Everything flows, everything changes. The basis for the almost 3% rally in the USD index since the beginning of the year was a reassessment of market views on the fate of the federal funds rate, unexpected strength in the U.S. economy, and demand for the dollar as a safe haven amid heightened geopolitical risks and the approaching U.S. presidential elections. Only the last driver continues to work for the peak of EUR/USD. Changes in the other two may be the key to the further dynamics of the main currency pair.

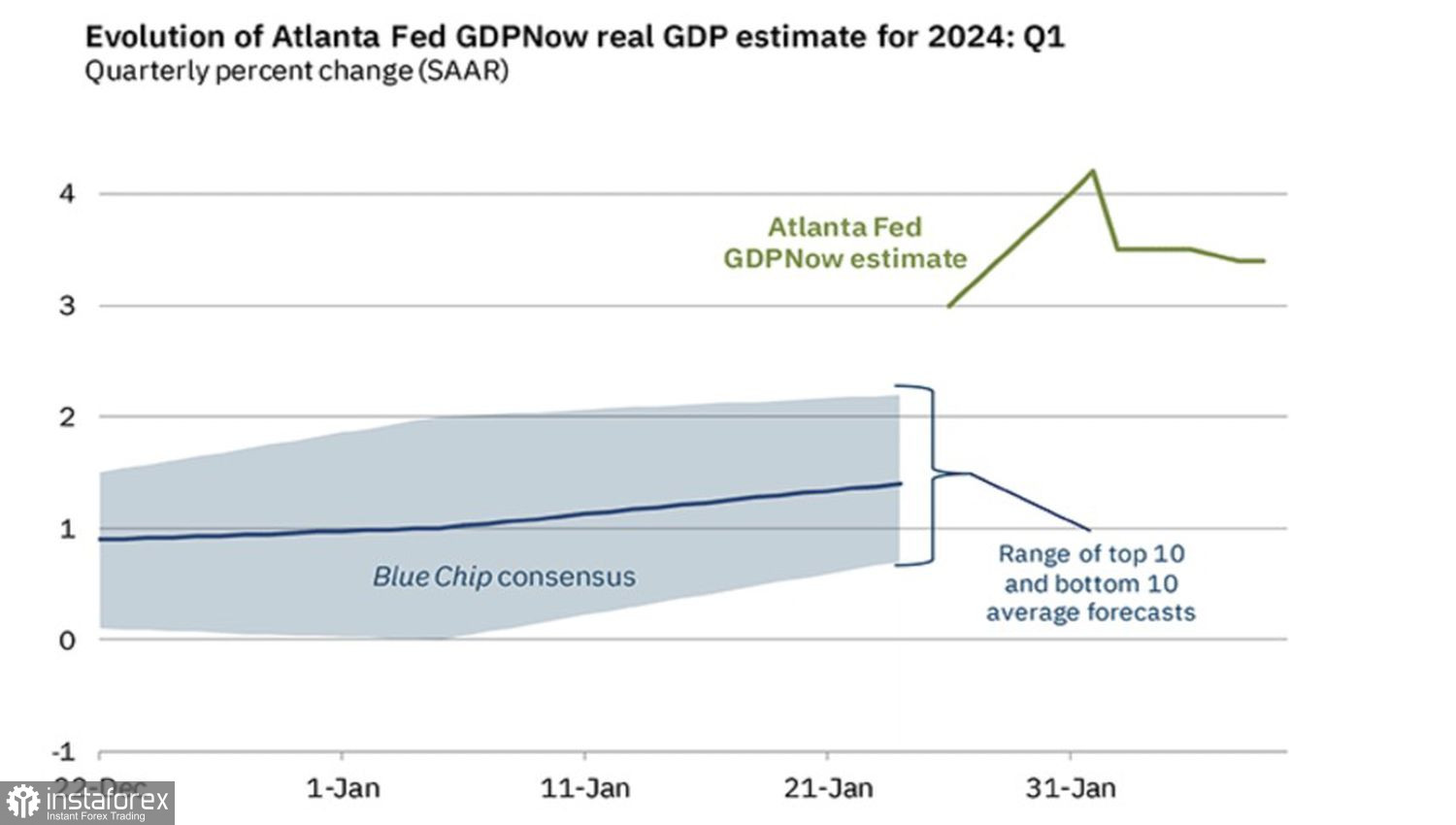

The best that was expected from the American economy was a soft landing. The basic scenario assumed that it would start to slow down under the influence of the aggressive monetary restriction of the Federal Reserve. This process will start between 2023 and 2024. Its first sign will be a cooling of the U.S. labor market. In fact, GDP unexpectedly grew by 3.3% in the fourth quarter, and the leading indicator from the Federal Reserve Bank of Atlanta signals its expansion by another 3.4% in January–March.

U.S. GDP Forecasts

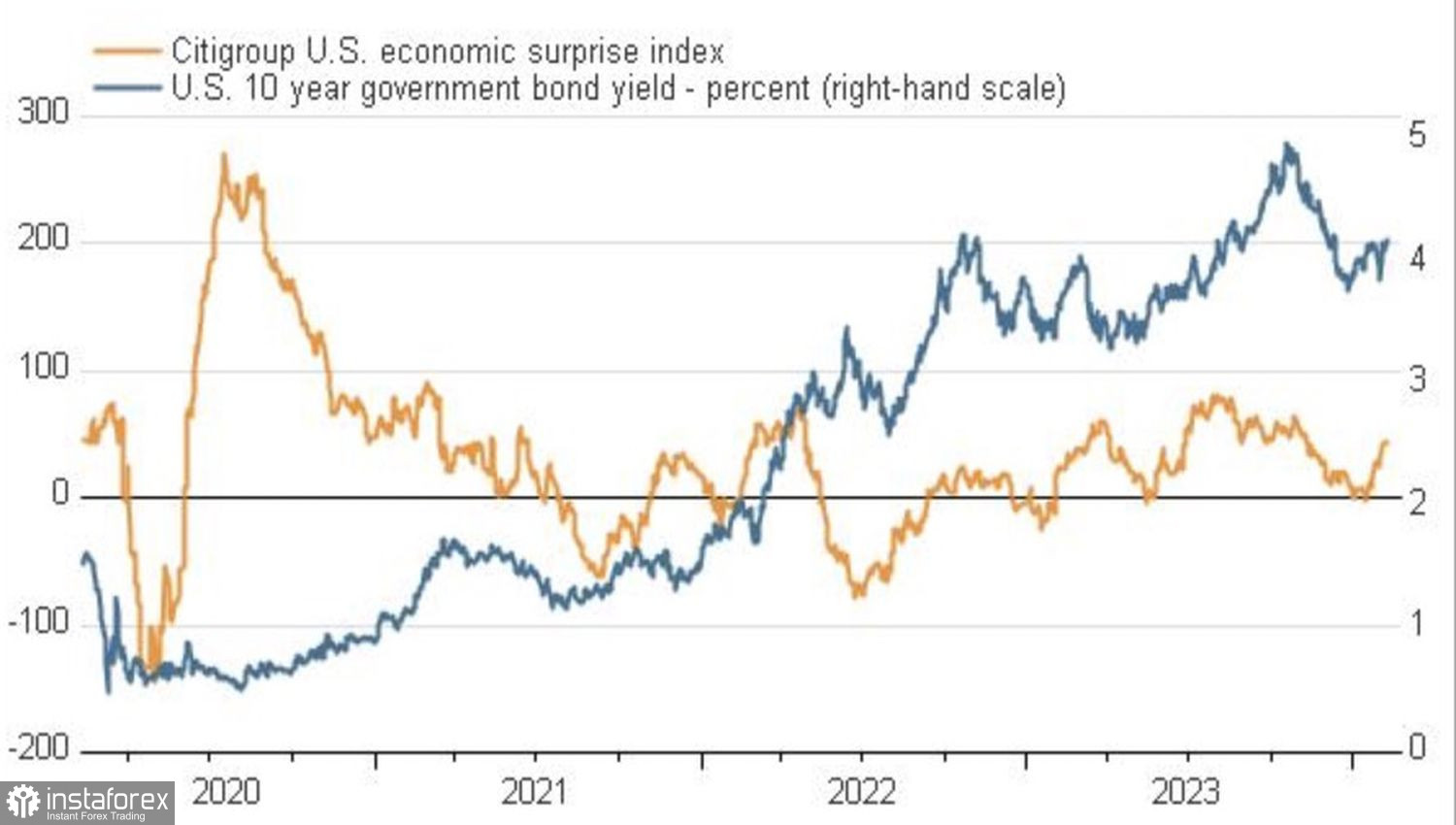

Employment, retail sales, business activity, and other indicators turned out to be better than forecasts, leading to an increase in the U.S. economic surprise index and raising yields on Treasury bonds. As a result, the U.S. dollar strengthened.

However, the better the actual data turns out to be, the more optimistic forecasts experts begin to make. Meeting them becomes difficult, and the economic surprise index is at risk of going down. Especially as the delayed effects of the Fed's monetary restriction begin to show. It affects the U.S. economy with a temporary lag, as initially, interest rates were fixed and low. This time is passing.

Dynamics of Economic Surprises and U.S. Bond Yields

After the Fed's dovish pivot, investors began to demand 6–7 acts of monetary expansion from the central bank. However, the market had to change its views due to strong macroeconomic statistics in the United States. Now, there is talk of a forecasted rate cut of 100 basis points in 2024, which is close to the FOMC consensus estimate of 75 basis points. If the U.S. economy starts to slow down, the process will go in the opposite direction. Derivatives will increase the assumed scale of monetary expansion to 125–150 basis points, which will negatively affect the dollar.

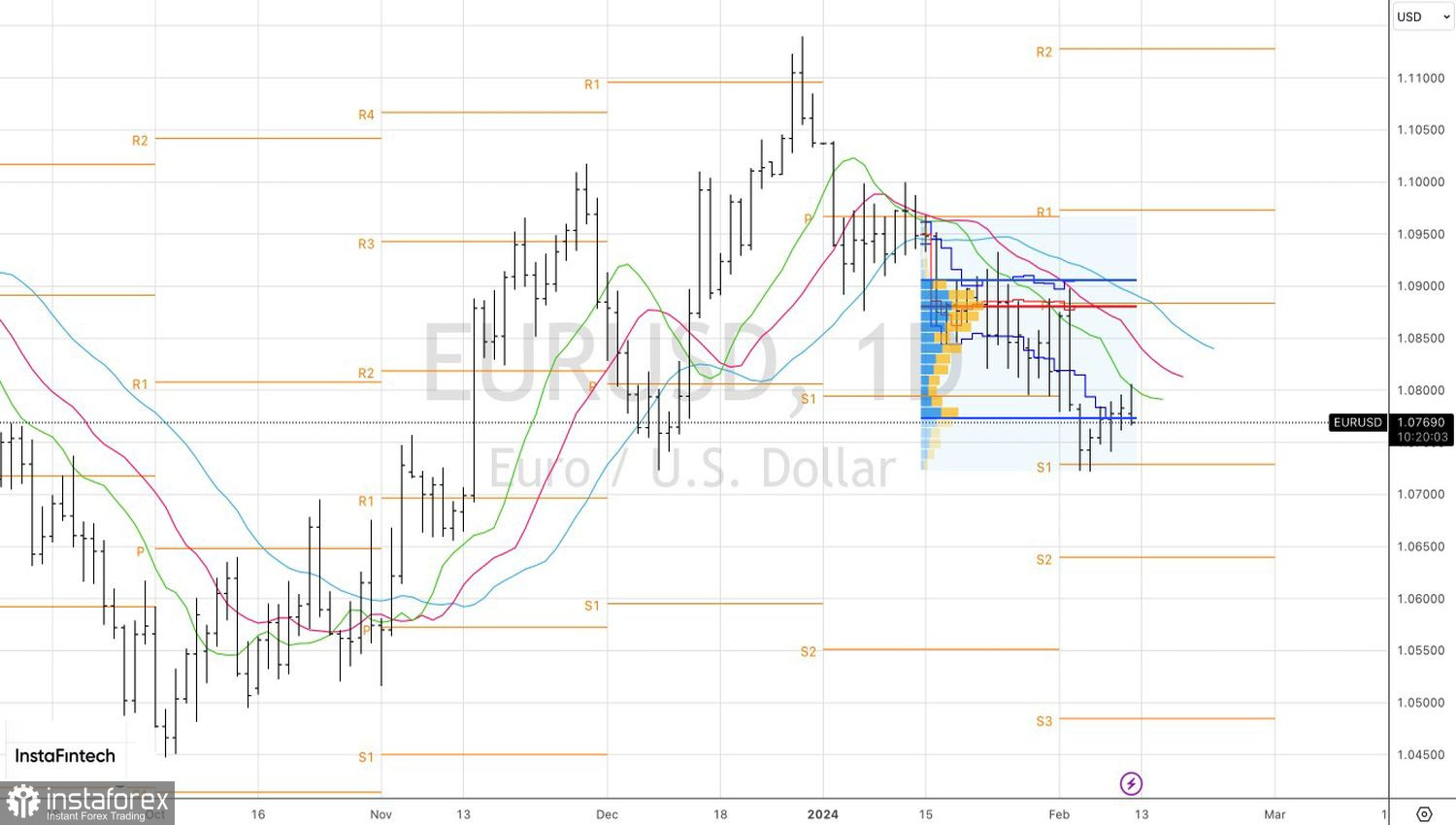

In every pair, there are always two currencies, and the dynamics of EUR/USD will be influenced by the ability of the European economy to recover and the willingness of the ECB to loosen monetary policy. However, the euro seems incapable of dropping too much from current levels. After a significant upward trend in October–December and a downward trend in January–February, it's time for consolidation.

Technically, on the daily chart, the inability of the bulls to consolidate in the fair value range of 1.0775–1.0905 is a sign of their weakness. Similarly, a rebound from the moving average is a signal of pullback exhaustion and a return to the downward trend. Moreover, a breakdown of support at 1.076 may be the basis for increasing previously formed shorts.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română