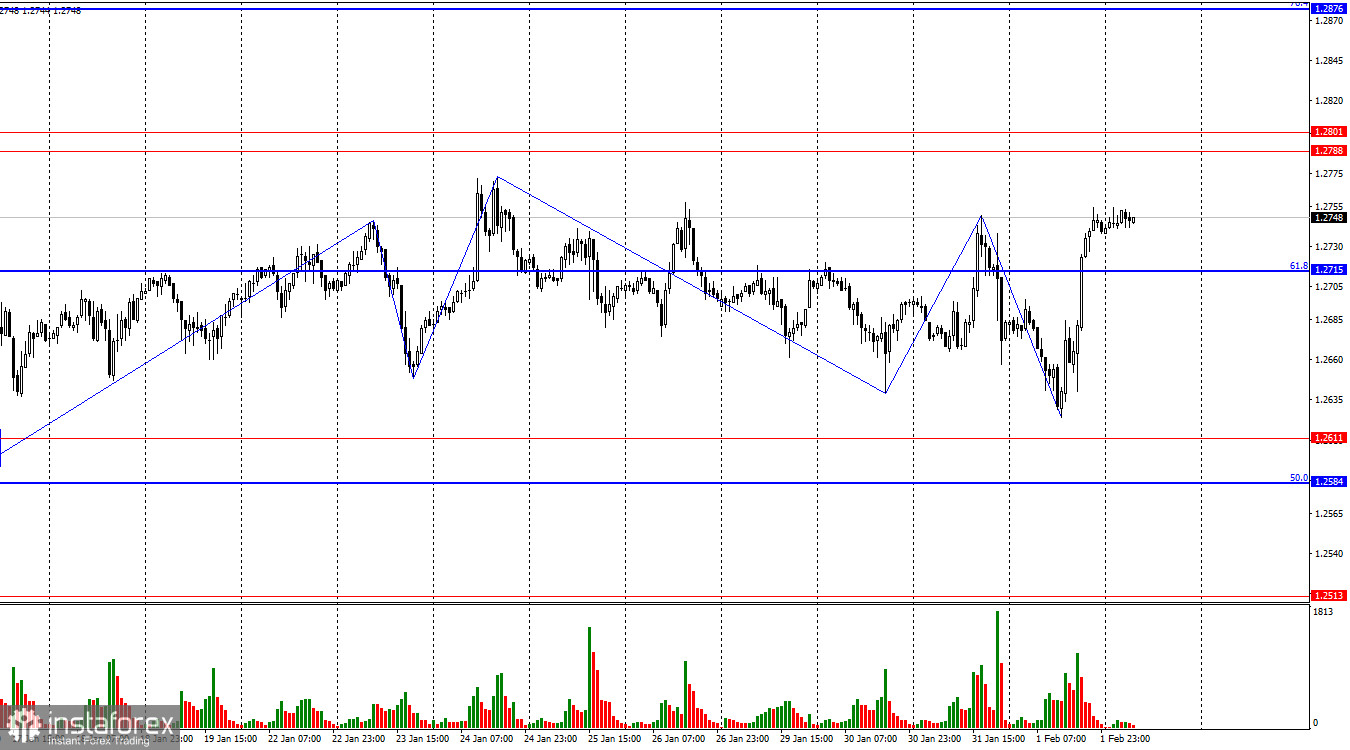

On the hourly chart, the GBP/USD pair executed a reversal in favor of the British pound on Thursday and started a new upward movement towards the resistance zone of 1.2788–1.2801. I cannot call this growth systematic, but we have what we have. For a horizontal corridor, such movements are more than logical. A rebound of quotes today from the zone of 1.2788–1.2801 will work in favor of the American currency and be the beginning of a new decline toward the support zone of 1.2611–1.2584. The sideways trend persists.

The situation with the waves remains very ambiguous. Trends are currently quite short-term; almost all the time, we see single waves or triples that alternate with each other and are approximately the same size. The "bullish" sentiment among traders persists only because of the bears' inability to close below the level of 1.2584. Thus, the sideways trend remains and will continue until the pair exits the zone of 1.2584–1.2801. The last two "triples" look almost mirror-like.

The information background on Thursday was very strong. The Bank of England meeting attracted the attention of all traders, but its results can be interpreted differently. On the one hand, the mood of the board became more "dovish": only two people voted for a rate hike, and one voted for a rate cut. Also, the regulator's statement no longer contained the phrase about possible additional tightening. On the other hand, Bailey announced that the rate could be held longer than expected because the main goal of achieving 2% inflation remains unchanged. And achieving it may require more effort and time. According to Bailey, everything will depend on economic information.

As we can see, traders mostly interpreted the information received as "bullish" or "hawkish," which allowed the British pound to show a new rise. But I believe that the horizontal corridor had a greater impact, as yesterday the pair was trading near its lower line.

On the 4-hour chart, the pair made another rebound from the level of 1.2745 and immediately returned to this level. A new rebound from this level will again work in favor of the American currency, and a new decline towards the level of 1.2620. There are no emerging divergences today for any of the indicators, and the ascending trend corridor has been left by the quotes. The trend may continue to change to "bearish," but it will take time and require significant efforts from the bears. In particular, closing below the level of 1.2620. The sideways trend for the British pound persists and is visible to the naked eye.

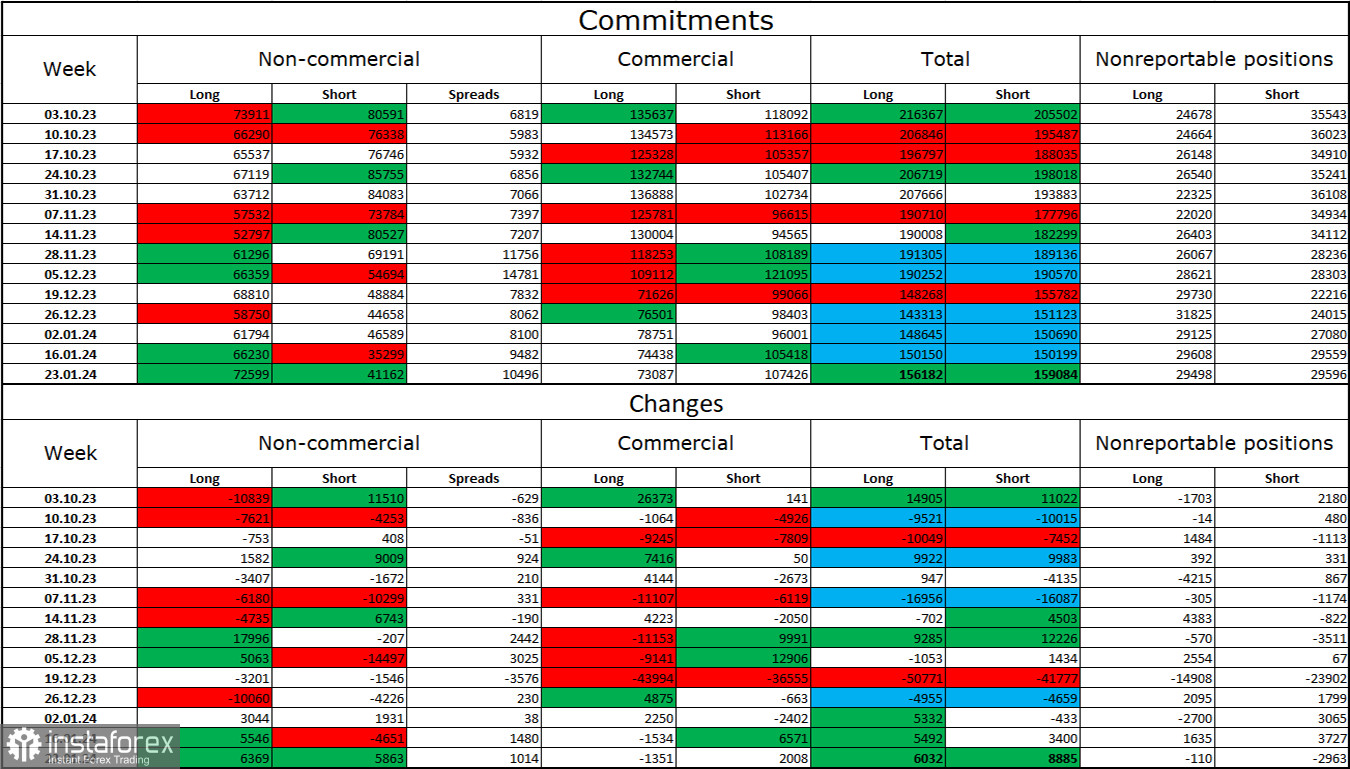

Commitments of Traders (COT) Report:

The sentiment of the "non-commercial" trader category for the last reporting week has not changed. The number of long contracts in the hands of speculators increased by 6369 units, and the number of short contracts increased by 5863 units. The overall sentiment of large players changed to "bearish" several months ago, but at the moment, bulls have a significant advantage again. There is an almost twofold gap between the number of long and short contracts: 73 thousand versus 41 thousand.

In my opinion, the British pound still has excellent prospects for a decline. I believe that over time, bulls will continue to get rid of buy positions, as all possible factors for buying the British pound have already been worked out. The growth we have seen in the last three months is, in my opinion, corrective. For over a month, bulls have not been able to push the level of 1.2745. However, the bears are in no hurry to go on the offensive and cannot cope with the zone of 1.2584–1.2611.

News Calendar for the United States and the United Kingdom:

USA – Nonfarm Payrolls (13:30 UTC).

USA – Unemployment Rate (13:30 UTC).

USA – Average Hourly Earnings (13:30 UTC).

USA – University of Michigan Consumer Sentiment (15:00 UTC).

On Friday, the economic events calendar contains several important entries in the United States. The impact of the information background on market sentiment today can be strong.

GBP/USD forecast and trader advice:

I don't see any signals to buy right now, and there weren't any yesterday either. A rebound from the support zone of 1.2584–1.2611 may be such, but today it is unlikely to happen. Consolidation above the zone of 1.2788 – 1.2801 can be used for purchases. Sales will be possible on a rebound from the resistance zone of 1.2788–1.2801, with targets at 1.2715 and 1.2611.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română