The US economy generated the largest increase (+353,000) of non-farm jobs since the sharp rise in January 2023. In addition to this, December's job gains were revised higher by 117,000 positions to total 333,000 for the month. Wage growth accelerated to +0.6% per month.

Of course, one strong report is not yet conclusive evidence, but in any case, it significantly contradicts Federal Reserve Chief Jerome Powell's statement that the labor market is rebalancing, or that job creation has slowed. If we express the Fed's mandate in the simplest terms, it sounds like "we need to tighten financial conditions to curb consumer demand and, consequently, inflation." Well, the Fed raised the rate to 5.5%, and by all criteria, this should have led to an economic slowdown and a decrease in consumer demand, but something went wrong.

The latest GDP data for the fourth quarter does not indicate an economic slowdown, and the labor market is creating as many or more jobs. Consumer spending remains high, and if financial conditions ease, as the market expects, it is possible that instead of lowering the rate, there may be a need to raise it again.

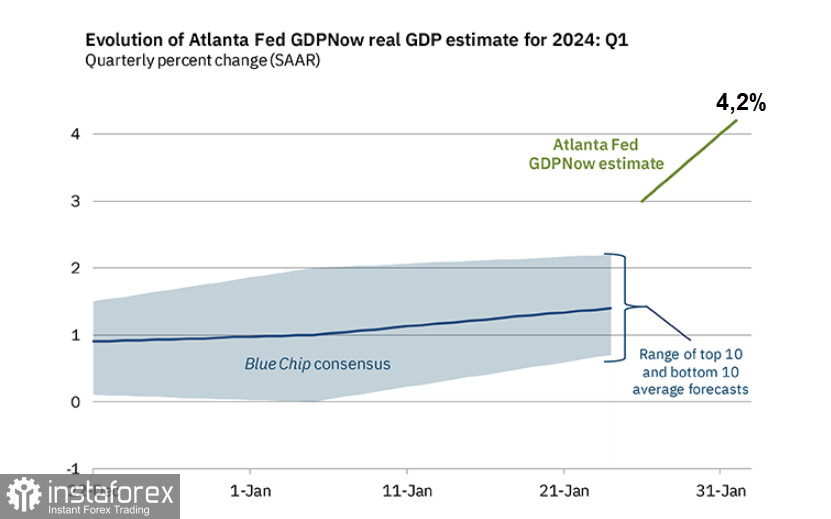

This surprising conclusion directly follows from the latest reports. U.S. GDP grew at a 3.3 percent annual rate in the fourth quarter. The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2024 is 4.2% on February 1. Forecasts for the growth of real personal consumption expenditures and real gross private domestic investment in the first quarter increased from 3.6% and -0.3%, respectively, to 4.9% and 1.7%.

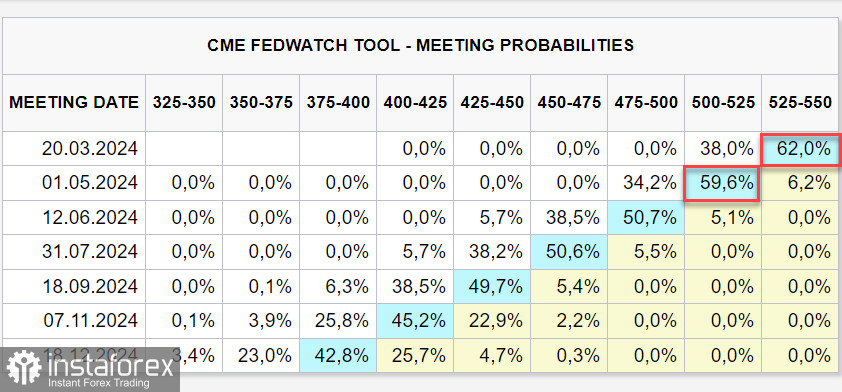

The dynamics of job growth, wages, and GDP suggest that the risks of not slowing but accelerating inflation remain high. Taking these risks into account, and considering Powell's more hawkish statement at the press conference after the FOMC meeting last Wednesday, the expectations for the first rate cut were expected to be pushed back from March to May or even June. This has happened, as rate futures now indicate a 38% probability of the first cut in March and a 60% probability in May.

It seems that the scenario in which the US dollar would gradually weaken in the first half of 2024, which was almost considered a certainty in December, is now in doubt. The inflation report for December will be released on February 13, and if it turns out to be higher than November, which is a distinct possibility, the market could react with a further reduction in the probability of a rate cut in March and May, and an increase in UST yields.

On the other hand, yield is the primary criterion for currency demand. If bond yields show even a small but steady increase, it would signify a significant reevaluation, pushing the US dollar index higher.

It appears that the rebalancing on Monday morning had an effect on risk assets. Canadian stock exchanges closed in the red on Friday, and on Monday, indices in New Zealand, Australia, and China also showed a decline, while the Japanese Nikkei is near its highs. In the US stock market, there is a rally comparable to historical records.

The ISM report for the service sector in January is scheduled for release on Monday. Experts expect it to rise from 50.6 to 52, which can support the dollar. However, investors should focus on the employment sub-index, especially components like wage growth. If wage growth turns out to be positive, the probability that January inflation will exceed forecasts, especially its core part, will increase. In that case, expectations of a rate cut by the Fed in March will have to be set aside.

What could hinder the dollar's growth? Perhaps the budget deficit, for which servicing the national debt becomes increasingly burdensome at high interest rates. However, this factor will become less significant with economic growth, as income growth can be expected. A situation may arise where the government agrees to an extended period of high interest rates and a growth in the budget deficit, provided that inflation remains under control. This could be a decisive argument in connection with the U.S. presidential elections in November.

Thus, the scenario in which the US dollar would gradually weaken in the first half of 2024 is under threat. The inflation report for December may show a rise in prices beyond forecasts, and if this happens, the Fed's rate projections will change, UST yields will go even higher, and the dollar will receive a powerful impetus for growth.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română