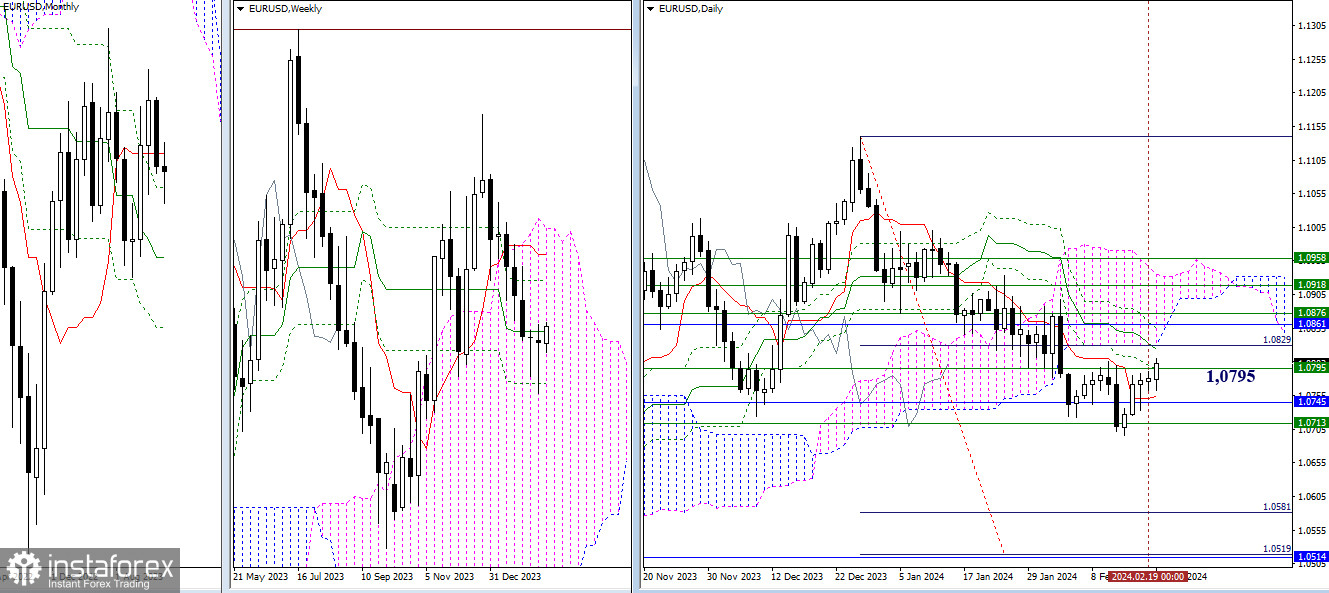

Higher Timeframes

After yesterday's contemplations, today, the bullish players are making another attempt and are striving to overcome resistances, implementing a continuation of the ascent. There are quite a few resistances accumulated in the nearest market segment; any of them can serve as a new obstacle. Nevertheless, there is no other way; to create new global prospects, it is necessary to pass through the established resistance zone (1.0795 – 1.0825 – 1.0861 – 1.0876 – 1.0918 – 1.0958).

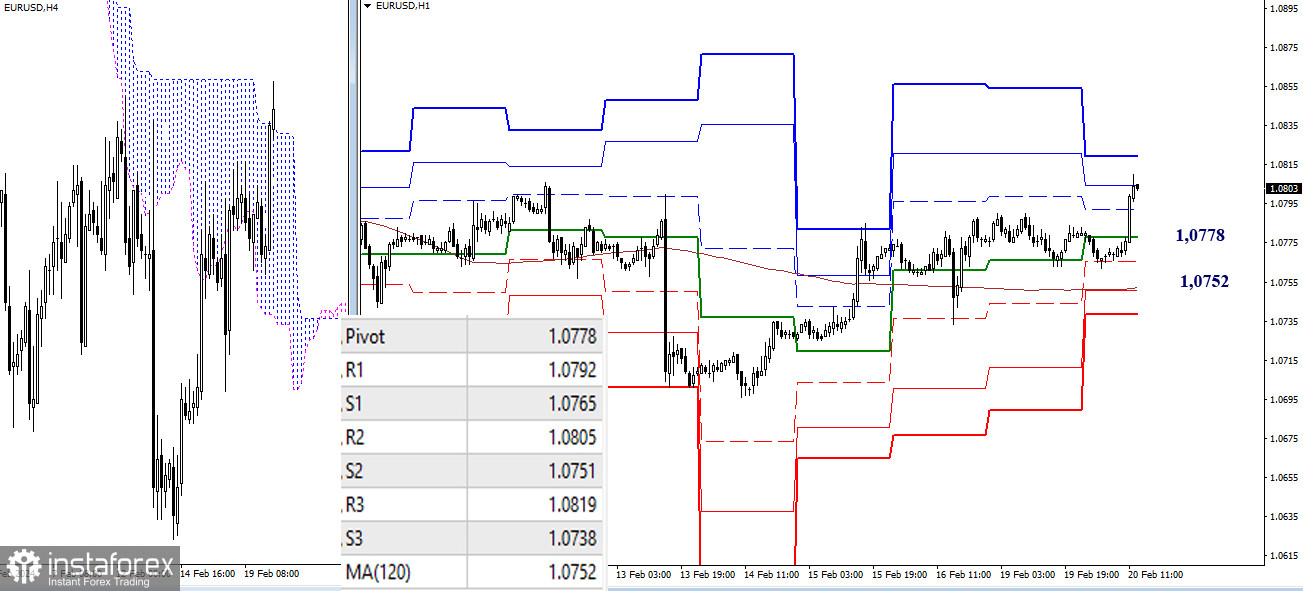

H4 – H1

On lower timeframes, the bulls are developing their advantages. At the moment, the second resistance of the classic pivot points (1.0805) is being tested. Next in line is R3 (1.0819), after which the movement will completely shift to the benchmarks of higher timeframes. On H4, the pair is now close to entering the bullish zone relative to the bearish cloud on H4. In case of a secure consolidation above the Ichimoku cloud, a new target for breaking the H4 cloud will appear. The loss of support for the weekly long-term trend (1.0752) will deprive the bullish players of their main advantage, so after the breakthrough and reversal of the moving average, an increase in bearish sentiments can be expected.

***

GBP/USD

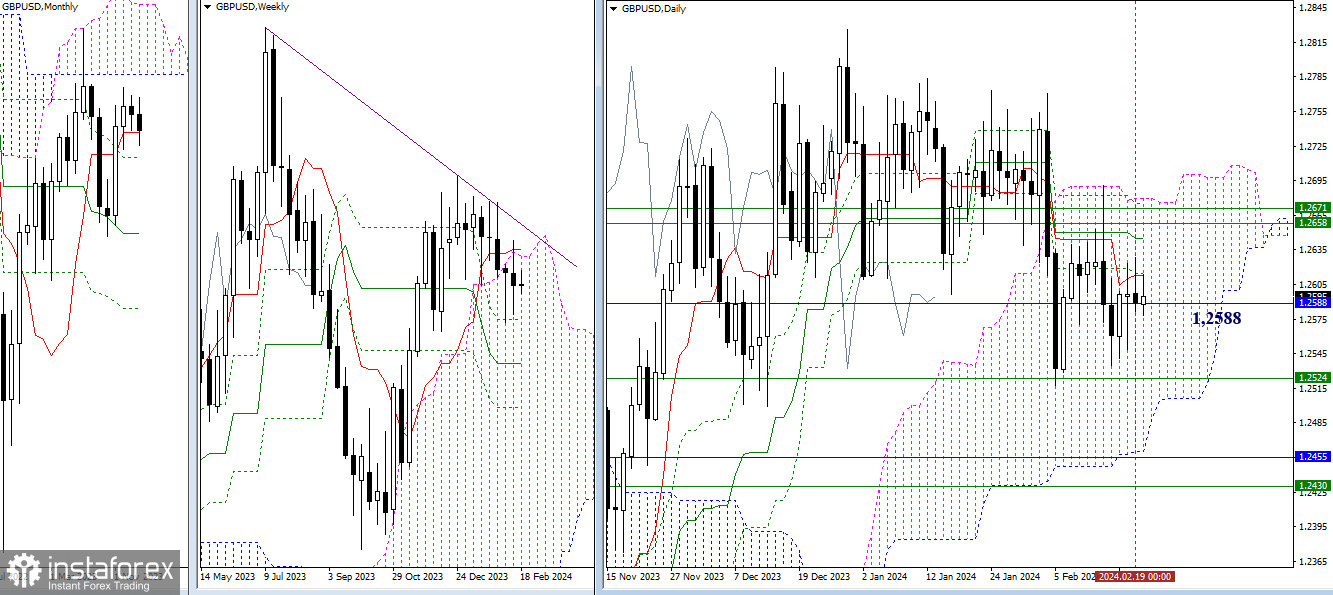

Higher Timeframes

Uncertainty persists. The center of attraction continues to be the monthly short-term trend (1.2588). All previously mentioned conclusions and expectations remain relevant today. The benchmarks for changing the situation still include the peak for the bears (1.2517), reinforced by weekly support (1.2524), and for the bulls, the range of 1.2571 – 1.2680, allowing entry into the bullish zone relative to the daily and weekly Ichimoku clouds.

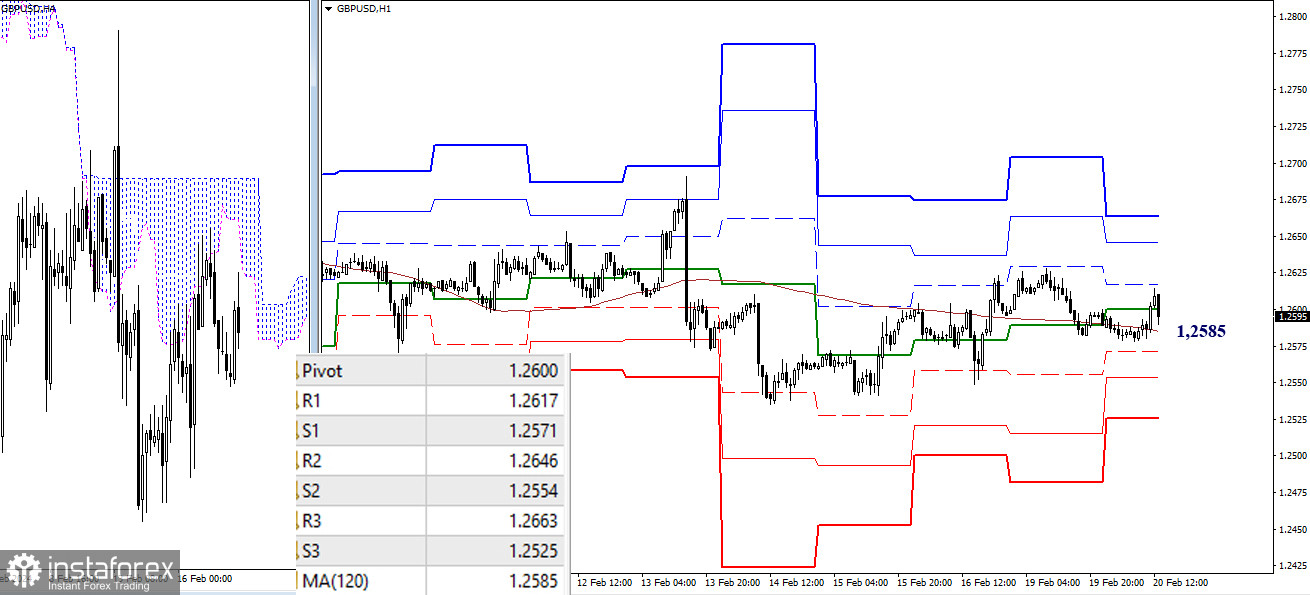

H4 – H1

On lower timeframes, the bullish players have the main advantage, but the situation is very unstable, and the balance is not obvious. The development of the ascent will strengthen bullish sentiments. Bullish targets today are located at 1.2617 – 1.2646 – 1.2663 (resistances of classic pivot points). Bearish targets can be noted at 1.2571 – 1.2554 – 1.2525 (supports of classic pivot points).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română