In the previous article, I said that the market is confident in the European Central Bank's imminent shift towards a more accommodative policy. At the same time, ECB Vice President Luis de Guindos said that the euro area's growth could be weaker this year than the ECB predicted. He mentioned that growth developments are more disappointing but also noted that inflation may be slightly lower than predicted.

If inflation is lower, it means the ECB will move more quickly towards an accommodative policy. If the EU economy turns out to be weaker than expected, the ECB will hasten its move towards accommodative policies to alleviate pressure. As we can see, many factors and even the ECB representatives' statements are currently pushing the market towards a decrease in demand for the single currency.

But what about the dollar? Federal Reserve Chief Jerome Powell reiterated on Monday that there is no talk of rate cuts in March. Major analytical firms and investment banks promptly adjusted their rate forecasts, so now they anticipate a rate cut no earlier than May. In other words, hawkish expectations are growing and dovish sentiments are getting weaker.

The market no longer believes that the Fed will lower the interest rate at the next meeting. According to the FedWatch tool, the probability of this scenario is only 16%. However, the odds of a rate cut in the May meeting are even uncertain, with the probability of this scenario being only 54% and it continues to decrease. Over the past few weeks, we have witnessed the market acknowledging its own mistake. I won't pay much attention to the 9% who believe that the rate will decrease by 50 basis points in May. Most likely, these are analysts who still expect a cut in March, followed immediately by another in May.

As for the end of the year (December meeting), most believe that the rate will fall to 4.25%, a rate cut of 125 basis points. However, this "majority" is highly conditional, as only 37% of economists adhere to this scenario. An equal number of experts believe that the rate will decrease by 100 basis points or less, and only 22% believe that the rate will fall by 150 basis points or more. In my opinion, the rate will decrease by a maximum of 100 basis points, and the process of monetary easing will begin in June. I believe that this basis is quite favorable for the dollar, and that demand for it should increase.

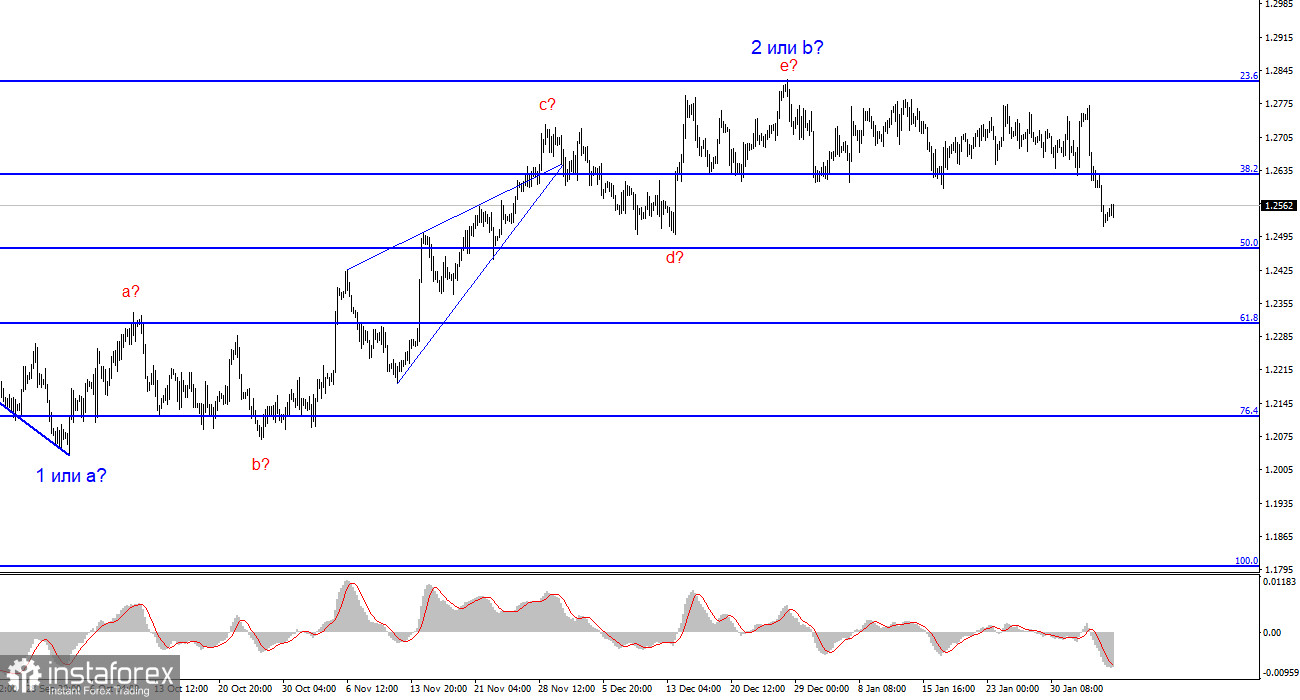

Based on the analysis, I conclude that a bearish wave pattern is being formed. Wave 2 or b appears to be complete, so in the near future, I expect an impulsive descending wave 3 or c to form with a significant decline in the instrument. The failed attempt to break through the 1.1125 level, which corresponds to the 23.6% Fibonacci, suggests that the market is prepared to sell a month ago. I am currently considering selling.

The wave pattern for the GBP/USD pair suggests a decline. At this time, I am considering selling the instrument with targets below the 1.2039 mark because wave 2 or b will eventually end, just like the sideways trend. I would wait for a successful attempt to break through the 1.2627 level, which, hopefully, everyone managed to open. Take note that after a daily decline, the instrument may rebound, but I only expect it to fall further.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română