Size matters. When the divergences in monetary policy are not as significant as anticipated, and the divergence in economic growth takes one's breath away, USD/JPY has no choice but to continue the rally. This has caused dissatisfaction among officials in Tokyo. The degree of verbal interventions is increasing, but can the authorities' intervention in the Forex life break the upward trend of the U.S. dollar against the yen? Or is a more serious reason needed?

In the fourth quarter, Japan's GDP contracted by 0.1%. Considering its decline by 0.8% in the third quarter, the economy faced a technical recession. In nominal terms, it turned out to be smaller than Germany. Japan slid to third place, but this does not prevent its stock indices from surprising with rapid rallies. After a 27% growth in 2023, which was the best result since 2013, TOPIX has risen another 14% since the beginning of January. Meanwhile, the rising correlation with the yen up to the peak of 2020 indicates that foreigners are actively contributing to stock purchases.

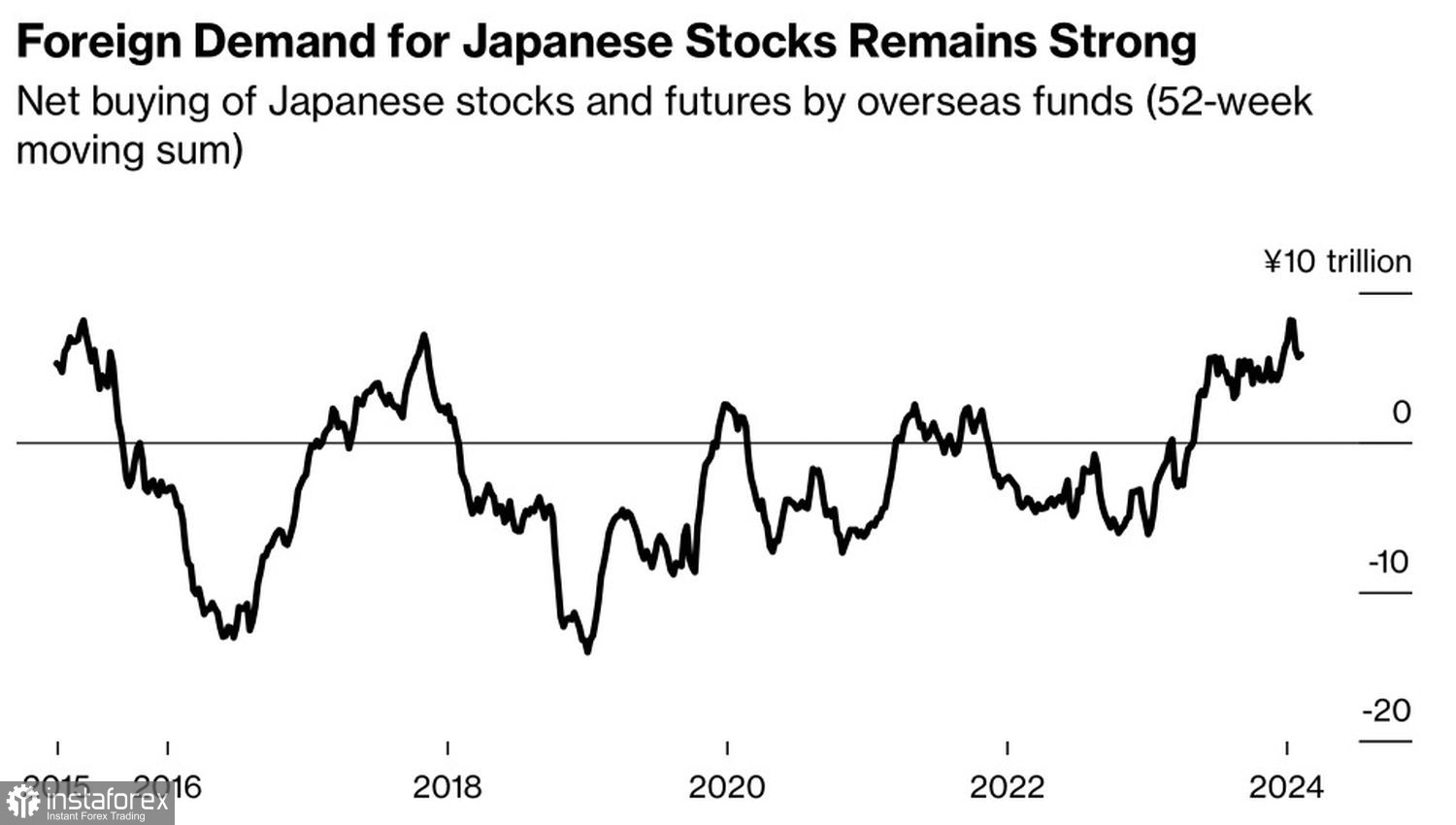

Indeed, in mid-January, the volume of net purchases of Japanese equities by non-residents jumped to £8.1 trillion or $54 billion equivalent over the last 52 weeks, which is the highest value of the indicator since its recording began in 2015. At the same time, the cost of currency risk hedging is -5.6%. In other words, foreigners can earn additional income by selling the yen. It is not surprising that its exchange rate against the U.S. dollar has fallen by 6% since the beginning of the year.

Dynamics of non-residents' purchases of Japanese stocks

Alongside the divergence in GDP growth and active currency risk hedging by non-residents, a reassessment of the market's views on the fate of the federal funds rate and the yen's volatility falling to its lowest levels since January 2022 exert pressure on the bears on USD/JPY. As a result, the risks of a reversal for the yen have fallen to the bottom since July, indicating that investors are not afraid of its strengthening.

But in vain! The fact that market expectations for the timing and scale of the Fed's monetary expansion have come closer to the December FOMC forecasts signals the loss of the U.S. dollar's main trump card. Simultaneously, the approaching date of the Bank of Japan's abandonment of negative interest rate policy, presumably in April, and the start date of the Federal Reserve's monetary policy tightening may increase the volatility of USD/JPY. The same goes for the U.S. presidential elections.

Dynamics of reversal risks for USD/JPY

An increase in the volatility of USD/JPY quotes will deal a double blow to the bulls. Investors will close their positions within the carry trade and return to the yen as the main funding currency. At the same time, the costs of currency risk hedging by non-residents will increase, reducing the net shorts of asset managers on the yen.

Technically, on the daily chart, the formation of a bar with a long upper shadow and the inability of the bulls to play out the "Range Contraction" pattern are reasons to sell the pair on a break below the support at 149.85.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română