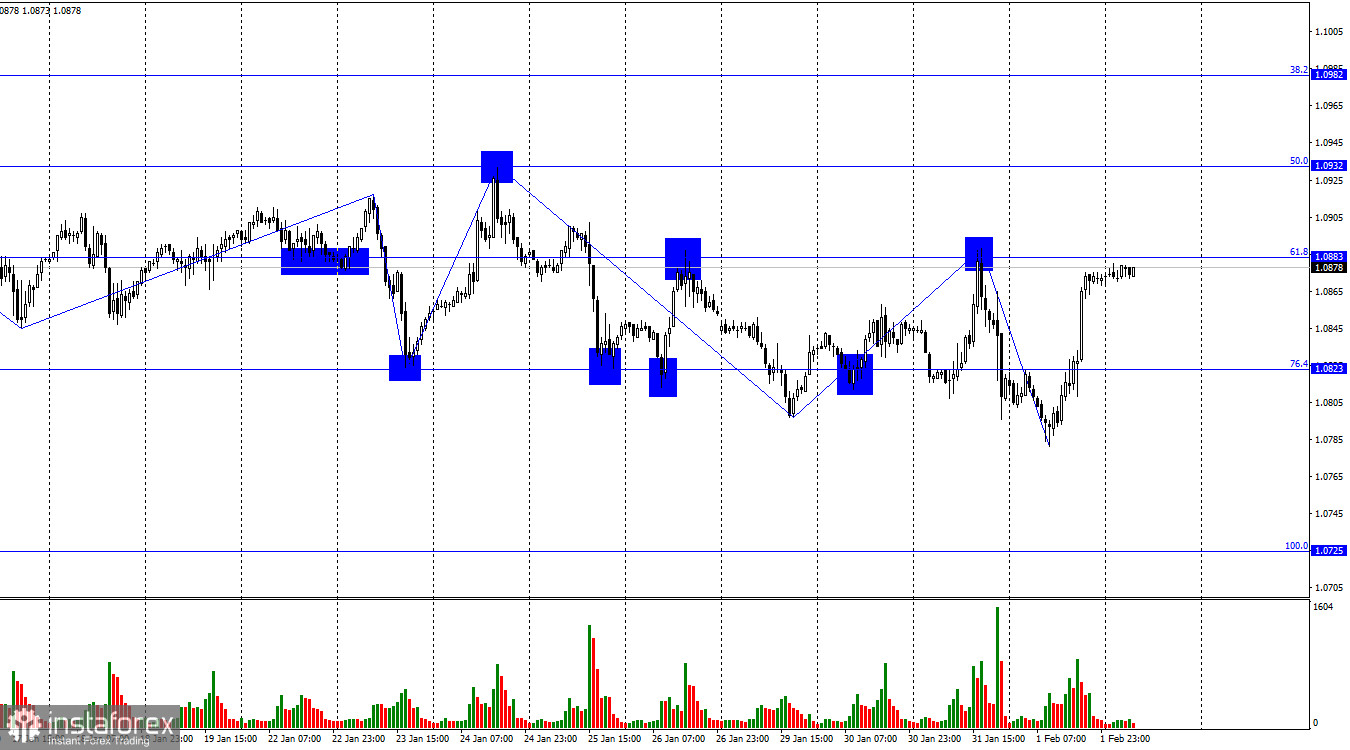

The EUR/USD pair executed a reversal in favor of the European currency on Thursday and initiated a new upward movement toward the corrective level of 61.8% (1.0883). A rebound of the pair's exchange rate from this level will favor the US dollar and a new decline towards the Fibonacci level of 76.4% (1.0823), and even slightly lower. The consolidation of quotes above the level of 1.0883 will allow for a continuation of the rise toward the corrective level of 50.0% (1.0932).

The situation with the waves remains ambiguous. Yesterday's downward wave broke the low of the previous wave by only a few points. The new upward wave has not yet reached the peak of the previous wave. Everything indicates that the "bearish" trend persists, but the waves are currently approximately equal in size. We do not see clearly defined impulsive and corrective waves, but "bearish" sentiment persists, and further declines in the European currency can be anticipated. However, the current picture shows that bears have an extremely weak advantage, and expecting a sharp decline in the euro is not advisable.

The information background on Thursday was again very strong. The market reacted accordingly, but I cannot say that the rise of the European currency was logical. Not at all. In the Eurozone, the inflation report for January was released with a value of 2.8%, which completely coincided with forecasts. This report could not have caused the rise of the euro. In the US, the ISM Business Activity Index for the manufacturing sector was released, which turned out to be significantly better than traders' expectations. It should have caused the rise of the dollar. Only the Bank of England meeting remains, the results of which were also expected to cause the rise of the dollar, not the euro or the pound. However, in the end, we saw the dominance of bulls. Thus, I believe that traders misinterpreted the information background of yesterday, and the decline of the pair today is quite likely.

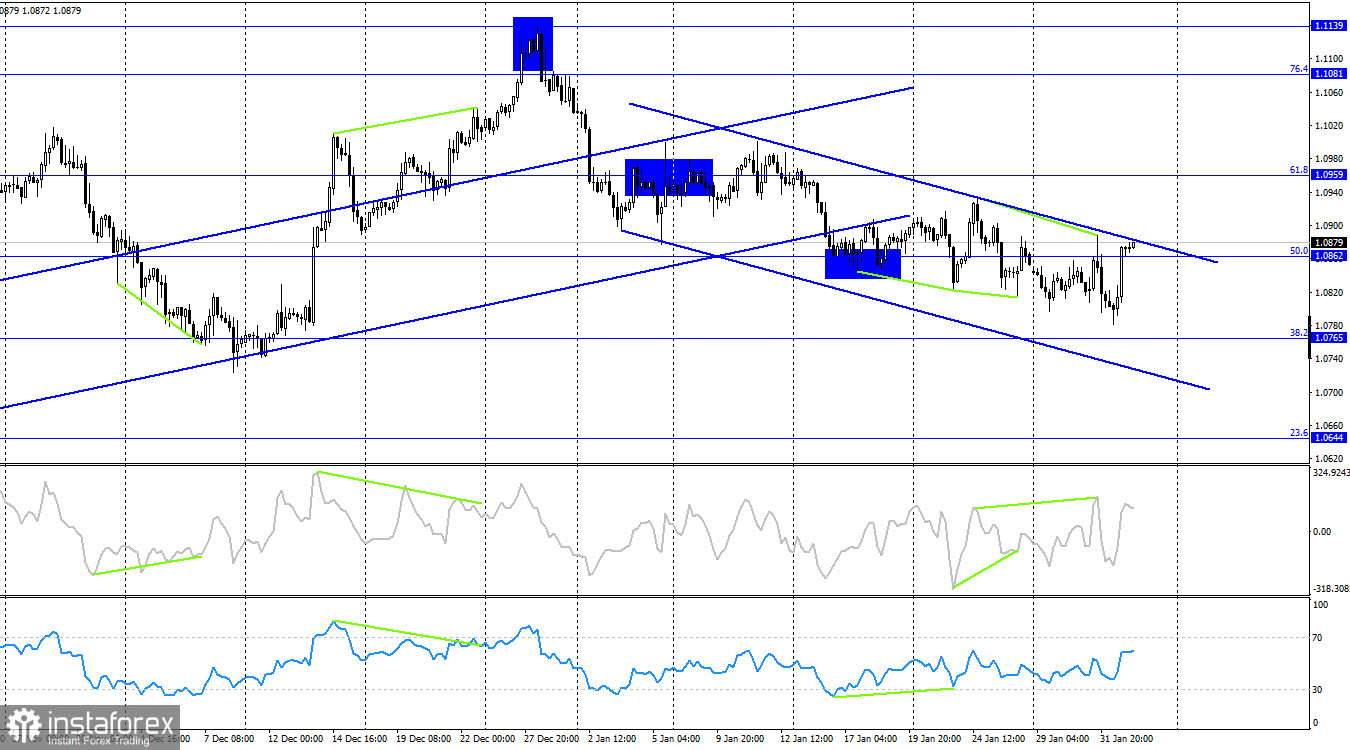

On the 4-hour chart, the pair executed a reversal in favor of the European currency and rose to the upper line of the descending trend corridor. A rebound from this line will work in favor of the American currency and the resumption of the decline toward the Fibonacci level of 38.2% (1.0765). Consolidation above the corridor will increase the likelihood of a continuation of the rise towards the next corrective level of 61.8% (1.0959). There are no emerging divergences today for any of the indicators, and the market sentiment remains "bearish."

Commitments of Traders (COT) Report:

During the last reporting week, speculators closed 9104 long contracts and opened 6664 short contracts. The sentiment of large traders remains "bullish" but continues to weaken. The total number of long contracts held by speculators is now 195 thousand, and short contracts are 107 thousand. Despite a fairly large difference, I still believe that the situation will continue to change in favor of bears. Bulls have dominated the market for too long, and now they need a strong information background to maintain the "bullish" trend. I do not see such a background now. Professional traders may continue to close long positions soon. I believe that the current figures allow for a continuation of the decline in the euro in the coming months.

News Calendar for the United States and the Eurozone:

USA – Nonfarm Payrolls (13:30 UTC).

USA – Unemployment Rate (13:30 UTC).

USA – Average Hourly Earnings (13:30 UTC).

USA – University of Michigan Consumer Sentiment (15:00 UTC).

On February 2nd, the economic events calendar contains numerous important entries, among which payrolls and unemployment stand out. The impact of the information background on traders' sentiment today can be strong.

EUR/USD forecast and trader advice:

Sales of the pair are possible today on a rebound from the level of 1.0883 on the hourly chart, with targets at 1.0823 and 1.0805. I will consider buying the pair today if there is a close on the hourly chart above the level of 1.0883, with targets at 1.0932 and 1.0982.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română