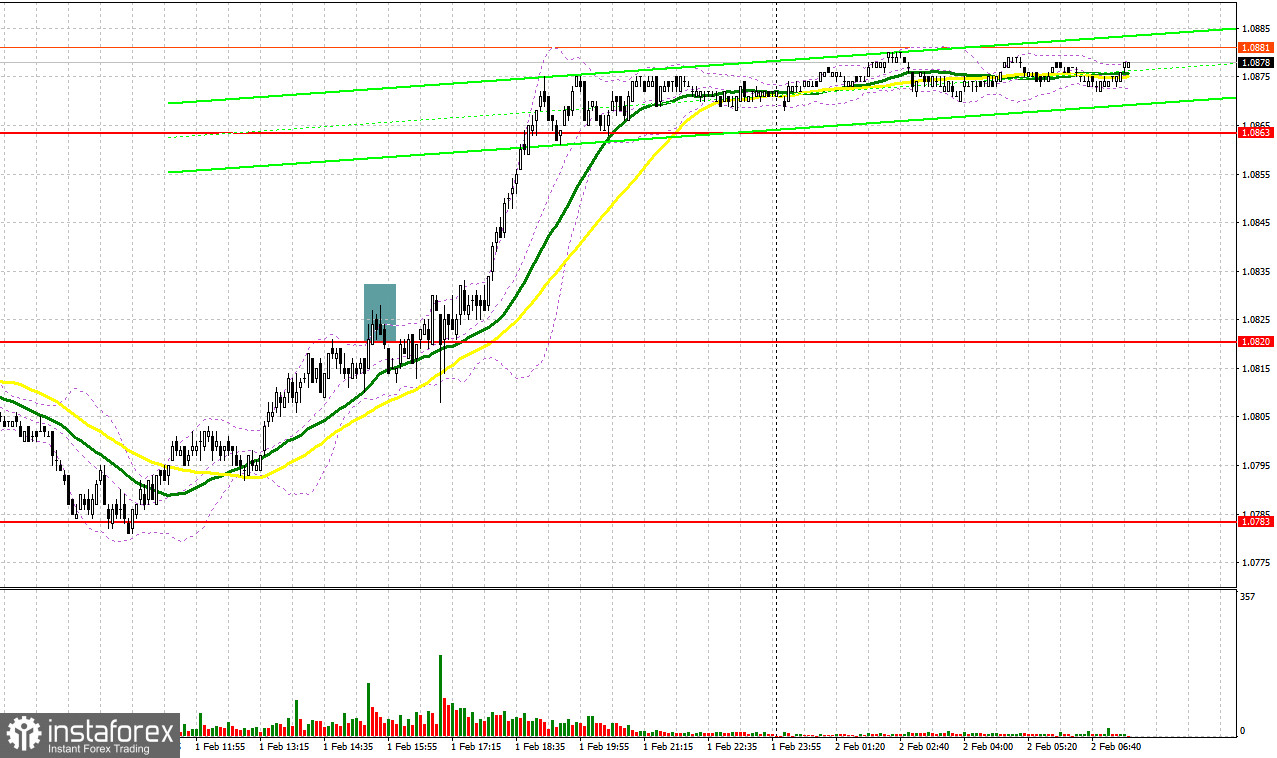

Yesterday, there was only one signal for market entry. Let's take a look at the 5-minute chart and discuss what happened. In my previous forecast, I focused on the level of 1.0797 and recommended making market entry decisions based on it. A breakthrough took place, but there was no retest. In the afternoon, a false breakout at 1.0820 produced a sell signal, but after several attempts to put pressure on the euro, the uptrend continued.

For long positions on EUR/USD

Reports on eurozone inflation and core prices turned out to be slightly below previous values but did not match the economists' forecasts, making the situation even more confusing than before. Obviously, the European Central Bank will now focus on new data. Today, the main driver of growth could be the US labor market report, but we will talk more about it in the forecast for the US session. A report on France's industrial output is due today, so there's a good chance of continuing the uptrend.

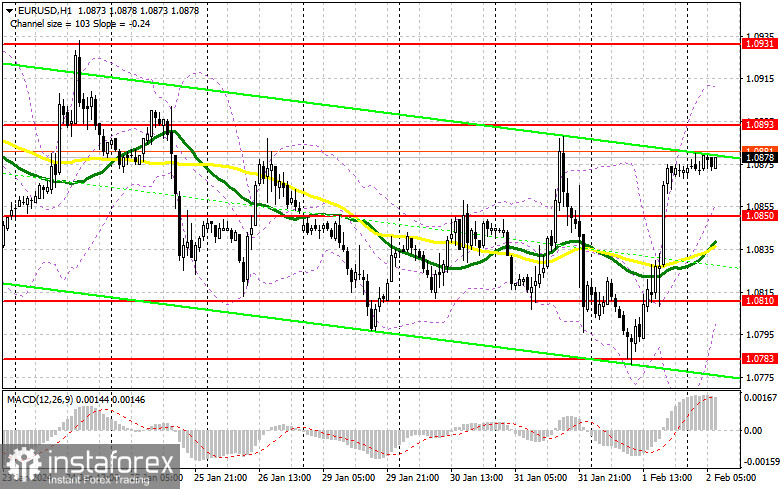

Of course, we would like to enter the market as low as possible, somewhere around 1.0850, where a false breakout will provide an entry point for long positions in anticipation of an upward correction to 1.0893. A breakout and a downward test of this range will create another entry point for long positions, providing an opportunity for a more powerful correction and the prospect of testing 1.0931. The ultimate target is found at the 1.0966 high, where I plan to take profits. Should EUR/USD decline and show no activity at 1.0850 in the first half of the day, the pressure on the pair will return. In this case, I will try to enter the market after a false breakout forms near 1.0810. I would consider opening long positions on a rebound from 1.0783, aiming for an upward correction of 30-35 pips within the day.

For short positions on EUR/USD:

The bears missed the market yesterday and now we need to do our best to prevent a new uptrend, which is where everything is heading. Safeguarding 1.08493 and forming a false breakout there after the release of eurozone data will indicate the presence of big players in the market, which could send the pair down to 1.0850. Just below this level, we have the moving averages that favor the bulls. Only after a breakout and consolidation below this range, as well as an upward retest, do I expect another sell signal, and the pair could fall to 1.0810. The ultimate target here is 1.0783, where I plan to take profits. In case EUR/USD moves upwards during the European session without bearish activity at 1.0893, which is likely to happen, the demand for EUR/USD will increase. In such a case, it will be possible to enter the market after a test of the next resistance at 1.0931. It is also possible to sell there but only after a failed consolidation. I plan to initiate short positions on a rebound from 1.0966, aiming for a downward correction of 30-35 pips.

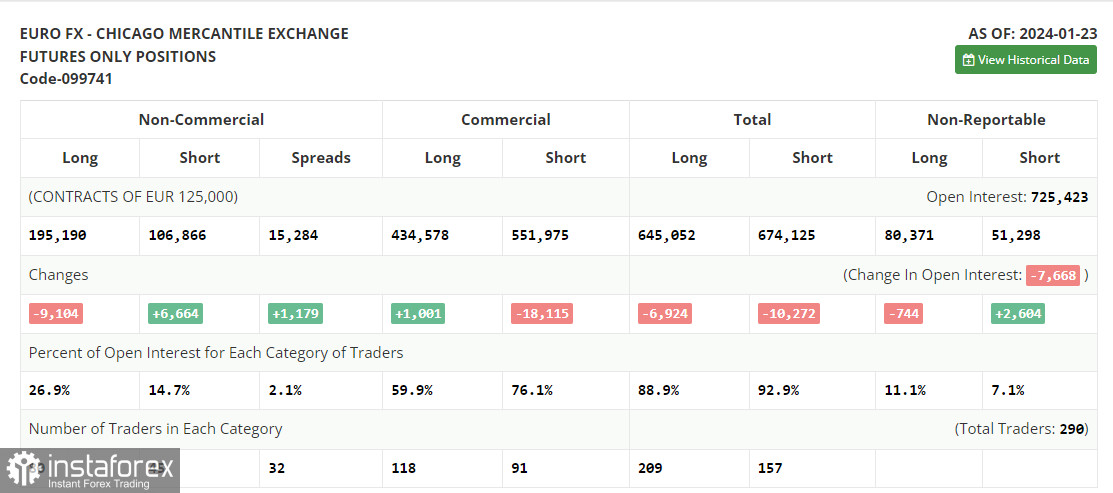

COT report:

In the COT report (Commitment of Traders) for January 23, there was a decrease in long positions and an increase in short positions, indicating a shift in favor of the US dollar. After the European Central Bank meeting, where the central bank made it clear that they plan to lower interest rates as early as this summer, the euro came under pressure again. Buyers have nothing to worry about, as the strong US economy allows the Federal Reserve to stick to its tough policy without fearing a recession, unlike the eurozone economy. The Federal Open Market Committee meeting will be held this week, afterwards it will be clear what the central bank plans to do with its policy. The COT report indicated that long non-commercial positions fell by 9,104 to 195,190, while short non-commercial positions increased by 6,664 to 106,866. As a result, the spread between long and short positions increased by 1,179.

Indicator signals:

Moving averages:

Trading above the 30- and 50-day moving averages indicates possible growth.

Please note that the time period and levels of the moving averages are analyzed only for the 1H chart, which differs from the general definition of the classic daily moving averages on the 1D chart.

Bollinger Bands

If EUR/USD declines, the indicator's lower border near 1.0810 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română