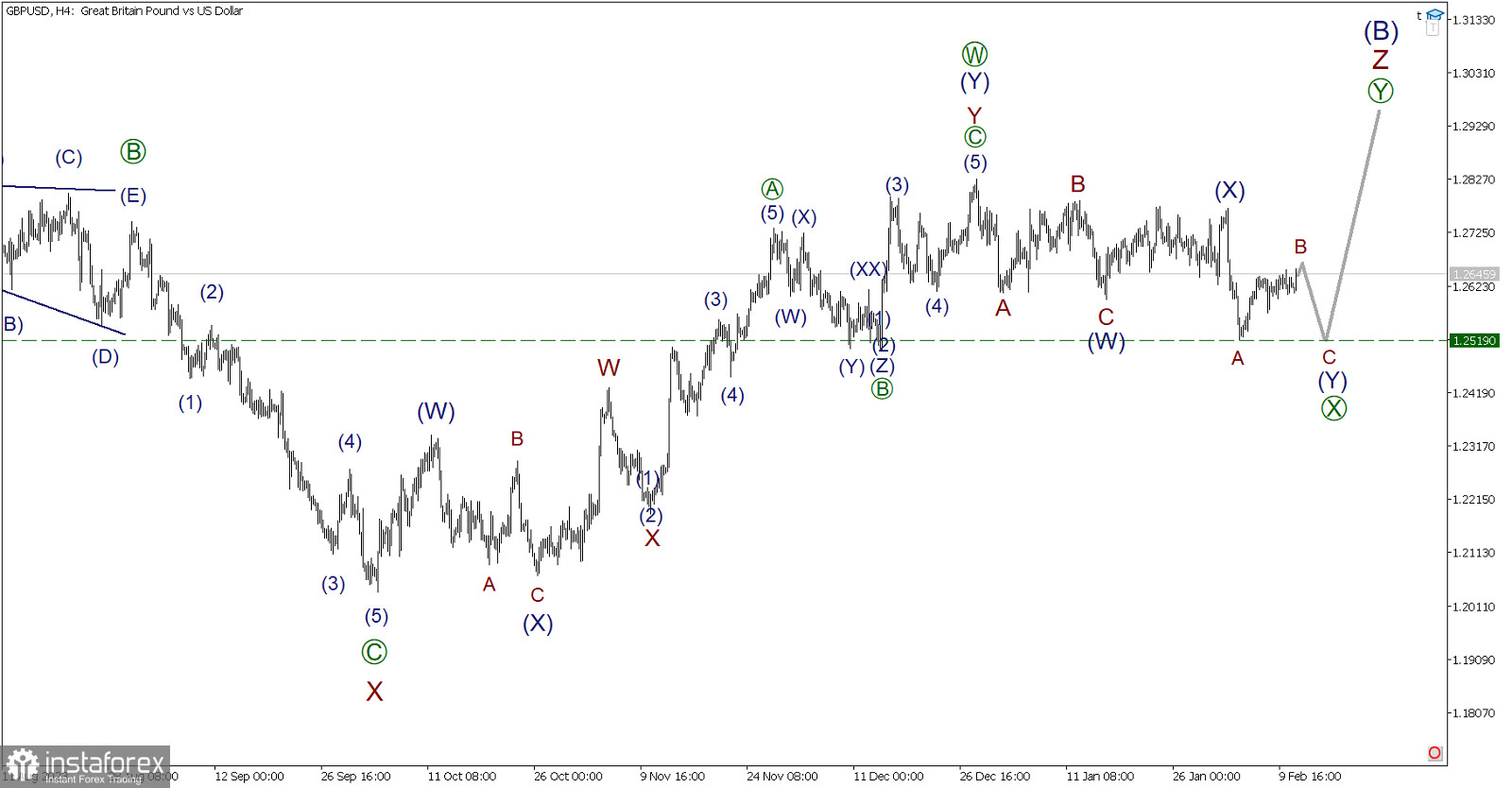

Analyzing the situation on the GBP/USD pair in a four-hour timeframe. In the long-term perspective, a significant correction (B) with a complex internal structure in the form of a triple zigzag may be forming. It is labeled with five sub-waves W-X-Y-X-Z. Currently, the last active sub-wave Z is being formed.

Based on the initial part, the active wave Z seems to take the form of a double zigzag [W]-[X]-[Y]. At the moment, only the bullish wave [W] is completed, consisting of three main sub-waves (W)-(X)-(Y). Since the end of December of the previous year, the market has been moving downward in a correction connecting wave [X].

Most of the connecting wave [X] is already completed. It has the form of a double zigzag (W)-(X)-(Y), for the full completion of which a final impulse wave C is necessary. Within impulse C, the price may fall to the low of 1.2519, marked by sub-wave A. In the current situation, opening short positions can be considered.

It is worth noting today's important news in the United States, which is the Consumer Price Index for January. In recent months, these indicators have not exceeded expectations. Thus, the bearish trend may be confirmed.

Trading recommendation: Sell at 1.2645, take profit at 1.2519.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română