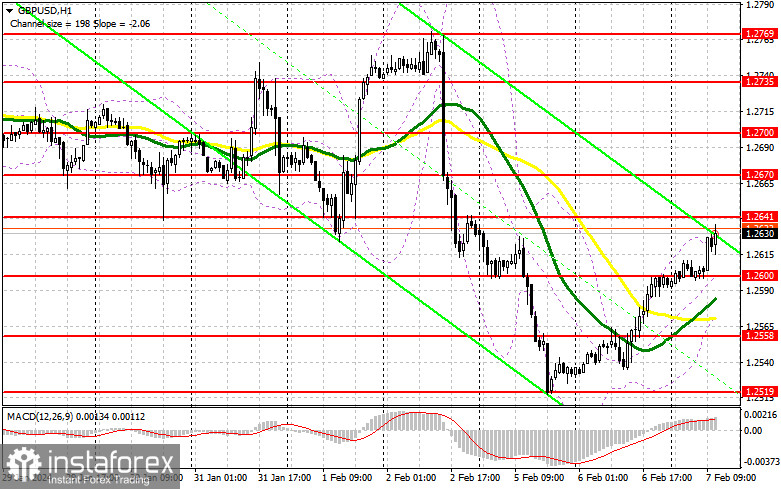

In my morning forecast, I focused on the level of 1.2625 and planned to make decisions on entering the market based on it. Let's take a look at the 5-minute chart and analyze what happened. The rise and the formation of a false breakout at 1.2625 resulted in a sell signal, but a significant drop did not occur. Considering that trading has already moved above 1.2625, I decided to exit the market and reassess the technical picture for the second half of the day.

To open long positions on GBP/USD, the following is required:

Buyers continue to actively push the pound higher and higher, facing no significant issues even around the resistance at 1.2625. The absence of important statistics from the UK also helps to continue the upward correction. Given that we have quite mediocre U.S. statistics ahead, in the form of the trade balance and consumer credit volume, the pound is likely to continue its ascent. However, I recommend focusing on the speeches and interviews of Federal Reserve representatives. Statements from FOMC members Susan M. Collins, Thomas Barkin, and Michelle Bowman are expected. A tendency towards a more dovish policy will harm the dollar and lead to further growth in risk assets.

As for buying, I will act in the direction of the new upward trend, but before that, I would like to ensure the presence of major buyers in the market. A drop and the formation of a false breakout around 1.2600 are suitable for this – especially since just below this level, the moving averages, favoring bulls, are located. All this will provide an excellent entry point for long positions, expecting further recovery of the pair to 1.2641. Breaking and consolidating above this range after weak U.S. statistics will strengthen demand for the pound and open the way to 1.2670. The ultimate target will be the maximum at 1.2700, where I plan to make a profit. In the scenario of the pair's decline and the absence of bullish activity at 1.2600 in the second half of the day, pressure on the pound will undoubtedly increase. In this case, I will postpone buying until testing 1.2558. Only a false breakout will confirm the correct entry point into the market. I plan to buy GBP/USD immediately on the rebound from the minimum of 1.2519 with the target of a 30-35 point correction within the day.

To open short positions on GBP/USD, the following is required:

Sellers have not yet made a significant impact, so I suggest shifting attention to the nearest resistance at 1.2641, where I expect new, more active actions from major players. The formation of a false breakout at this level, similar to what I discussed earlier, will confirm the presence of sellers, leading to the opening of short positions with the target of further decline to around 1.2600 – the support formed by the end of the first half of the day. Breaking and bottom-up retesting of this range can only occur after hawkish positions of Federal Reserve representatives, whose speeches are scheduled for the second half of the day. This will deal another blow to bullish positions, leading to the triggering of stop orders and opening the way to 1.2558. The ultimate target will be the area of 1.2519, where profit will be taken. In the scenario of GBP/USD growth and the absence of activity at 1.2641 in the second half of the day, which is likely to happen, buyers will attempt to continue the upward correction. In this case, I will postpone selling until a false breakout at the level of 1.2670. If there is no downward movement there, I will sell GBP/USD immediately on the rebound from 1.2700, but only counting on a pair correction down by 30-35 points within the day.

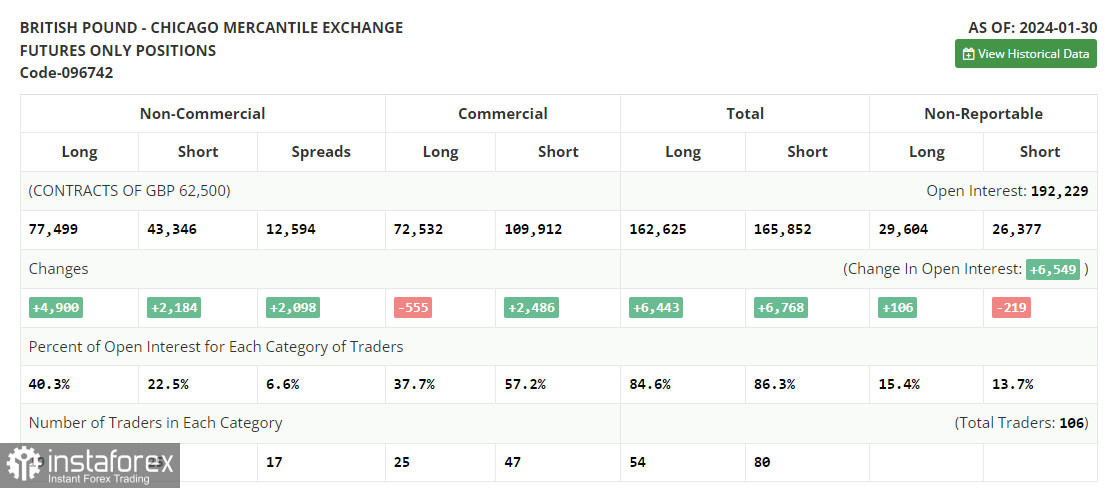

In the Commitment of Traders (COT) report as of January 30, there was an increase in both short and long positions. Despite traders now clearly seeing the future policy of the Bank of England, which intends to actively combat inflation despite clear signals from the economy that it's time to stop, the pound has returned to decline since the regulator made it clear that it has no intention of raising rates further. In the U.S., meanwhile, a wait-and-see position is also maintained, so the chances of a larger sell-off of the pound after buyers miss the annual minimum are quite high. In the latest COT report, it is stated that non-commercial long positions increased by 4,900 to the level of 77,499, while non-commercial short positions jumped by 2,184 to the level of 43,346. As a result, the spread between long and short positions increased by 2,098.

Indicator signals:

Moving averages

Trading is conducted above the 30 and 50-day moving averages, indicating further pound growth.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of classic daily moving averages on the daily chart D1.

Bollinger Bands

In case of decline, the lower boundary of the indicator around 1.2575 will act as support.

Indicator Descriptions:

- Moving Average (MA, determines the current trend by smoothing volatility and noise). Period 50. Marked on the chart in yellow.

- Moving Average (MA, determines the current trend by smoothing volatility and noise). Period 30. Marked on the chart in green.

- Moving Average Convergence/Divergence (MACD) indicator. Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands. Period 20.

- Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and meet certain requirements.

- Non-commercial long positions represent the total long open positions of non-commercial traders.

- Non-commercial short positions represent the total short open positions of non-commercial traders.

- The total non-commercial net position is the difference between non-commercial short and long positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română