EUR/USD

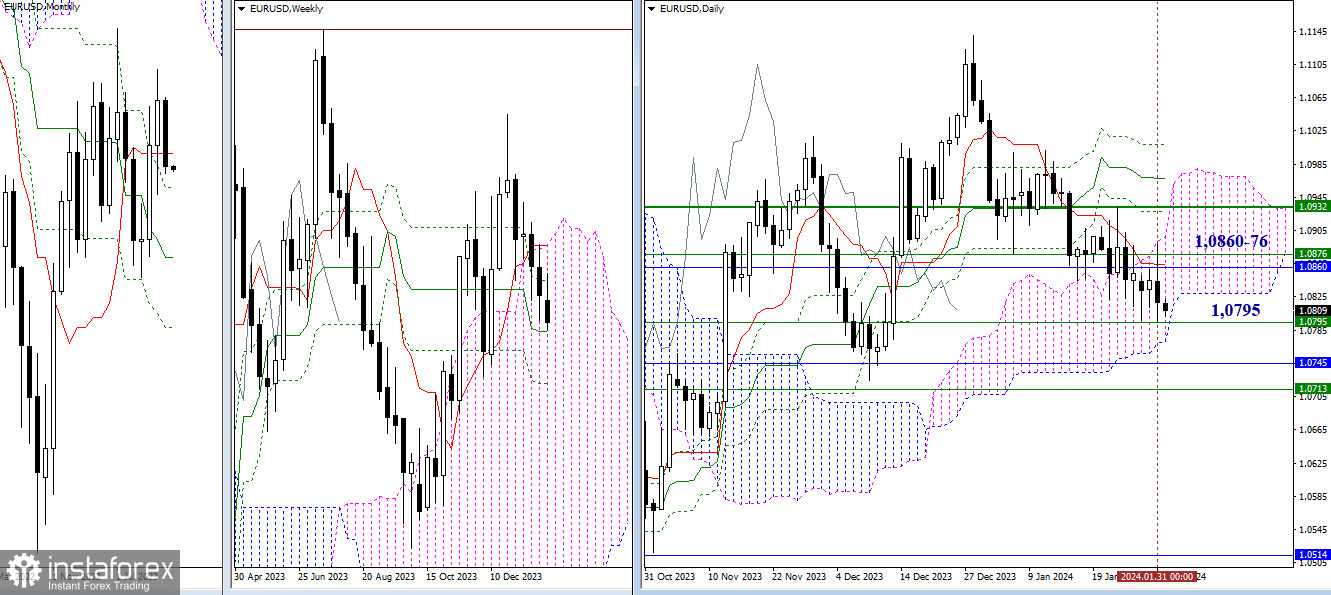

Higher Timeframes

Both sides were able to test their limits yesterday, but neither managed to achieve a result. The situation is still held by resistance levels at 1.0860–1.0876, where several levels of different timeframes converge, along with support from the weekly medium-term trend (1.0795). A breakthrough and a reliable consolidation beyond these boundaries could create prerequisites for the development of a new movement.

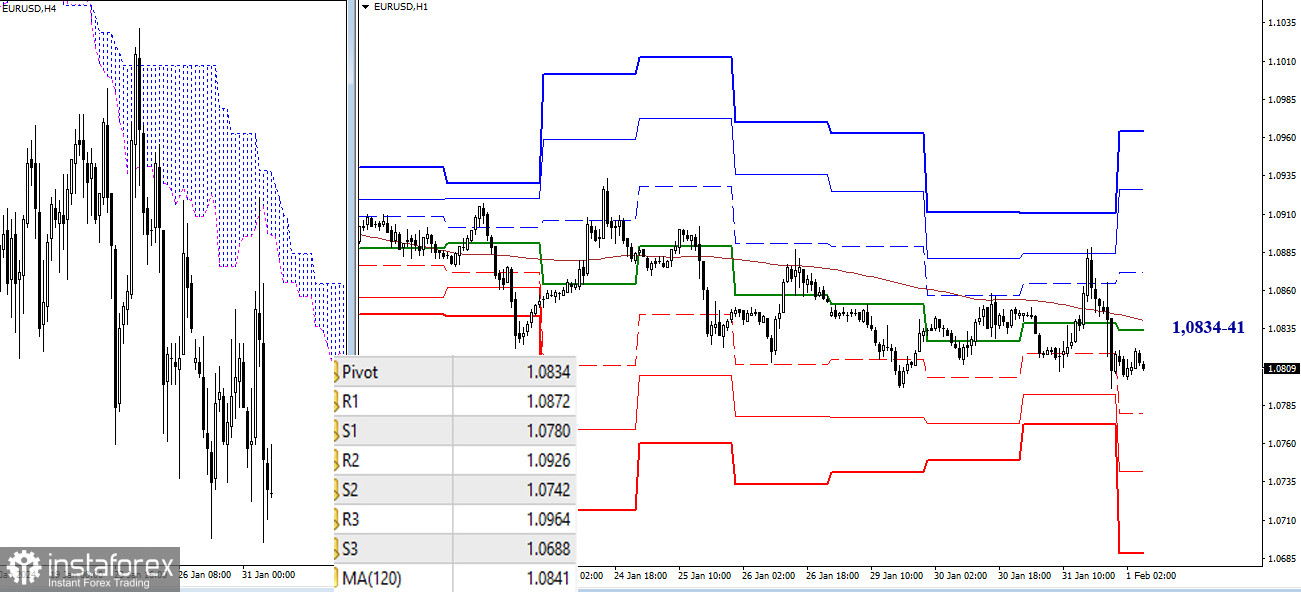

H4 - H1

Instability and uncertainty on lower timeframes are expressed in the frequent change of preferences. The market easily shifts its position relative to key levels, and players, having an advantage, are unable to capitalize on it and develop it. Currently, the main advantage is on the side of the bears. Strengthening bearish sentiments today is possible during the decline and breaking through the supports of classic pivot points (1.0780-1.0742-1.0688). If bulls again seize key levels today, currently located at 1.0834–41 (weekly long-term trend + central pivot point), attention will on the resistances of classic pivot points (1.0872 - 1.0926 - 1.0964).

***

GBP/USD

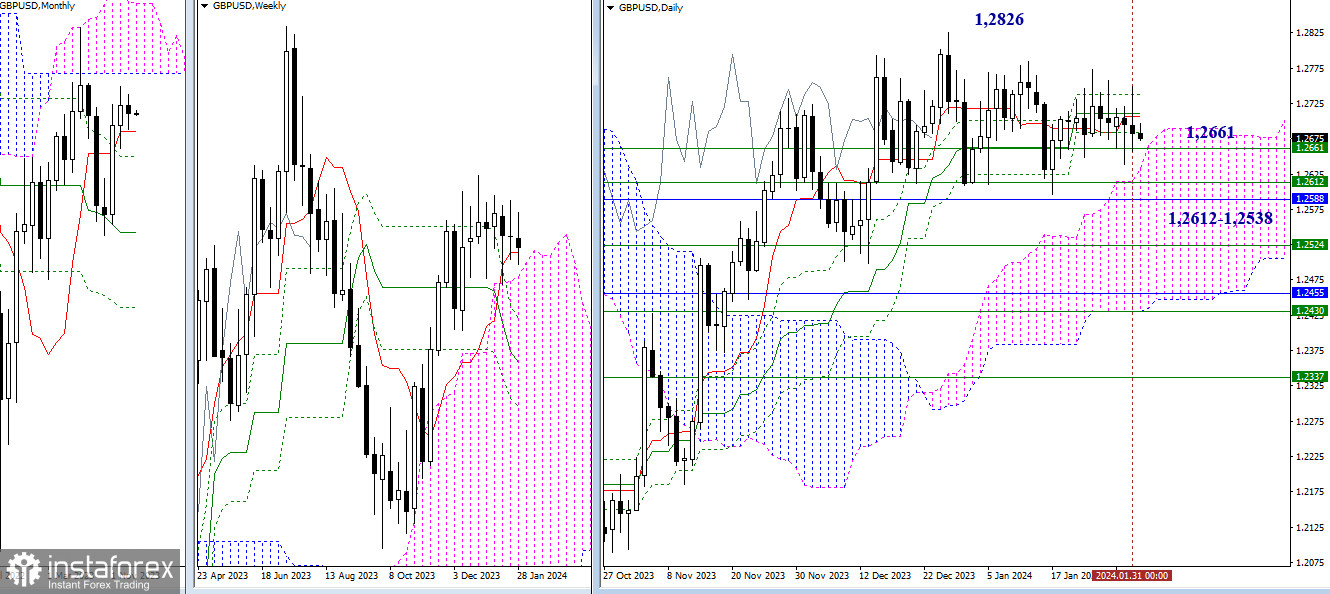

Higher Timeframes

Over the past day, the situation has not undergone significant changes. Uncertainty persists. Levels of the daily Ichimoku cross (1.2684 - 1.2711 - 1.2738) continue to exert attraction, with the main current support being the weekly short-term trend (1.2661). A breakthrough of 1.2661 and entry into the daily cloud will lead to a test of the area where the upper boundary of the weekly cloud (1.2612) and the monthly short-term trend (1.2588) have now converged. A rebound from 1.2661 and a breakout beyond the daily cross (1.2738) will allow considering an upward movement and the possibility of updating the high (1.2826).

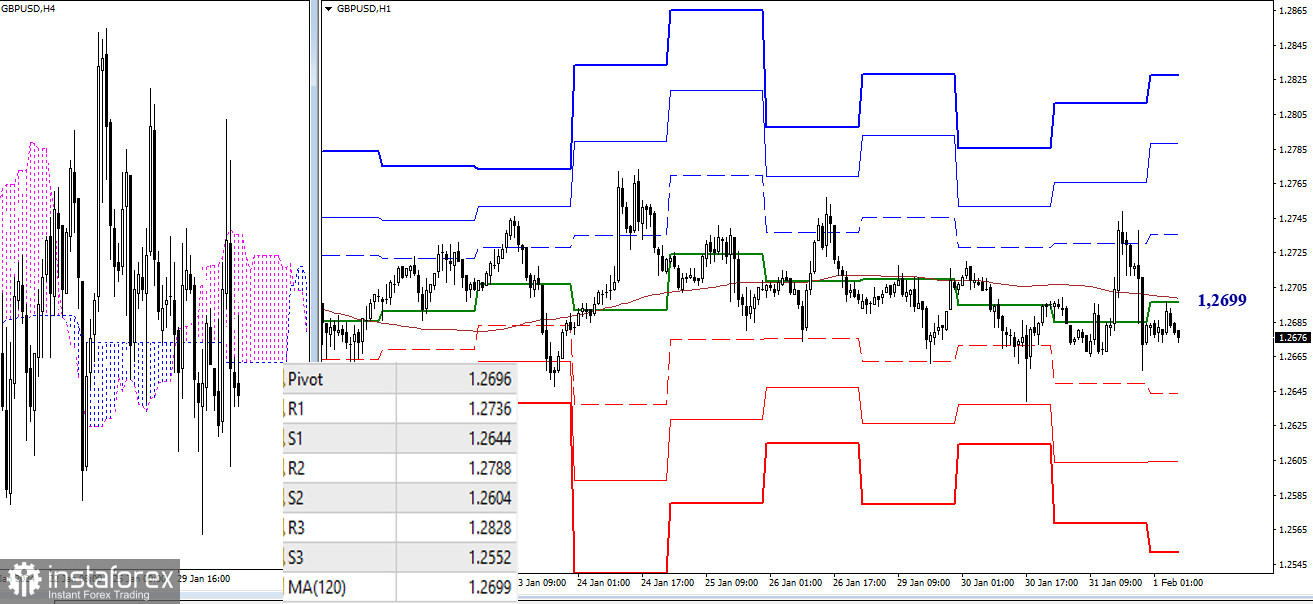

H4 - H1

Key levels continue to be the center of attraction on lower timeframes, and today, they converge in the area of 1.2699–96 (central pivot point + weekly long-term trend). In the case of the development of a directional movement within the day, landmarks of classic pivot points may come into play. For bears, supports at 1.2644 - 1.2604 - 1.2552 will be important. For bulls, resistances at 1.2736 - 1.2788 - 1.2828 will be of interest.

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română