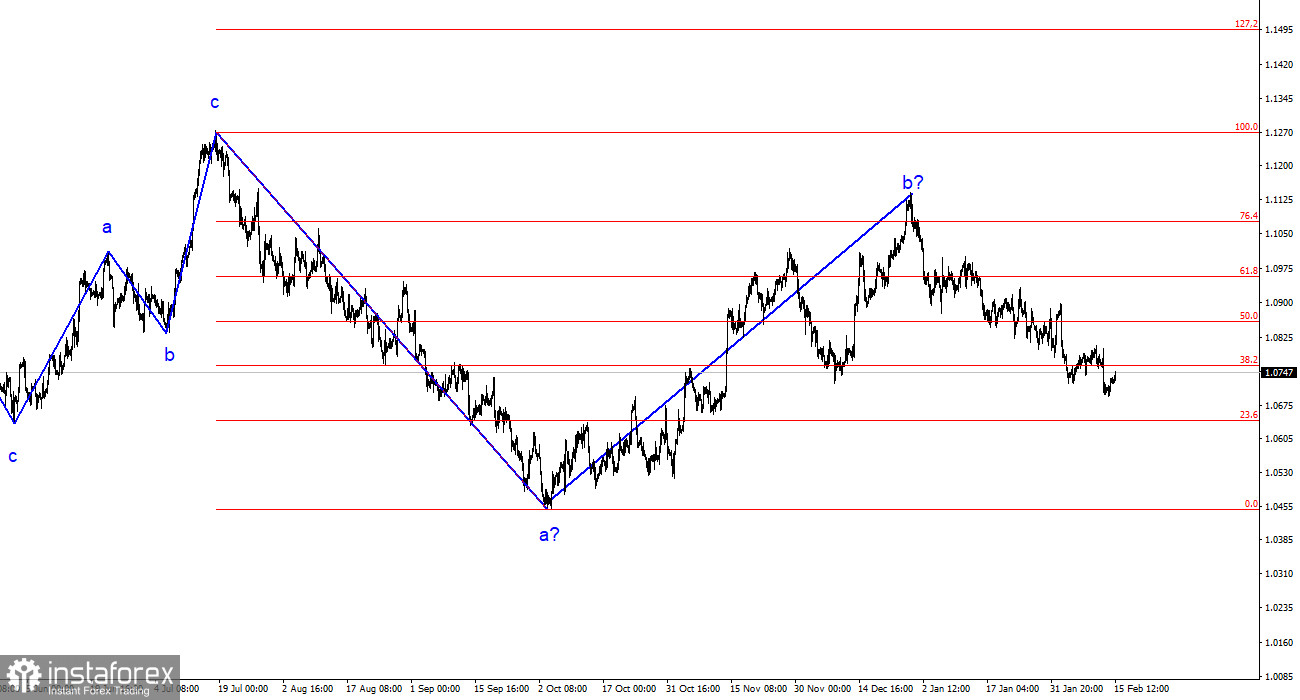

The wave analysis of the 4-hour chart for the euro/dollar pair remains unchanged. In the last year, we have seen only three-wave structures that constantly alternate with each other. At the moment, the construction of another three–wave downward trend is continuing. The expected wave 1 is completed, wave 2 or b has become more complicated three or four times, but at this time it can still be considered conditionally completed since the decline of the pair has been going on for more than a month.

The upward section of the trend can still be resumed, but its internal structure will be completely unreadable in this case. Let me remind you that I try to identify unambiguous wave structures that do not tolerate ambivalent interpretation. If the current wave analysis is correct, then the market has moved to the formation of wave 3 or C. A successful attempt to break through the 1.0788 mark, which corresponds to 76.4% Fibonacci, once again confirmed the market's readiness to sell. Now the nearest target is 1.0637, which equates to 100.0% Fibonacci. But even with this, I do not expect the end of the fall of the euro currency. Wave 3 or c should be much more extended both in time and in terms of targets.

American statistics decided to take an example from the European one

The euro/dollar exchange rate increased by 35 basis points on Thursday. This is not much and does not affect the current wave layout in any way, which also assumes the construction of a downward wave 3 or c with targets located much lower than the current levels. Therefore, I believe that tomorrow or next week the decline in the quotations of the European currency will resume. When exactly this will happen is not very important.

Christine Lagarde spoke at the European Parliament today. Of the important things, I can only note her confidence in maintaining the process of slowing inflation. Lagarde's confidence is certainly good, but the market still wants to hear information about when and under what conditions the ECB will switch to a more "soft" monetary policy. Unfortunately, Lagarde did not receive such a question, so she did not answer it. And even if such a question had been voiced, it is unlikely that market participants would have received a specific answer.

In America, several reports have been released today that have negatively affected the dollar exchange rate. Retail trade volumes decreased by 0.8% in January, against market expectations of -0.1%. The number of initial applications for unemployment benefits amounted to 212 thousand, with expectations of 220 thousand. A little later, another report on industrial production will be released. The decline in demand for the dollar occurred against the background of an unsuccessful retail trade report. And it is also obvious that the market will not play back this data for a long time. Therefore, we saw a slight increase in the pair, but it is unlikely that it will be the beginning of a new upward wave.

General conclusions

Based on the analysis, I conclude that the construction of a downward set of waves continues. Wave 2 or b has taken on a completed form, so in the near future, I expect the continuation of the construction of an impulsive downward wave 3 or c with a significant decrease in the pair. An unsuccessful attempt to break through the 1.1125 mark, which corresponds to 23.6% Fibonacci, indicated that the market was ready to sell a month ago. I continue to consider only sales with targets near the estimated 1.0462 mark, which corresponds to 127.2% Fibonacci.

On the higher wave scale, it can be seen that the proposed wave 2 or b, which is already more than 61.8% Fibonacci in length from the first wave, can be completed. If this is indeed the case, then the scenario with the construction of wave 3 or c and the decline of the pair below the 4th figure has begun to be realized.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română