The most dramatic movements in the gold market occurred early last week when spot prices dropped below $2,000 per ounce. The latest weekly gold survey showed that Wall Street and Main Street have again converged in their opinions. Both sides see little chance of a sell-off in the near term.

Adrian Day, President of Adrian Day Asset Management, views the ongoing sideways movement of prices positively, considering that the market has already priced in the situation of prolonged higher interest rates and may resume an upward trajectory.

James Stanley, senior market strategist at Forex.com, has changed his view from bearish to bullish. However, he believes that the next price trend will be determined by the CPI report. From his perspective, if the year-over-year core Consumer Price Index exceeds 4%, there may be some turmoil regarding risk trends, which could negatively impact gold. But Stanley believes that the Consumer Price Index will decrease, providing an opportunity for the bulls.

According to Bob Haberkorn, Senior Commodities Broker at RJO Futures, the Friday weakness in gold prices was a market reaction to data from China, as they were betting on data from the United States. He adds that the rise in stocks also undermines the footing of the precious metal. As long as NASDAQ reaches new records, and the S&P is above 5000, gold loses some of its luster.

Haberkorn believes that before positioning gold as bullish, prices must rise above $2,075. Therefore, there is a risk of a decline during this week, and if the price falls below $2,000, gold could realistically return to $1,950. He also mphasized that the short-term direction of gold will depend on inflation data.

Darin Newsom, Senior Market Analyst at Barchart.com, does not expect any major surprises in price movements from U.S. inflation data. From his perspective, gold will determine its direction based on geopolitical events, both domestically and abroad.

Mark Leibovit, publisher of the VR Metals/Resource Letter, said there is potential for a decline in gold prices in the range of $1,950–$1,980 per ounce in the near future.

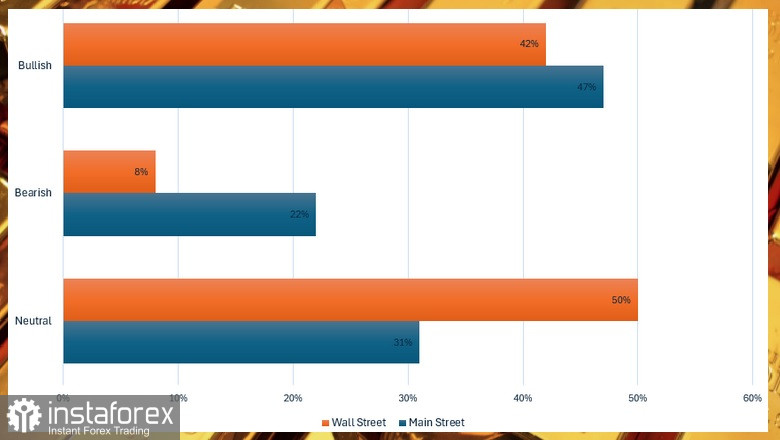

In summary, 12 analysts participated in the gold survey. Four experts, or 42%, expect price growth, while only one analyst, making up just 8%, predicts a price decline. Six analysts anticipate a sideways direction.

In an online poll with 165 votes, the majority remained bullish. 77 retail investors, constituting 47%, expect price growth. Another 37, or 22%, anticipate a decline, and 51 respondents, or 31%, remained neutral.

Inflation data in the U.S. will once again take center stage this week: the Consumer Price Index report for January will be released on Tuesday, the final reading of the Consumer Price Index for December on Wednesday, and the preliminary Consumer Price Index for January on Friday. Additionally, attention should be given to weekly jobless claims and retail sales in the U.S. for January.

The manufacturing indices of the Federal Reserve Banks of Philadelphia and New York will be published on Thursday, followed by housing starts and building permits on Friday. Central bank representatives will also give speeches throughout the week.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română