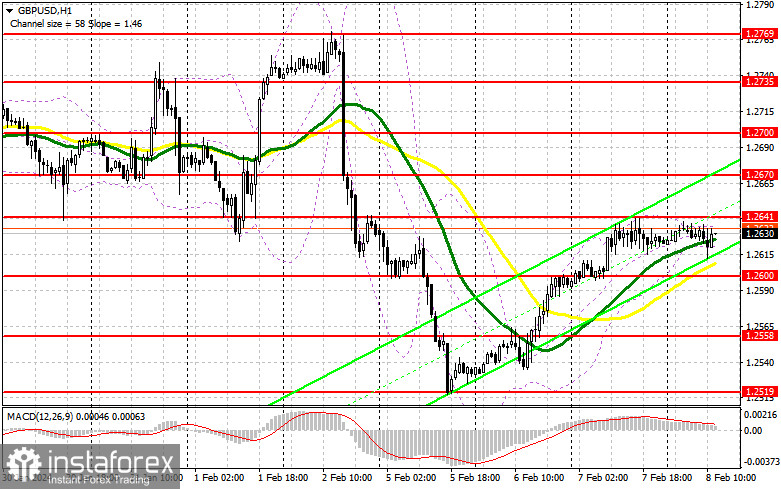

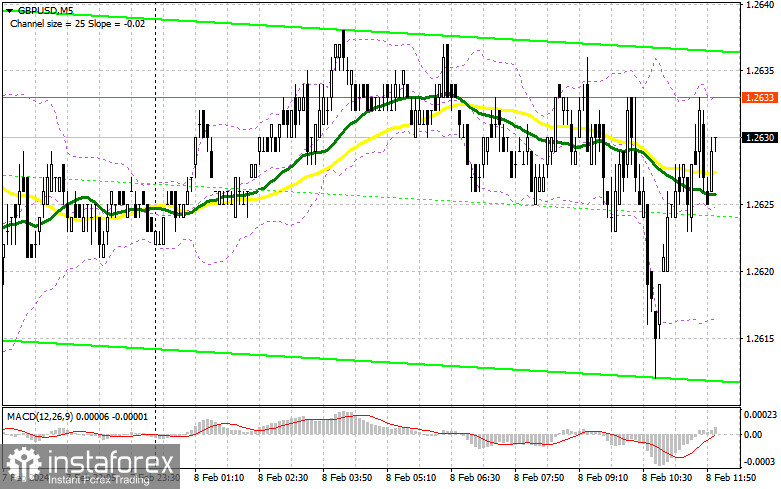

In my morning forecast, I focused on the level of 1.2600 and planned to make trading decisions based on it. Let's look at the 5-minute chart and analyze what happened there. The decline occurred, but the test and false breakout at 1.2600 did not materialize. As a result, there were no signals in the first half of the day. It is worth noting that even if signals were present, it would have been challenging to profit with a volatility of 20 points. The technical picture for the second half of the day remained unchanged.

To open long positions on GBP/USD, it is required:

A lot will depend on the US data. The number of initial claims for unemployment benefits and the number of continuing claims for unemployment benefits is unlikely to lead to significant market changes, but a significant discrepancy in the indicators can affect market volatility. The speech of FOMC member Thomas Barkin should be in favor of dollar buyers, so it's better not to rush with long positions.

As for purchases, I will continue to act in the direction of the upward trend, but before that, I would like to ensure the presence of large buyers in the market. A decline and the formation of a false breakout in the area of 1.2600 is perfect for this, especially since the moving averages, playing on the bulls' side, are slightly above. All this will provide an excellent entry point into long positions, counting on further recovery of the pair to 1.2641. A breakout and consolidation above this range after weak US statistics will strengthen demand for the pound and open the way to 1.2670. The ultimate target will be a maximum of 1.2700, where I plan to make a profit. In the scenario of the pair's decline and the lack of bullish activity at 1.2600 in the second half of the day, pressure on the pound will increase. In this case, I will postpone purchases until the test of 1.2558. Only a false breakout will confirm the correct entry point into the market. I plan to buy GBP/USD immediately on the rebound from the minimum of 1.2519 with the target of a correction of 30-35 points within the day.

To open short positions on GBP/USD, it is required:

Sellers have declared themselves quite modestly so far, so I recommend shifting attention to the nearest resistance at 1.2641, where I expect new, more active actions from major players. The formation of a false breakout will allow confirming the presence of sellers, leading to the opening of short positions with the aim of further decline to the area of 1.2600 – support formed at the end of yesterday's trading day. A breakout and a reverse test from bottom to top of this range can only occur after hawkish statements from Federal Reserve representatives, whose speeches are scheduled for the second half of the day. This will deal another blow to bullish positions, leading to stop-loss triggering and opening the path to 1.2558. The ultimate target will be the area of 1.2519, where profits will be taken. In the scenario of GBP/USD growth and the absence of activity at 1.2641 in the second half of the day, which is likely to happen, buyers will attempt to continue the upward correction. In this case, I will postpone sales until a false breakout at the level of 1.2670. If there is no downward movement there, I will sell GBP/USD immediately on the rebound from 1.2700, but only counting on a pair correction down by 30-35 points within the day.

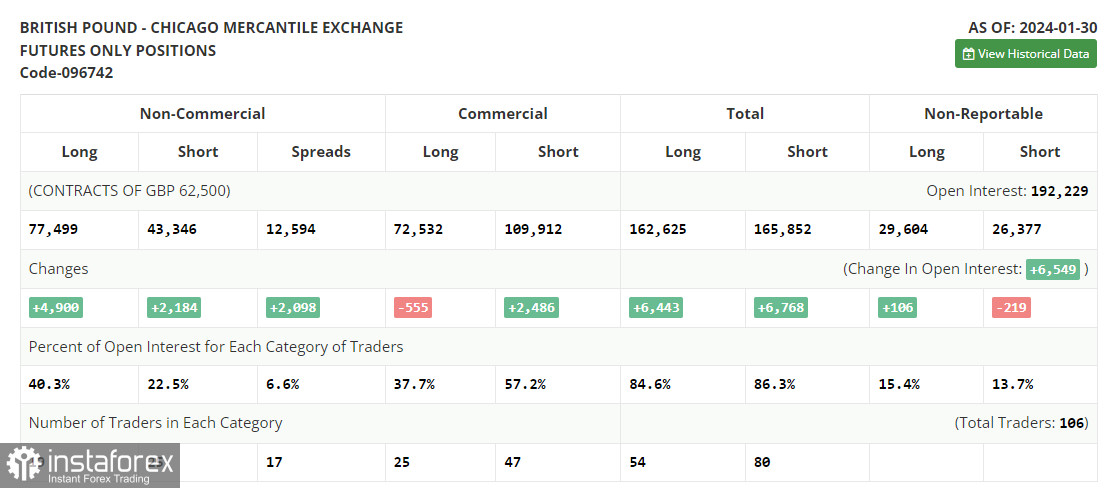

In the COT (Commitment of Traders) report as of January 30, there was an increase in both short and long positions. Despite traders now clearly seeing the future policy of the Bank of England, which intends to continue actively fighting inflation despite clear signals from the economy that it's time to stop, the pound has returned to decline. The regulator has made it clear that it has no intention of raising rates further. In the US, they are also sticking to a wait-and-see position, so the chances of a larger sell-off of the pound after buyers miss the annual minimum are quite high. In the latest COT report, it is stated that long non-commercial positions increased by 4,900 to the level of 77,499, while short non-commercial positions jumped by 2,184 to the level of 43,346. As a result, the spread between long and short positions increased by 2,098.

Indicator signals:

Moving averages

Trading is conducted above the 30 and 50-day moving averages, indicating further pound growth.

Note. The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of classical daily moving averages on the daily chart D1.

Bollinger Bands

In case of a decline, the lower boundary of the indicator at 1.2620 will act as support.

Description of indicators:

• Moving average (MA) is used to determine the current trend by smoothing volatility and noise. Period - 50. Marked on the chart in yellow;

• Moving average (MA) is used to determine the current trend by smoothing volatility and noise. Period - 30. Marked on the chart in green;

• MACD indicator (Moving Average Convergence/Divergence) Fast EMA - period 12. Slow EMA - period 26. SMA - period 9;

• Bollinger Bands (Bollinger Bands). Period - 20;

• Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting specific requirements;

• Long non-commercial positions represent the total long open position of non-commercial traders;

• Short non-commercial positions represent the total short open position of non-commercial traders;

• The total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română