Last week, Federal Reserve Chairman Jerome Powell made it clear that a rate cut in March is not likely. However, Powell spoke for the second time. During his new speech, he once again discussed monetary policy and decisions made by the entire Monetary Policy Committee at the January meeting. He said that the strength of the economy allows the Fed to be "careful" in deciding when to lower interest rates. Powell said rate cuts would come once the Fed becomes more secure that inflation is moving down to the target level.

Powell also noted that the economy has made good progress on inflation, but there are still some concerns about reaching the target level. There are risks of a re-acceleration in inflation, and it is necessary to make sure that they will not interfere with the Fed's plans before it starts any rate changes. "If inflation were to prove more persistent, that could call for us to reduce rates later and perhaps slower," Powell shared. He also reiterated that the March meeting is too early for a rate cut. The head of the Fed expects inflation to fall in the first half of 2024, but there is always a risk that something will go wrong.

Powell also mentioned that all Committee policies support rate cuts this year, but everything will depend on incoming economic data. According to Powell, the probability of a recession is very low. Therefore, I conclude that we can forget about a rate cut in March. Even the market has already abandoned this idea. Austan Goolsbee did say that it is not worth delaying rate cuts, but he did not specify any specific time frames. Perhaps he believes that "not delaying" means starting monetary easing in June.

I believe that thanks to Powell's speech, there may be even more bears in the market. Since the decline of both instruments I regularly write about means that the U.S. currency is rising, I am fully satisfied with this scenario. I think that last week's U.S. reports clearly outlined the prospects for the U.S. economy. These prospects are very good and allow the Fed to keep the rate at its peak for at least a few more months. I believe the first rate cut will happen in June, and before that happens, both instruments can achieve their goals for waves 3 or C.

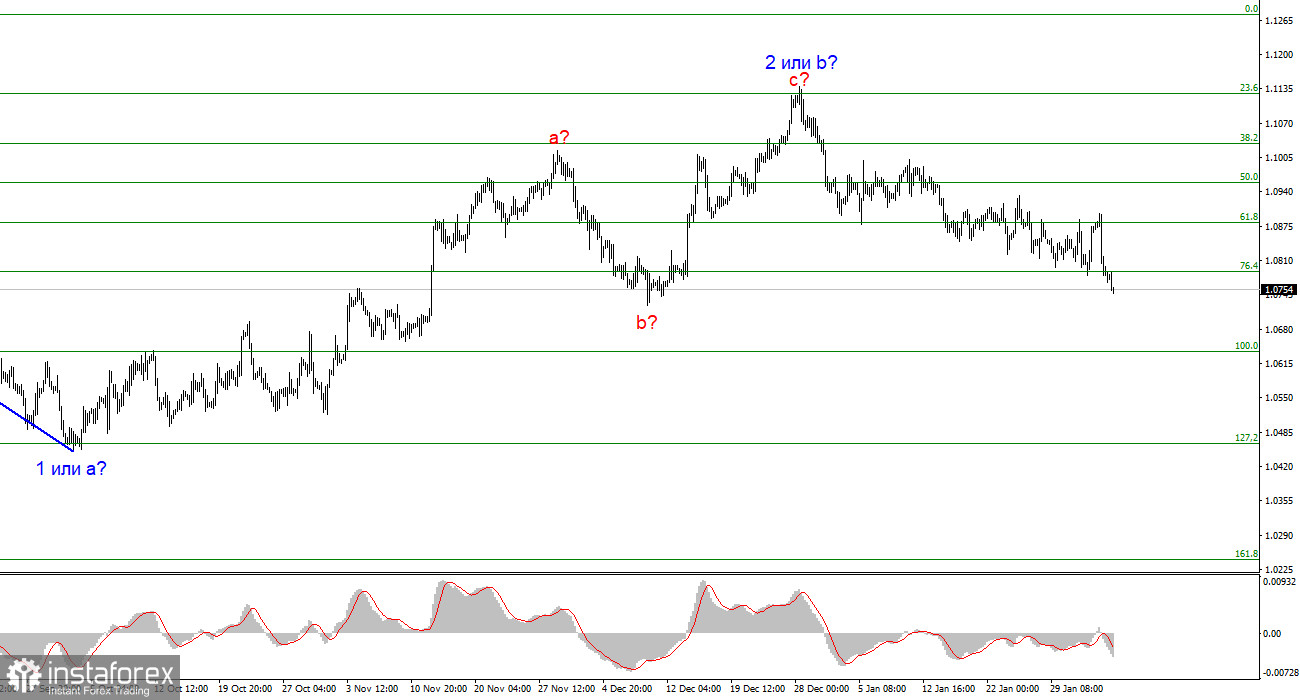

Based on the analysis, I conclude that a bearish wave pattern is being formed. Wave 2 or b appears to be complete, so in the near future, I expect an impulsive descending wave 3 or c to form with a significant decline in the instrument. The failed attempt to break through the 1.1125 level, which corresponds to the 23.6% Fibonacci, suggests that the market is prepared to sell a month ago. I am currently considering selling.

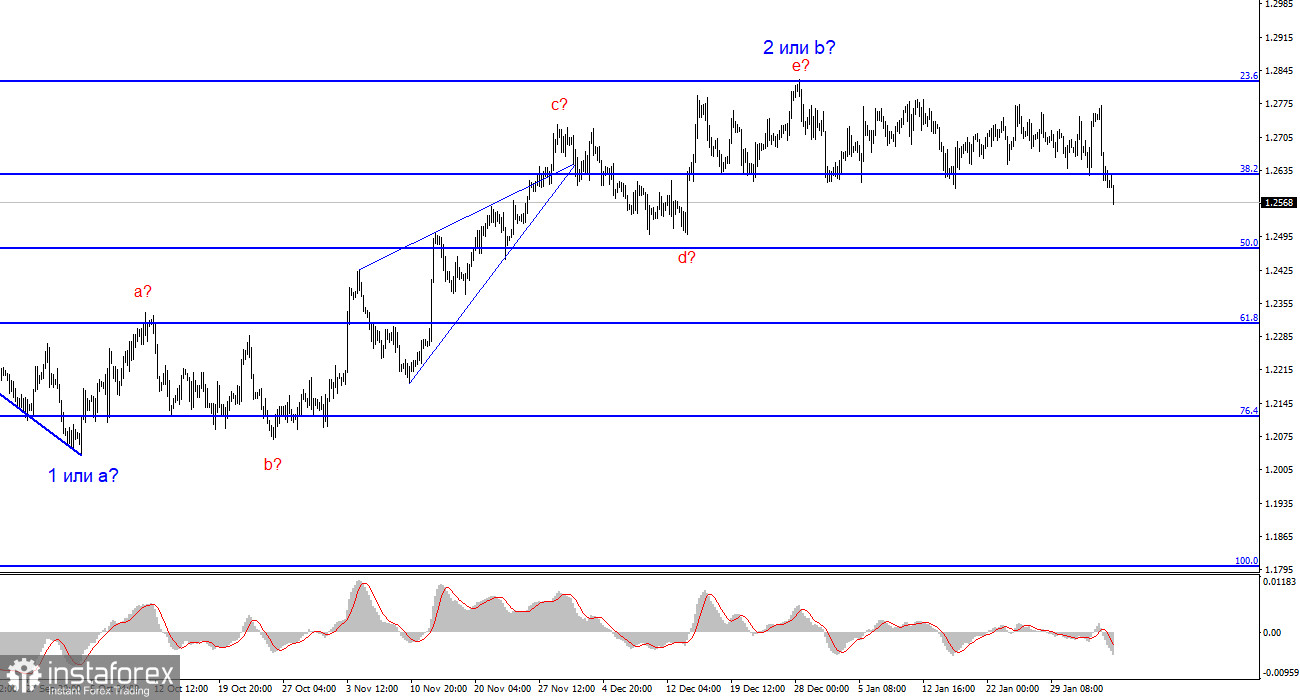

The wave pattern for the GBP/USD pair suggests a decline. At this time, I am considering selling the instrument with targets below the 1.2039 mark because wave 2 or b will eventually end, just like the sideways movement. I would wait for a successful attempt to break through the 1.2627 level, as this will serve as a sell signal, which, hopefully, everyone managed to open. Take note that after a daily decline, the instrument may pull back up, but I only expect it to fall further.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română