In my morning forecast, I highlighted the level of 1.0758 and planned to make trading decisions based on it. Let's look at the 5-minute chart and analyze what happened there. The decline occurred, but due to the very low market volatility, which was about 20 points, we once again did not reach the test of 1.0758. Accordingly, there were no entry signals. The technical picture for the second half of the day remained unchanged.

To open long positions on EUR/USD, it is required:

The complete absence of important data for the Eurozone led to trading remaining in a sideways channel with the prospect of further recovery of the pair within an upward correction. However, much will depend on the US data related to the labor market. We all remember how the dollar reacted to unemployment-related reports last week. It is unlikely that the story will repeat today, as the data is weekly. The number of initial claims for unemployment benefits and the number of continuing claims for unemployment benefits - that's all we can expect. Only a significant discrepancy in the indicators can lead to the strengthening of the euro. The speech of FOMC member Thomas Barkin should be in favor of dollar buyers.

As for the strategy for the second half of the day, I will act according to the morning forecast: the formation of a false breakout in the area of 1.0758, where moving averages pass, will be a suitable condition for buying against the trend, counting on further upward correction to the area of 1.0793. The breakthrough and updating from top to bottom of this range will give a chance to buy with the development of a more powerful upward correction and the prospect of updating 1.0823. The ultimate target will be a maximum of 1.0856, where I will take profit. In the case of a decline in EUR/USD and the absence of activity at 1.0758 in the second half of the day, pressure on the pair will return. In this case, I plan to enter the market only after the formation of a false breakout in the area of 1.0725. I will open long positions immediately on the rebound from 1.0696 with the target of an upward correction of 30-35 points within the day.

To open short positions on EUR/USD, it is required:

Bears tried to return but did not even reach the nearest support at 1.0758. For this reason, it is now best to focus on protecting the 1.0793 resistance, a movement that may occur at any moment after weak US statistics. Protection and the formation of a false breakout there will indicate the presence of large players in the market, which can lead to a new downward movement of the pair to 1.0758, thereby continuing the development of a new downtrend. The breakthrough and consolidation below this range, as well as the reverse test from bottom to top, will provide another selling point with a collapse of the pair to 1.0725. The ultimate target will be the minimum of 1.0696, where I will take profit. In the case of upward movement of EUR/USD in the second half of the day, as well as the absence of bears at 1.0793, buyers will continue to play out their positions. In this case, I will postpone sales until the test of the next resistance at 1.0823. I will also sell there, but only after an unsuccessful consolidation. I plan to open short positions immediately on the rebound from 1.0856 with the target of a downward correction of 30-35 points.

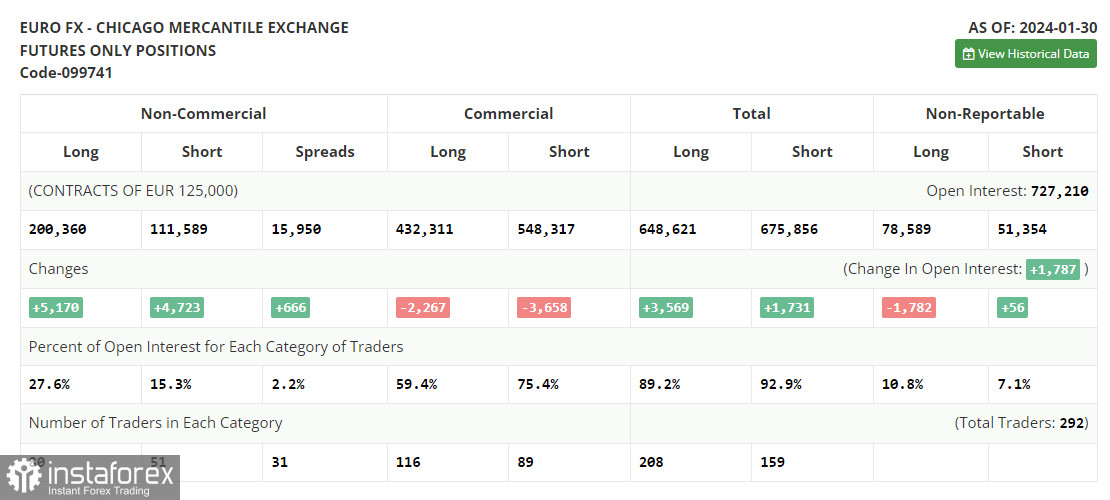

In the COT (Commitment of Traders) report as of January 30, there was an increase in both long and short positions. Obviously, after the meeting of the Federal Reserve, it became clear that no one is going to change anything yet, and the latest data on US GDP and labor market indicate that rates should be kept high for as long as possible, as lowering them now can lead to another surge in inflationary pressure, which the central bank has been fighting for almost two years. This week promises to be quite calm in terms of statistics, so one can count on the continuation of the bearish trend in the euro and the strengthening of the US dollar. The COT report indicates that long non-commercial positions increased by 5,170 to the level of 200,360, while short non-commercial positions increased by 4,723 to the level of 111,589. As a result, the spread between long and short positions increased by 666.

Indicator signals:

Moving averages

Trading is carried out above the 30 and 50-day moving averages, indicating further correction of the pair.

Note. The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of classical daily moving averages on the daily chart D1.

Bollinger Bands

In case of a decline, the lower boundary of the indicator at 1.0758 will act as support.

Description of indicators:

- Moving Average (MA) is used to determine the current trend by smoothing volatility and noise. The period is 50. Marked on the chart in yellow.

- Moving Average (MA) is used to determine the current trend by smoothing volatility and noise. The period is 30. Marked on the chart in green.

- The MACD indicator (Moving Average Convergence/Divergence) Fast EMA - period 12. Slow EMA - period 26. SMA - period 9.

- Bollinger Bands. Period - 20.

- Non-commercial traders - speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting specific requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- The total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română