Main Trading Idea:

Today, I suggest paying attention to the EUR/USD pair, as during the day, a strong signal with potentially high profits may be generated. First of all, I want to say that recently, the information background has either been too abundant or absent every day. Today, the situation will be better from my point of view, as all the most important reports will be released at approximately the same time. This means that we will have only one time point when the information background will strongly influence the price movement.

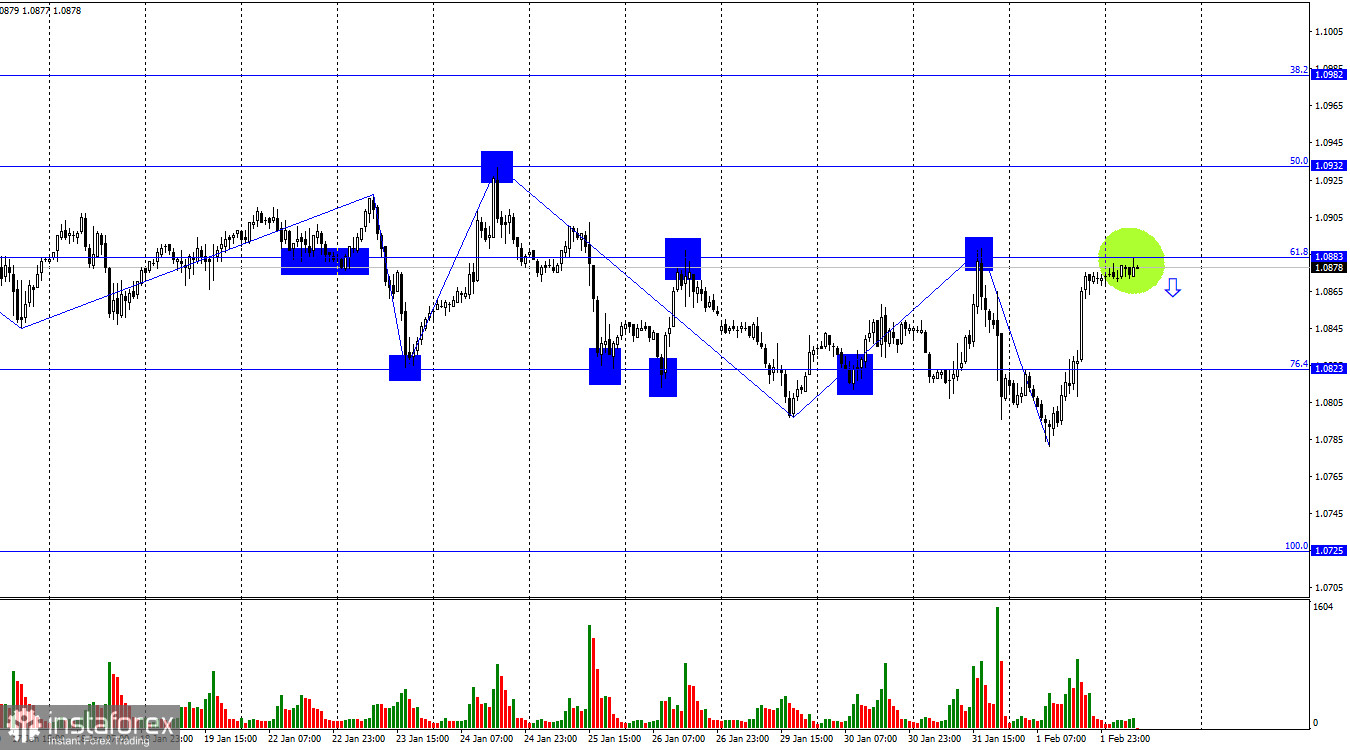

On the hourly chart, the bulls approached the corrective level of 61.8% (1.0883). Note that only this week, the price rebounded twice from this level. Thus, the probability of a third rebound is very high. If this rebound occurs, it will be possible to expect a decline in the European currency of 70-80 points.

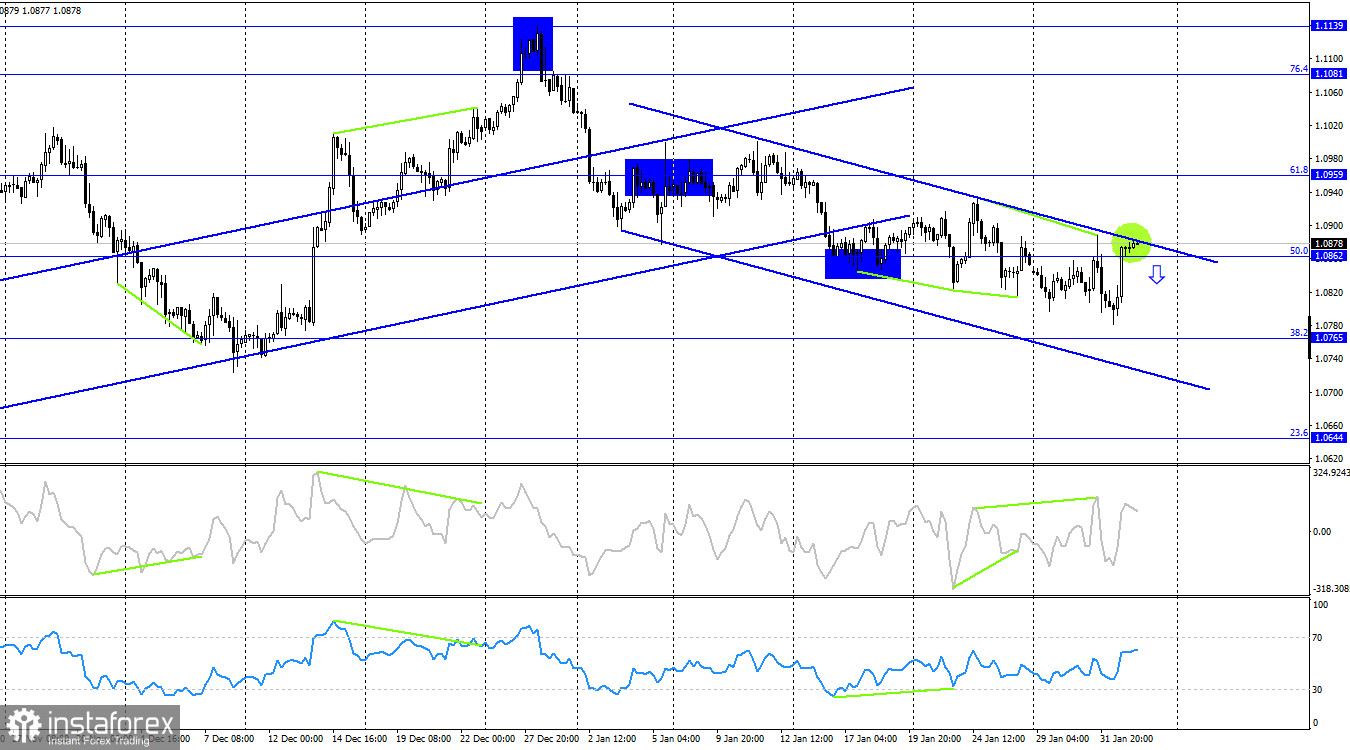

On the 4-hour chart, the pair is within a descending trend corridor. Thus, the "bearish" sentiment in the market persists. A rebound of quotes from the upper line of the descending corridor will also serve as a signal for bears, and the price is already near this line. The bulls encountered quite strong resistance on both charts, which they may find challenging to overcome.

Also, I would like to remind you that yesterday's rise in the euro looks very doubtful. The Thursday information background did not support the bulls. The EU Consumer Price Index came out within the forecast. Describing the Bank of England meeting as "hawkish" is very difficult. And the ISM index in the US turned out to be stronger than expected, which should have helped the bears. Therefore, I think that today the market may turn down again.

Alternative Scenario:

Certainly, it is always necessary to have a "backup" option, as the currency market regularly presents surprises and there are no 100% trading signals. In the case of consolidation above the level of 1.0883 and above the descending corridor, purchases with targets at 1.0932 and 1.0982 will be possible.

It is also essential to closely monitor the nonfarm payrolls and unemployment reports in the US. They will be released at the beginning of the American session and can quite support both the dollar and the euro. If at the time of the release of these statistics, the signal has already formed, it is advisable to set a stop loss at the entry point into the trade to protect yourself from possible reversals and losses.

Forecast for EUR/USD and trader advice:

Today, I expect a decline in the European currency and the formation of two sell signals on both charts. If the American statistics do not turn out to be much weaker than the forecasts, the decline will be quite logical, as yesterday the European currency had no significant reasons to show a rise of 80 points. I believe that today bears can quite play out these 80 points. If the US statistics turn out to be weak, then you should wait for the formation of buy signals near the same level of 1.0883.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română