While there will be few economic events in the European Union, the situation will not be much different in the United States. The news background of the first two days of the week will be similar to that of the euro. During these days, I expect dollar pairs to remain stagnant. On Wednesday evening, the "FOMC minutes" will be published, which is the report from the latest meeting of the U.S. central bank. On Thursday, business activity indices for the services and manufacturing sectors (as well as composite indices) and the number of initial jobless claims may provide impetus to traders. We will also find out the number of new home sales. Friday will be a nearly quiet day with no significant events.

Obviously, the PMI data will be the key event. In the United States, business activity is much better than in the European Union or the United Kingdom, but this does not mean that dollar buyers will find new reasons to make deals. The PMI data may come in below expectations, and in any case, these are not crucial reports.

I believe that next week, the focus will be more on the sentiment (in those instruments where it does not raise many questions) and the speeches of FOMC members. Market participants are betting the central bank will lower interest rates starting in June. According to the CME FedWatch Tool, market participants are pricing a 35% chance of a U.S. rate cut in May. If the most important FOMC members confirm that the central bank is not in a hurry to lower interest rates, this could give additional strength to U.S. dollar buyers. Therefore, I think it's important to pay attention to the speeches of Michelle Bowman, Patrick Harker, Neel Kashkari, and Christopher Waller.

In addition, members of the ECB Governing Council will also deliver speeches. In particular, Isabelle Schnabel will speak. Based on everything mentioned above, buyers and sellers of the U.S. dollar will have to sit on a lean news diet in the next five days. Sentiment, levels, and wave analysis will be crucial for the market, and activity may be quite low.

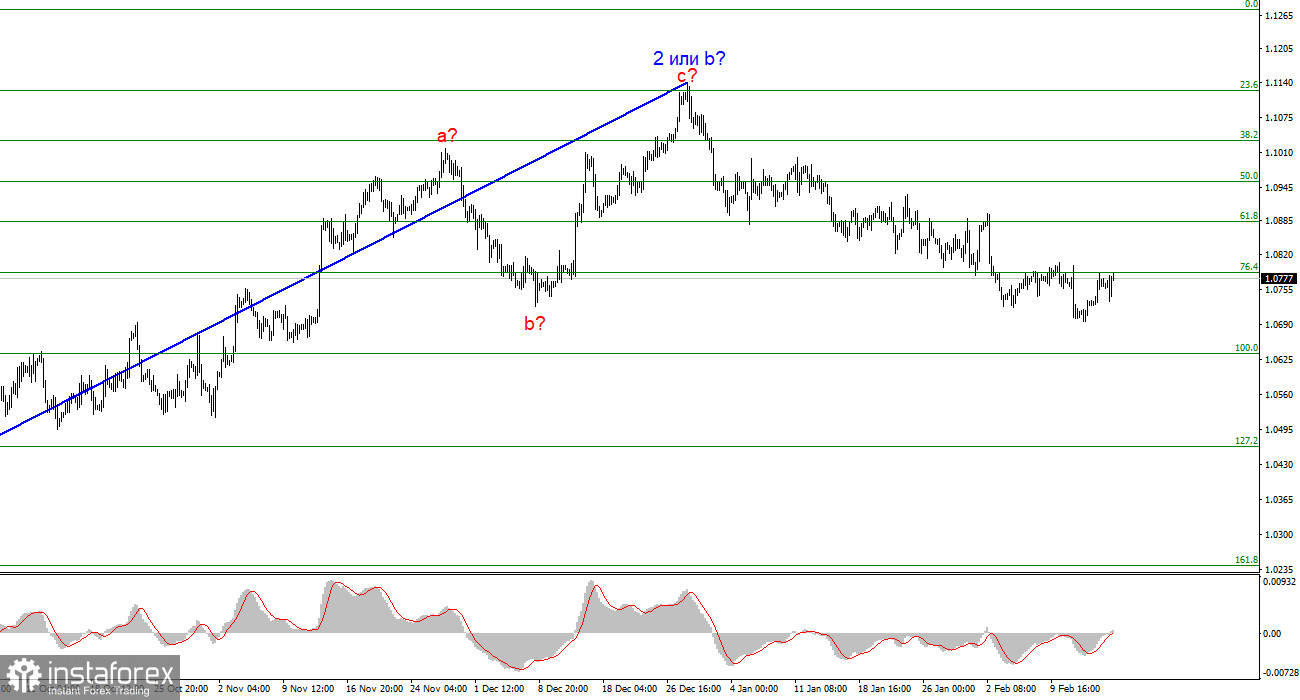

Based on the analysis, I conclude that a bearish wave pattern is being formed. Wave 2 or b appears to be complete, so in the near future, I expect an impulsive descending wave 3 or c to form with a significant decline in the instrument. The failed attempt to break through the 1.1125 level, which corresponds to the 23.6% Fibonacci, suggests that the market is prepared to sell a month ago. I am currently considering selling.

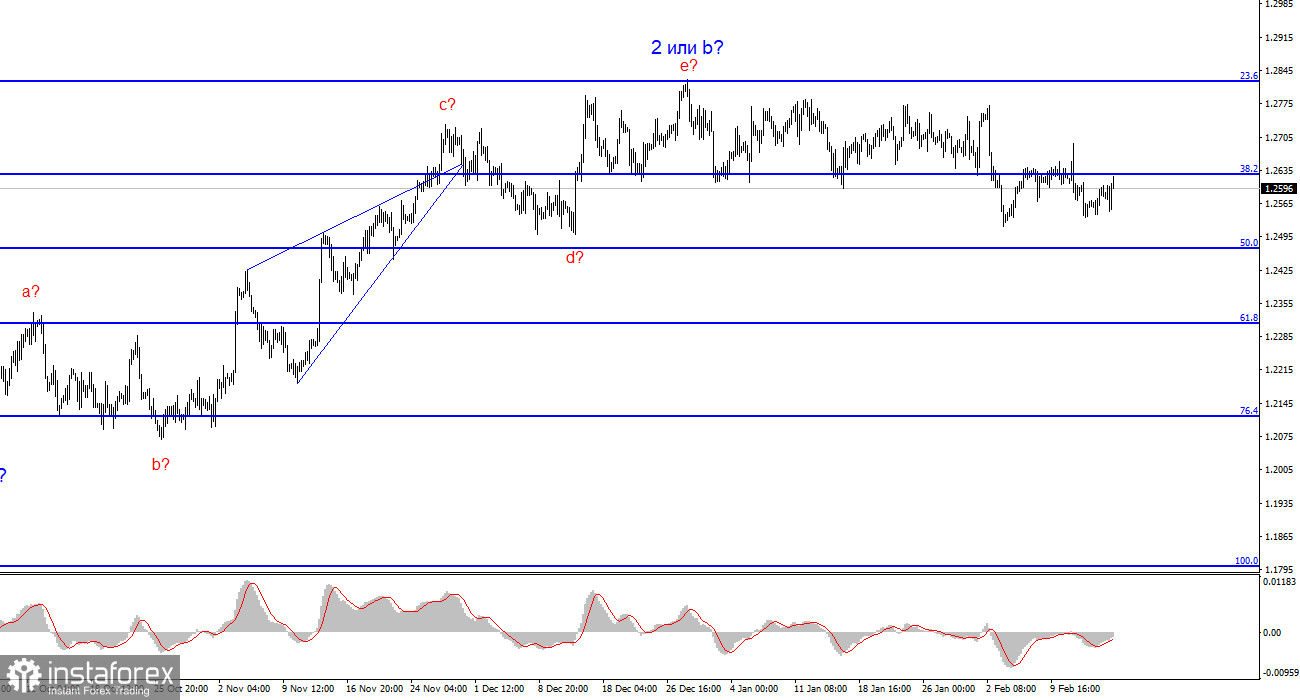

The wave pattern for the GBP/USD pair suggests a decline. At this time, I am considering selling the instrument with targets below the 1.2039 mark because wave 2 or b will eventually end, just like the sideways trend. A successful attempt to break through the 1.2627 level acted as a sell signal. Another signal was formed, in the form of an unsuccessful attempt to break this level from below. Now I am quite confident about the instrument's decline, at least to the 1.2468 level, which would already be a significant achievement for the dollar, as the demand for it remains very low.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română