The yen seriously disappointed its supporters at the start. At the end of 2023, significant expectations were placed on it. Due to the anticipated divergence in the monetary policies of the Federal Reserve and the Bank of Japan (BoJ), the USD/JPY pair was expected to decline. However, in early February, the Japanese yen lost more than 5% of its value against the U.S. dollar and rightfully holds the position of the main underperformer among G10 currencies. This trend has persisted for the past two years.

If in 2022–2023, the main driver of the USD/JPY rally was the Bank of Japan's reluctance to abandon ultra-easy monetary policy while the Fed actively tightened its policy, everything changed in 2024. At the end of the previous year, markets demanded too much from the Federal Reserve – a 150 basis points reduction in the federal funds rate to 4%. And Kazuo Ueda and his colleagues were expected to abandon negative bets. But not everything materialized as expected.

BoJ is indeed moving towards normalization. According to Reuters insiders, the Board of Governors will raise the overnight rate in April, abandon yield targeting, but continue to buy as many bonds as necessary to maintain debt market stability. Sources familiar with his thinking stated that investors correctly interpreted the signals conveyed by Ueda.

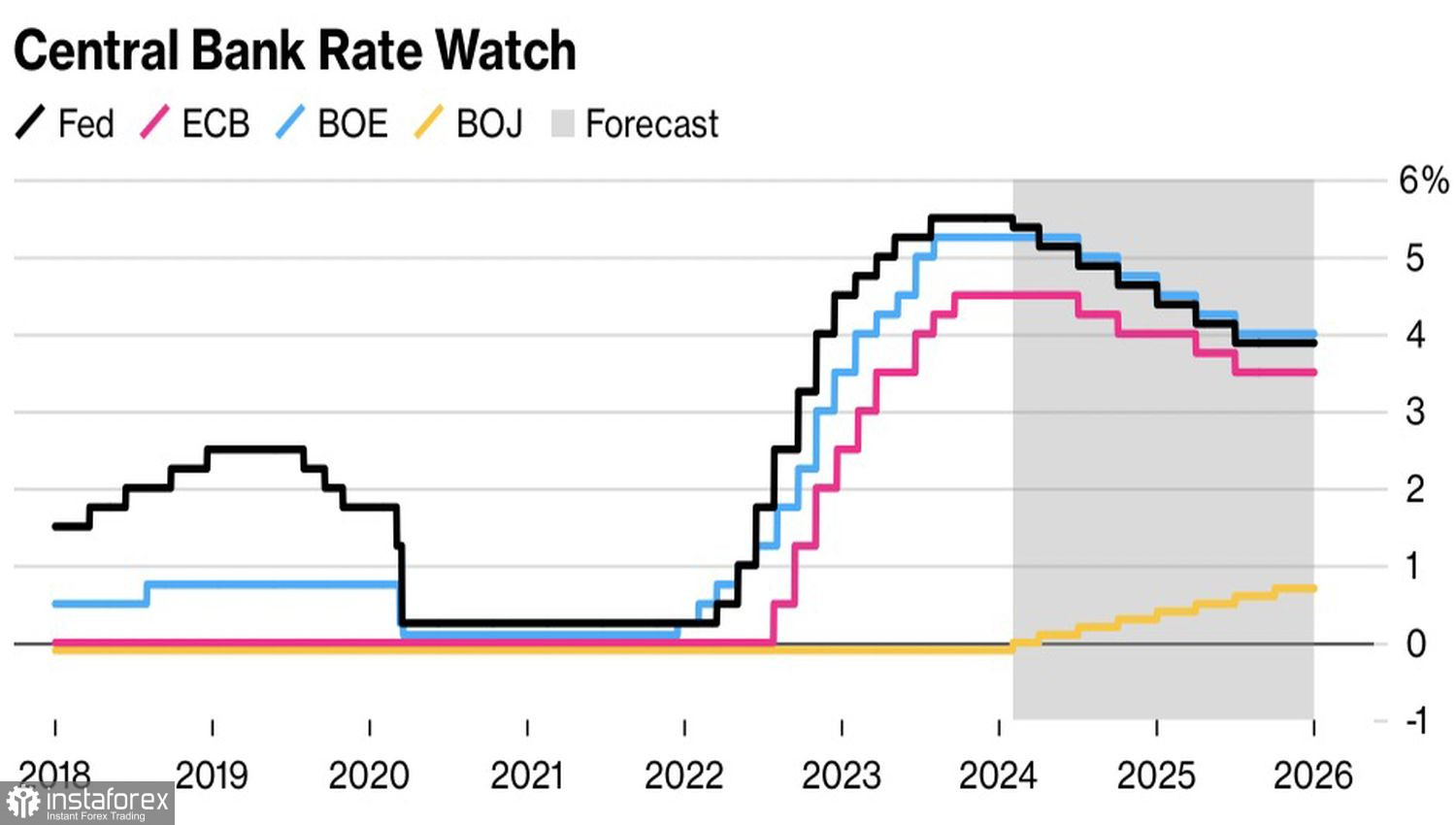

The OECD predicts that the overnight rate will rise to 0.7% in a couple of years. Amid the declining borrowing costs from the Federal Reserve, this divergence should support the bears on USD/JPY.

Dynamics of Fed rates and other central banks

However, while things are going according to plan in Japan, things are not going as smoothly as investors would like in the U.S. Two robust reports on U.S. employment, slowing inflation, strong retail sales, and an acceleration of business activity in the service sector indicate that the U.S. economy is gaining momentum. As a result, yields on Treasury bonds are rising, marking the best two-day rally since the summer of 2022 after the release of January labor market statistics.

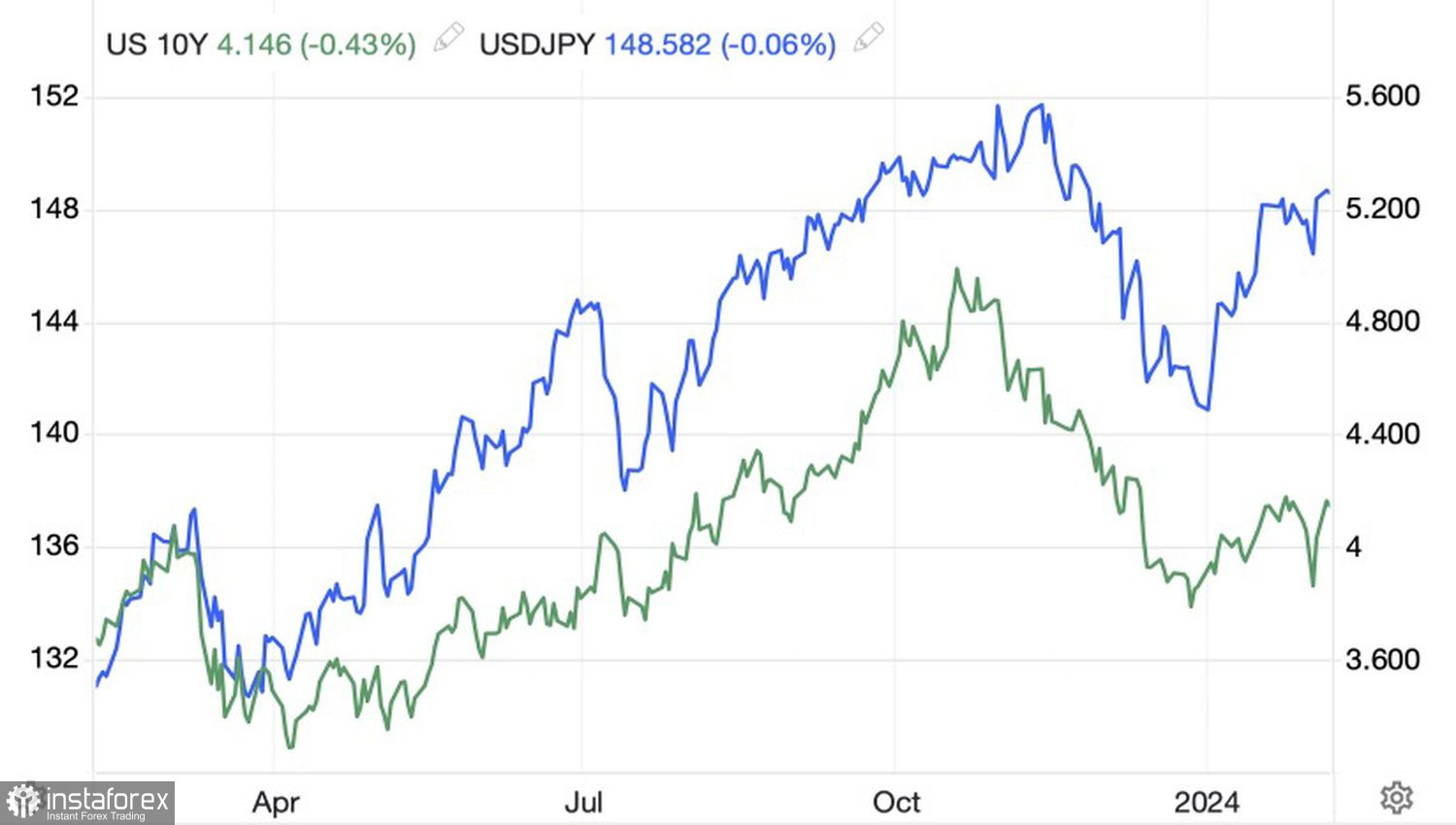

A significant correlation between U.S. debt rates and USD/JPY quotes pushes the pair upward, making it forget about the Bank of Japan's intentions to normalize monetary policy.

Dynamics of USD/JPY and U.S. Treasury Yields

In my opinion, without a slowdown in the U.S. economy and inflation, it doesn't make sense to count on the yen strengthening against the U.S. dollar. A couple more strong reports, such as the January U.S. labor market report, and investors will start to ponder whether the Fed should resume the cycle of tightening monetary policy rather than easing it. In such conditions, the Bank of Japan's departure from negative rates becomes of secondary importance.

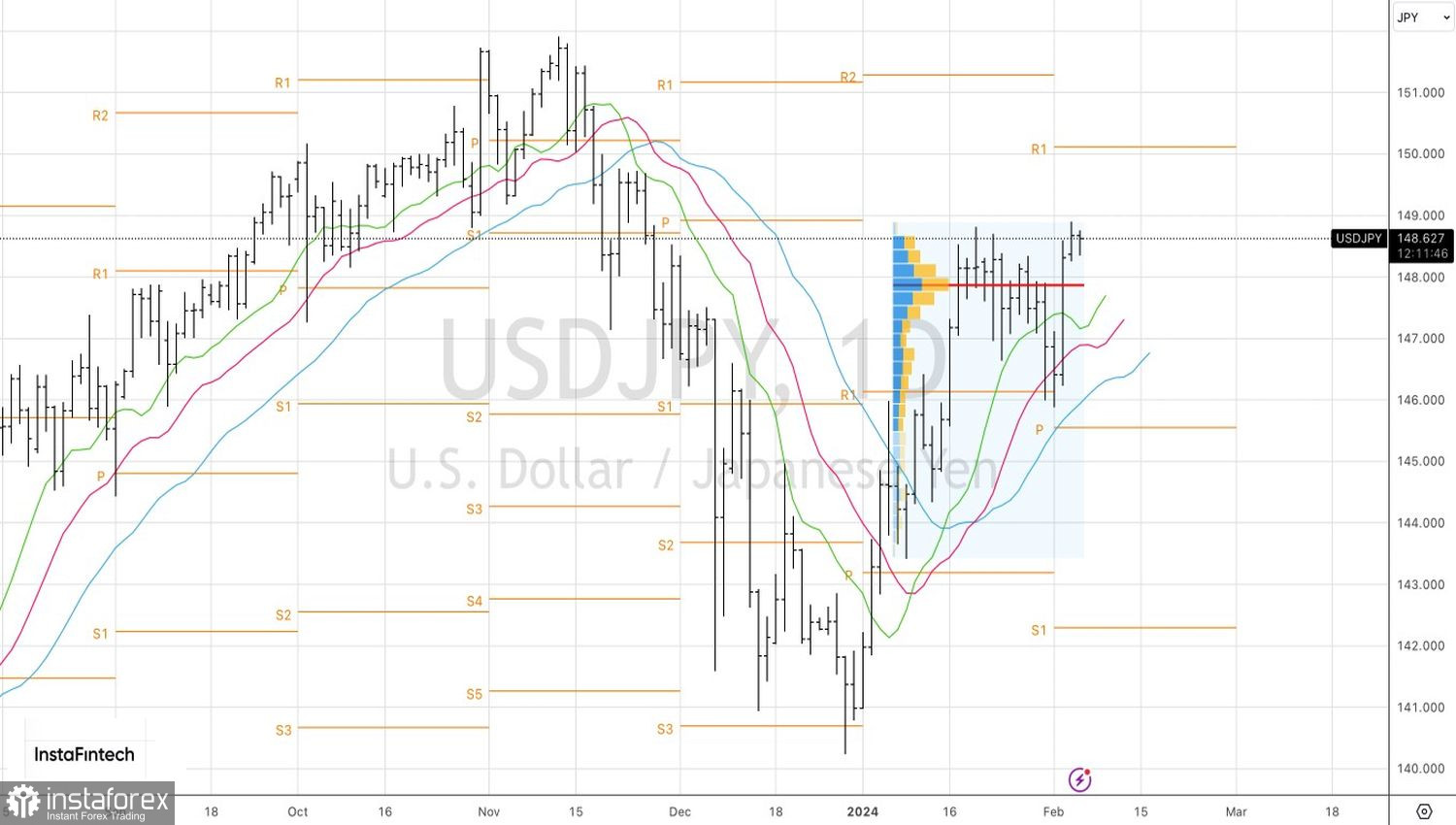

Technically, on the daily chart of USD/JPY, the return of quotes above moving averages and fair value indicates that the situation is controlled by the bulls. Previously formed long positions should be maintained and increased on a breakout of resistance at 148.8. Initial targets include levels at 150.1 and 151.25.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română