The upcoming week will be relatively low-key in terms of interesting and significant events. Despite a good amount of news and economic data this week, the market has not been overly active. If we assume that market activity depends on the strength of the news background, the next five days may seem less eventful and more mundane. Nevertheless, let's consider all the most important events.

You may brush off Monday and Tuesday, as there are no events scheduled in the United States or the European Union. The European Central Bank will hold a meeting on Wednesday, but since monetary issues will not be discussed, forex traders will likely ignore this event. Thursday will bring a few reports. First, the data on business activity (in the services sector, manufacturing sector, and composite) in Germany, followed by similar data for the euro bloc half an hour later. Afterwards, the final inflation figures for January will be revealed. So what can we expect from this data?

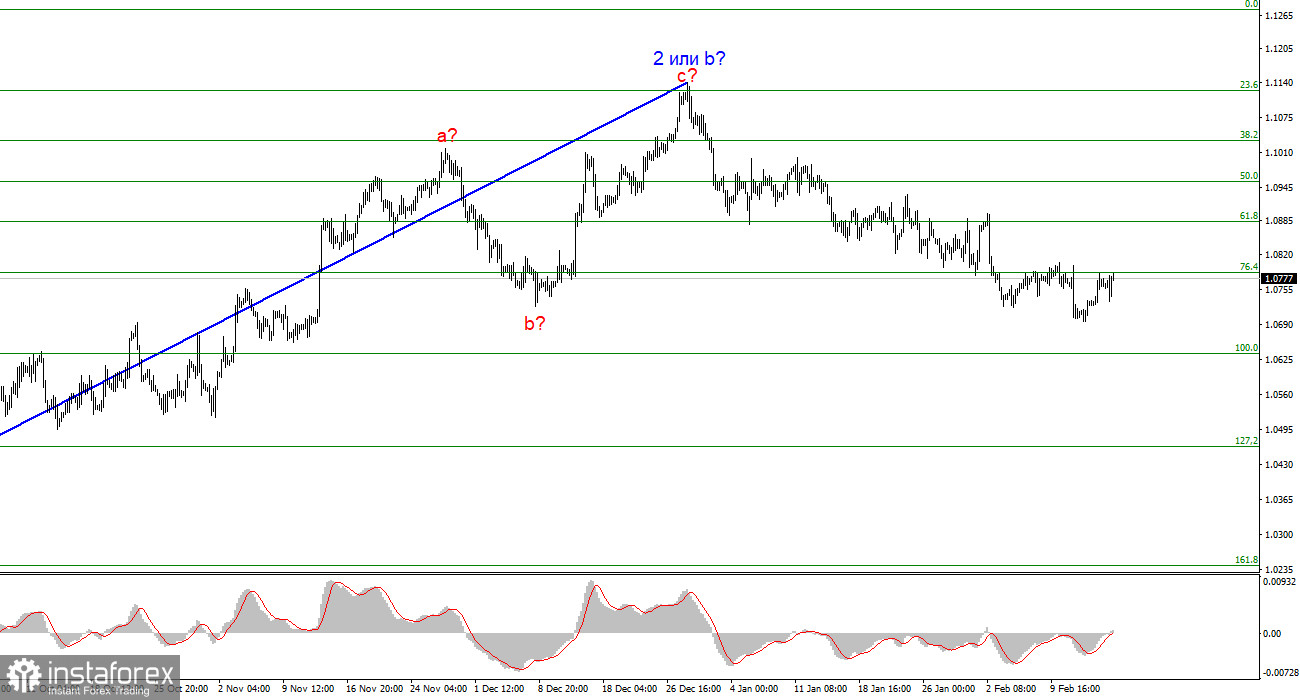

In my opinion, there is practically nothing to expect. The euro continues to build a downtrend. At best, buyers can hope for an internal corrective wave. However, considering the size of previous corrective waves, it is unlikely to be very strong. The news background can only provide minimal support to buyers or sellers, as it is clear that PMI data are not the kind of news that causes an instrument to move 100 pips in just a few days. Moreover, it is unlikely for market participants to be shocked by the values of this report, as the final assessment often does not differ significantly from the preliminary one.

On Friday, the GDP report for Germany for the fourth quarter and the IFO Business Expectations Index and Business Climate Index will be released. These aren't exactly very important data. They may only slightly fuel market activity for a very short period. At this point, I can say that I do not expect significant movements next week. A successful attempt to break through the 1.0788 level will indicate readiness for the formation of a corrective wave. An unsuccessful attempt will suggest a continuation of the instrument's decline.

Based on the analysis, I conclude that a bearish wave pattern is being formed. Wave 2 or b appears to be complete, so in the near future, I expect an impulsive descending wave 3 or c to form with a significant decline in the instrument. The failed attempt to break through the 1.1125 level, which corresponds to the 23.6% Fibonacci, suggests that the market is prepared to sell a month ago. I am currently considering short positions with targets around the level of 1.0462, which corresponds to 127.2% according to Fibonacci.

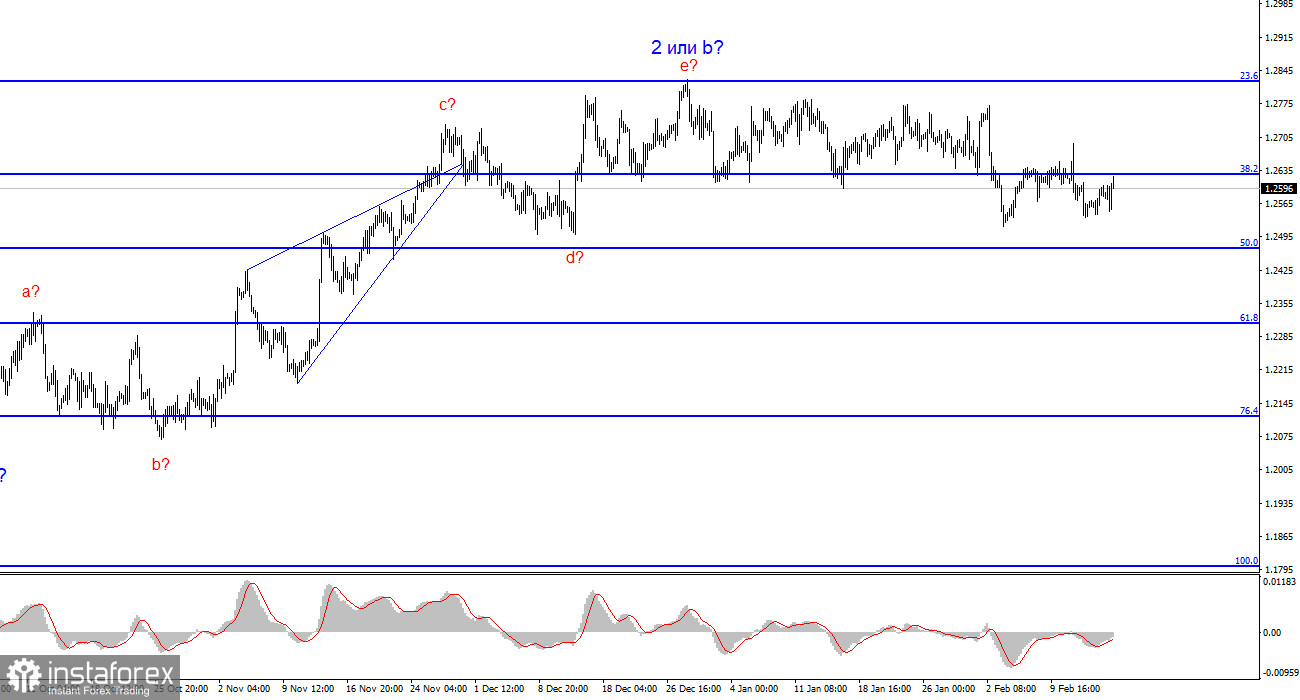

The wave pattern for the GBP/USD pair suggests a decline. At this time, I am considering selling the instrument with targets below the 1.2039 mark because wave 2 or b will eventually end, just like the sideways trend. A successful attempt to break through the 1.2627 level acted as a sell signal. Another signal was formed, in the form of an unsuccessful attempt to break this level from below. Now I am quite confident about the instrument's decline, at least to the 1.2468 level, which would already be a significant achievement for the dollar, as the demand for it remains very low.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română