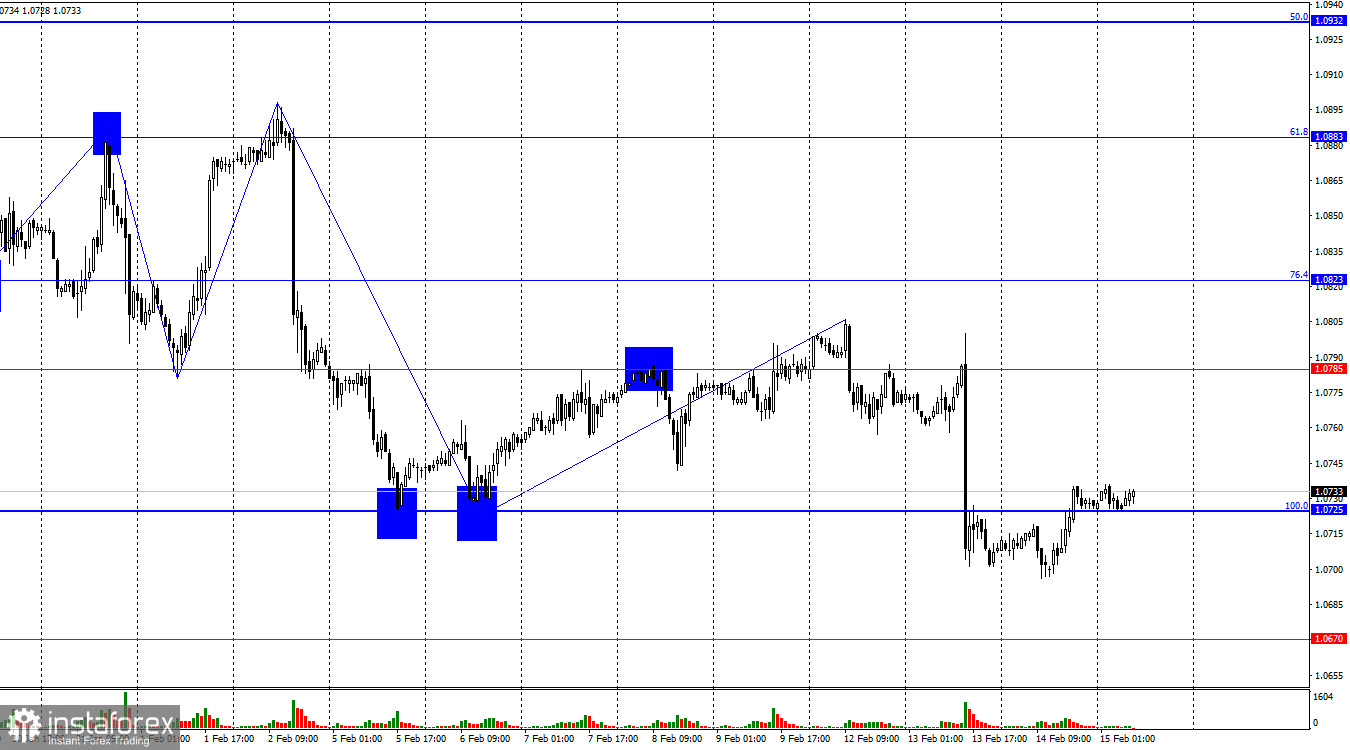

The EUR/USD pair on Wednesday had every chance to continue falling towards the level of 1.0670, but instead performed a reversal in favor of the European currency and consolidated above the corrective level of 100.0%–1.0725. Thus, today the growth process can be continued toward the next level of 1.0785. Fixing the pair's exchange rate below the level of 1.0725 will work in favor of the US dollar and resume falling towards 1.0670. The "bearish" trend persists.

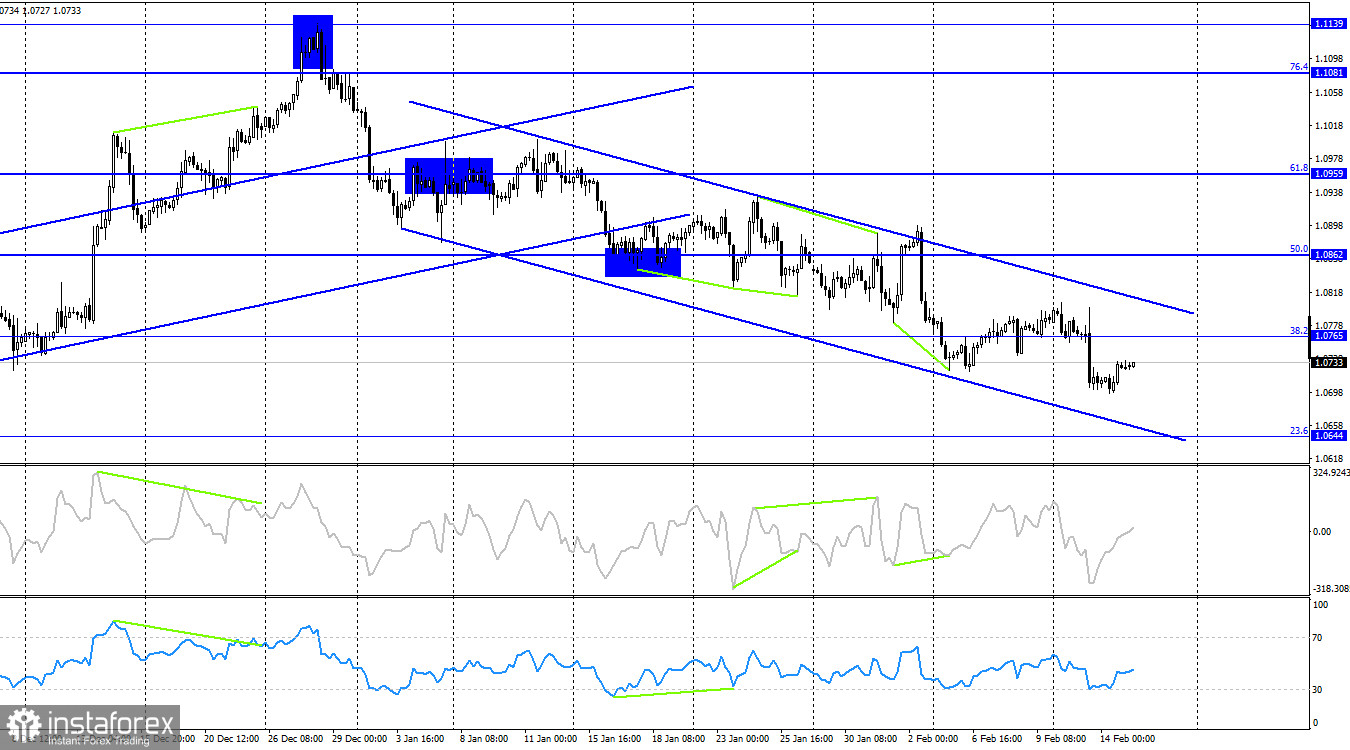

The situation with the waves is becoming clearer. The last completed wave down again confidently broke through the low of the previous wave, and the last wave up did not come close to the peak of the previous wave. Thus, at this time there is no sign of the end of the "bearish" trend. They may appear if a new upward wave performs a breakdown of the peak on February 12. In this case, we can expect a trend change to "bullish".

The information background on Wednesday was more interesting than strong. The GDP of the European Union in the second quarter did not surprise traders, as its second estimate coincided with the first. But industrial production was pleased, which showed an increase of 2.6% m/m in December. Traders expected a 0.2% reduction in its volumes. However, traders may have been pleased, but the bulls could not extract much benefit from this report. In the afternoon, more active Americans raised the euro exchange rate, so presumably, a new wave of upward movement began. Christine Lagarde's speech will take place today, and the euro exchange rate may go up and down against the background of this event. The information background will have an impact on the mood of traders today and can cross out any graphical signal. Lagarde is now more likely to be expected to use "dovish" rhetoric than "hawkish". I assume that today the pair can perform a new consolidation under the 1.0725 level.

On the 4-hour chart, the pair performed a new reversal in favor of the US dollar and consolidated under the corrective level of 38.2%–1.0765. Thus, the process of falling can now be continued towards the next Fibo level of 23.6%–1.0644. There are no emerging divergences in any indicator today, and the downward trend channel still characterizes the mood of traders as "bearish".

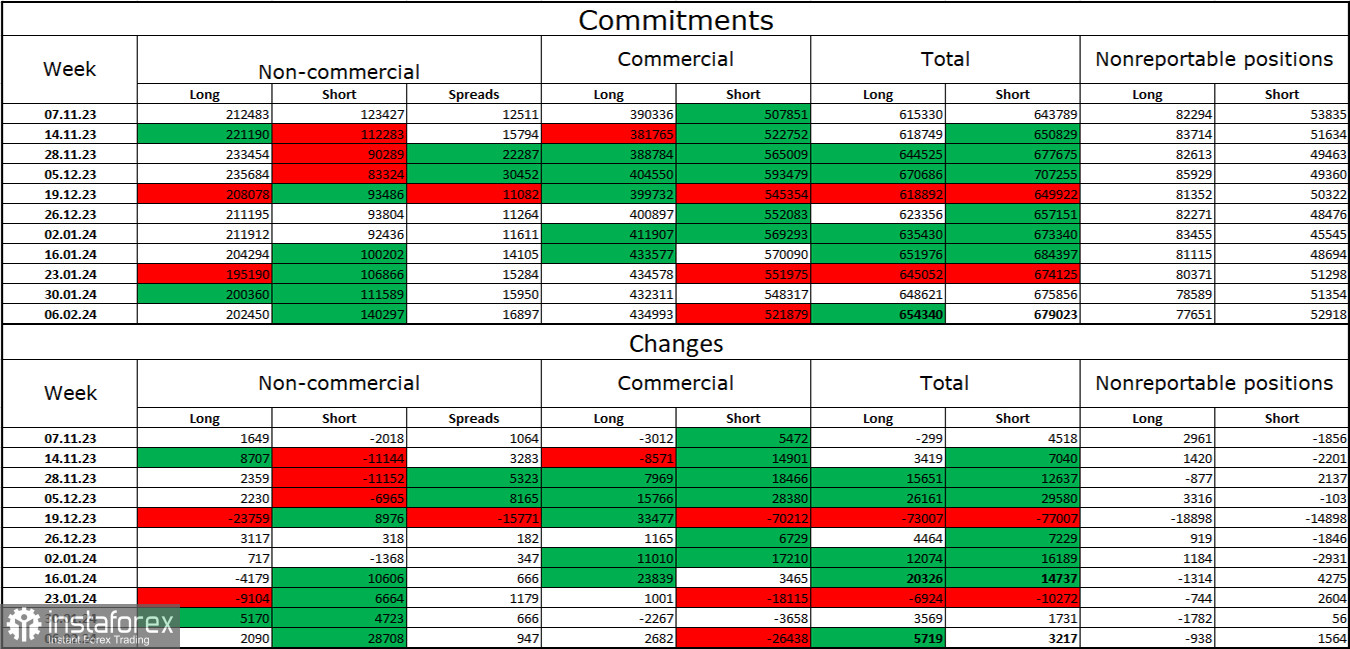

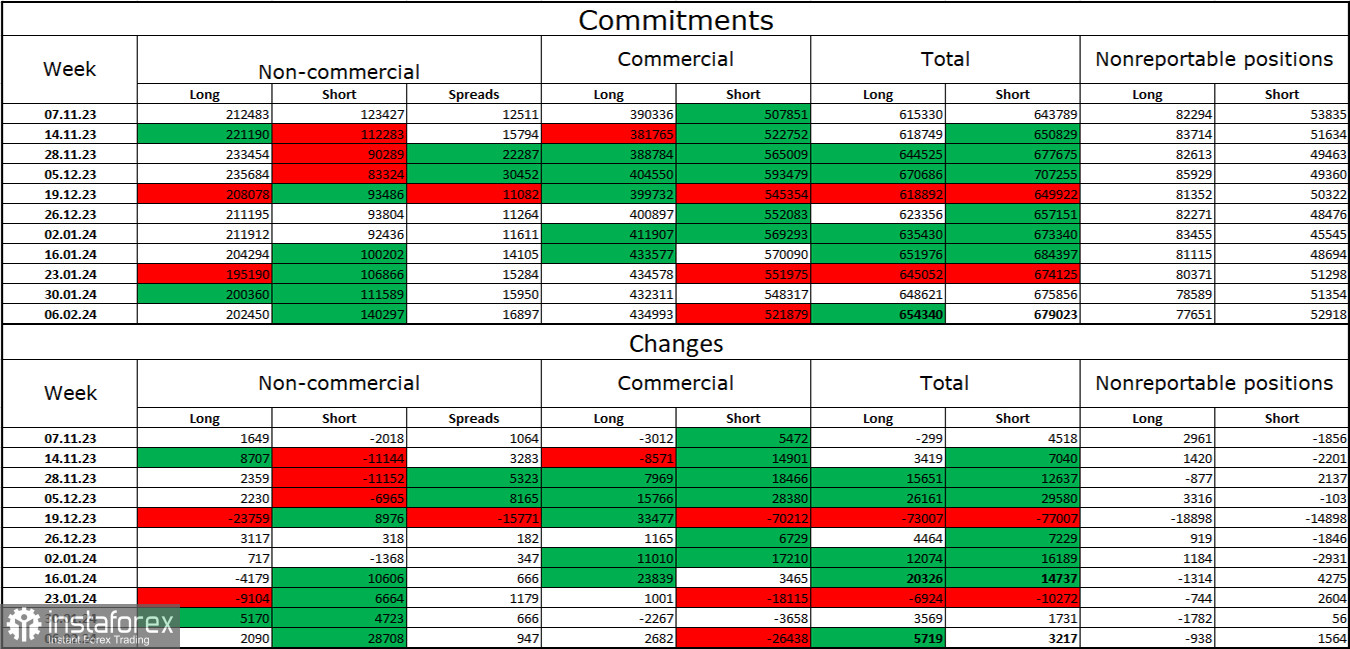

Commitments of Traders (COT) Report:

In the last reporting week, speculators opened 2,090 long contracts and 28,708 short contracts. The mood of large traders remains bullish but continues to weaken. The total number of long contracts concentrated in the hands of speculators now stands at 202 thousand, and short contracts – 140 thousand. Despite the rather large difference, I still believe that the situation will continue to change in favor of the bears. Bulls have dominated the market for too long, and now they need a strong information background to maintain a bullish trend. I don't see such a background right now. Professional traders can continue closing long positions (or opening short ones) shortly. I believe that the current figures allow for the continuation of the fall of the euro currency in the coming months.

News calendar for the USA and the European Union:

European Union – Speech by ECB President Christine Lagarde (08-00 UTC).

USA – Change in industrial production (13-30 UTC).

USA – The number of initial applications for unemployment benefits (13-30 UTC).

USA – Change in industrial production (14-15 UTC).

On February 15, the calendar of economic events contains several interesting entries, among which Christine Lagarde's speech stands out. The influence of the information background on the mood of traders today may be of medium strength.

EUR/USD forecast and tips for traders:

Sales of the pair will be possible today when closing below the 1.0725 level on the hourly chart with a target of 1.0670. Purchases of the pair were possible when consolidating above the 1.0725 level with a target of 1.0785, but Christine Lagarde's speech may change the intraday mood to "bearish."

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română