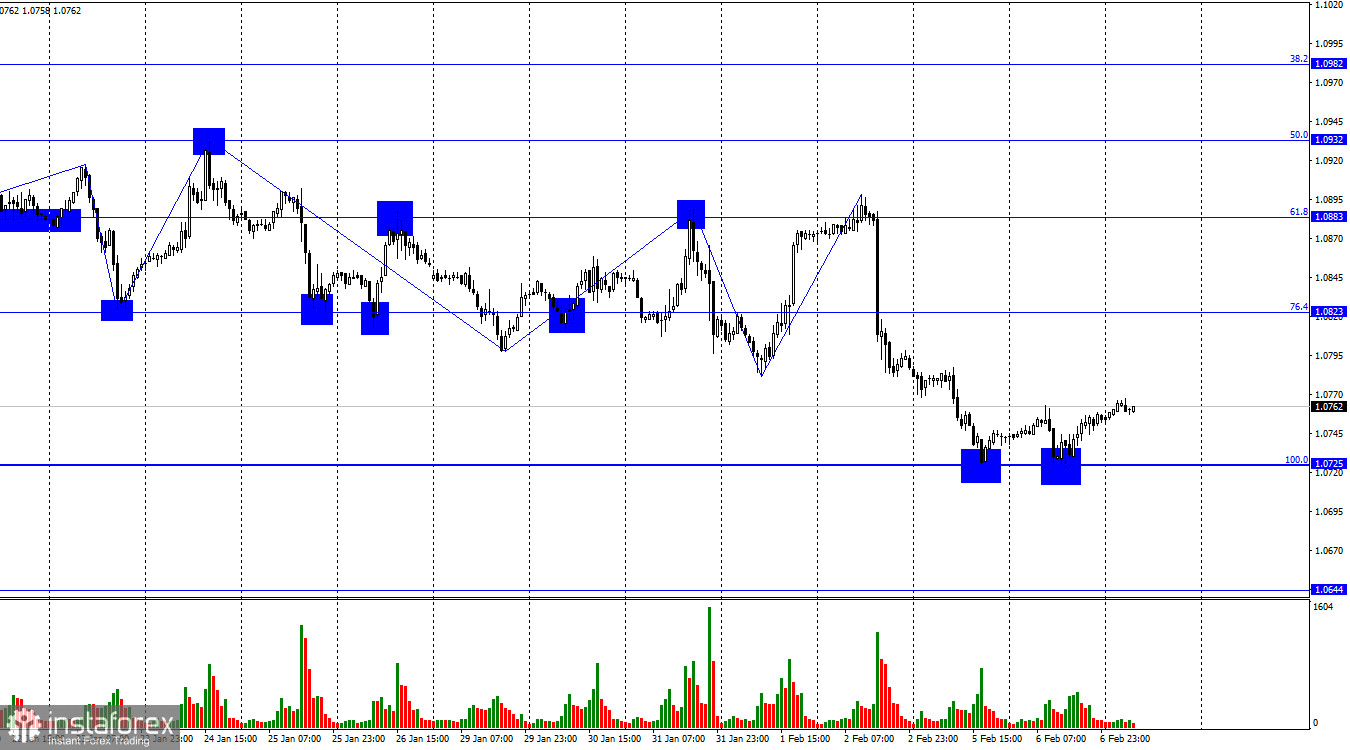

The EUR/USD pair executed a retracement to the corrective level of 100.0% on Tuesday, reaching 1.0725, bouncing off it, and initiating a new reversal in favor of the European currency. Thus, the growth process may continue today towards the Fibonacci level of 76.4% (1.0823). The consolidation of the pair's exchange rate below the level of 1.0725 will work in favor of the American currency, as will the resumption of the decline toward the level of 1.0644.

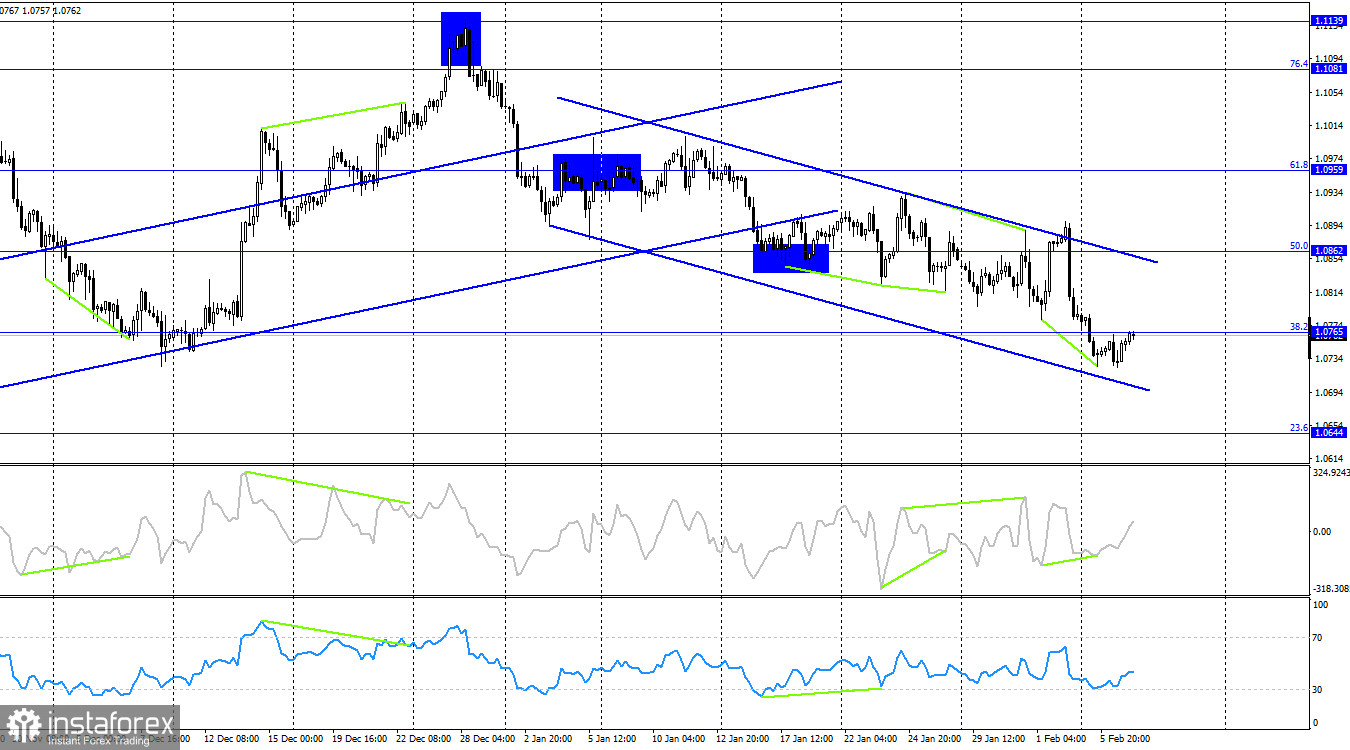

The situation with the waves remains ambiguous. The "bearish" trend is undeniable, but the waves are currently very peculiar. The last upward wave broke the peak of the previous wave, but only by a few points. The last downward wave also broke the lows of the previous wave. Everything indicates that the "bearish" trend persists, but the waves are practically the same size at the moment. We do not see clearly defined impulsive and corrective waves, but a continuation of the decline in the European currency can be expected, as the trend is still "bearish." However, the current picture shows that bears have a rather weak advantage and a strong decline in the euro should not be expected.

The background information on Tuesday was weak. Business activity indices in the construction sectors of the European Union and Germany were slightly below traders' expectations and well below the 50.0 mark, which serves as a benchmark for determining the sector's condition. Any value below is considered negative, and the indices in the construction sector for Germany and the EU amounted to 36.3 and 41.3, respectively, at the end of January. However, these are secondary data for traders, and bulls still supported demand for the currency of the European Union yesterday. Trader activity on Tuesday was weak; neither bulls nor bears showed a strong desire to attack. The report on retail trade in the European Union also turned out to be weak, showing a volume reduction of 1.1% in December. The information background certainly did not contribute to the rise of the European currency.

On the 4-hour chart, the pair made a new reversal in favor of the American currency after bouncing off the upper line of the descending trend corridor and consolidating below the Fibonacci level of 38.2% (1.0765). This consolidation allows us to expect a continuation of the decline towards the next correction level of 23.6%–1.0644, but the "bullish" divergence on the CCI indicator may work in favor of the euro and growth towards the upper line of the descending trend corridor. The consolidation of the pair's exchange rate above 1.0765 will increase the probability of the pair's growth.

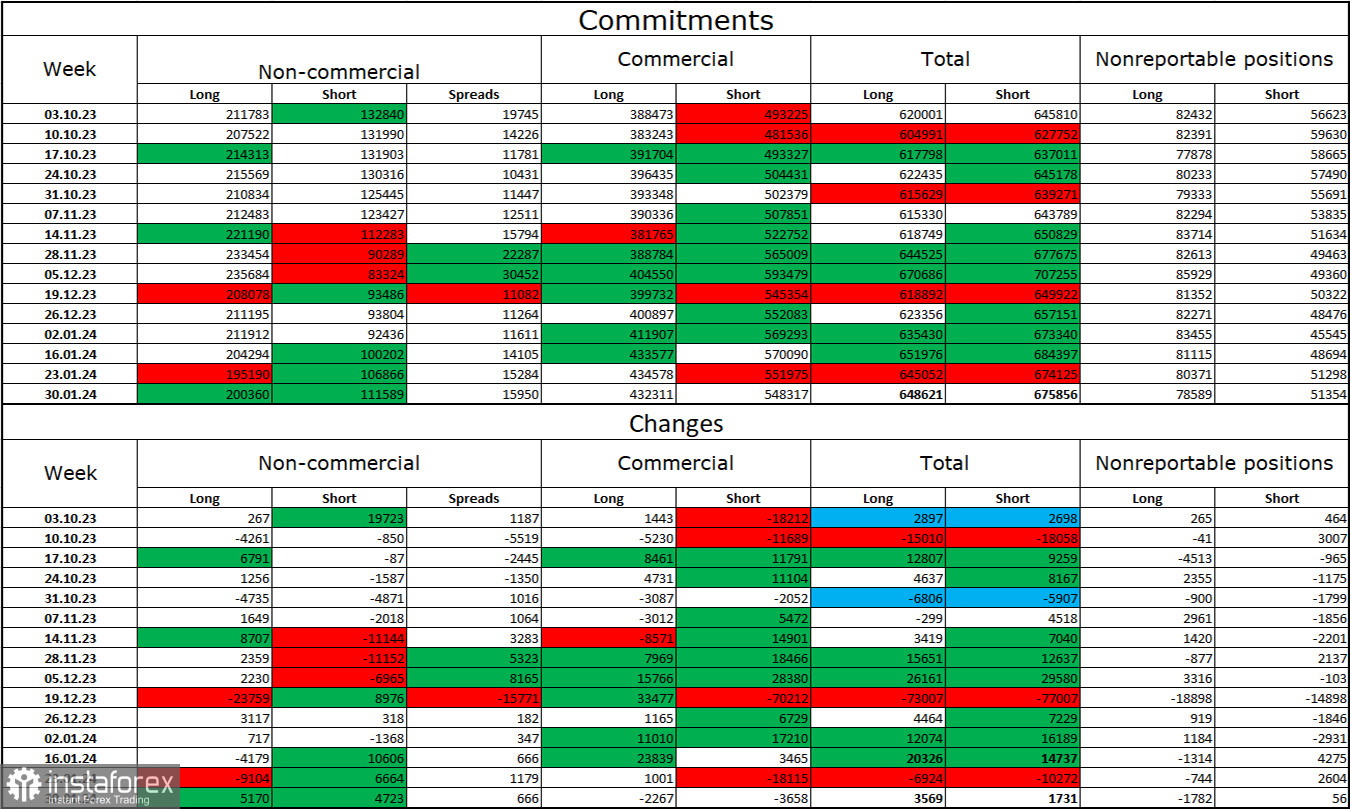

Commitments of Traders (COT) Report:

In the last reporting week, speculators opened 5170 long contracts and 4723 short contracts. The sentiment of large traders remains "bullish" but continues to weaken. The total number of long contracts held by speculators is now 200 thousand, and short contracts are 111 thousand. Despite a fairly large difference, I still believe that the situation will continue to change in favor of the bears. Bulls have dominated the market for too long, and now they need a strong information background to maintain the "bullish" trend. I don't see such a background at the moment. Professional traders may continue to close long positions soon. I believe that the current figures allow for a continuation of the decline in the euro in the coming months.

News Calendar for the USA and the European Union:

European Union - Industrial Production in Germany (07:00 UTC).

On February 7th, the economic events calendar contains only one not-very-important entry. The impact of the information background on traders' sentiment today may be very weak.

EUR/USD Forecast and Trader Tips:

Sales of the pair were possible on the rebound from the level of 1.0883 on the hourly chart, with targets at 1.0823 and 1.0805. Both targets have been achieved, and even the level of 1.0725, which could be considered the third target, has also been worked out. New sales - on consolidation below 1.0725 with a target of 1.0644. Purchases of the pair were possible on the rebound on the hourly chart from the level of 1.0725 with a target of 1.0823.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română